People wishing to expand their skill sets within the commercial real estate market can now access a wide range of resources. Although they were not as common in the past, commercial real estate-specific degrees and certifications have become more and more popular in recent years. Young professionals with formal educations in commercial real estate are now more prevalent in the labor market.

According to Thomas Sherlock, a principal at Talonvest Capital, “Having a formal education in commercial real estate is an opportunity and advantage for anyone interested in a CRE career, For many individuals, that formal education provides the opportunity to start a career with a greater understanding of important fundamental factors in a variety of the industry’s interconnected specialties.”

While working in the industry, many seasoned experts are obtaining qualifications in commercial real estate.

At the Marshall Bennett Institute of Real Estate at Roosevelt University, Catherine Hughey is pursuing a Master of Science in Real Estate while also enrolling in two in-person evening courses. She also serves as general manager for JLL at the modern, 473,000 square foot 800 Fulton office skyscraper in Chicago’s Fulton Market. Hughey, a lifelong learner who graduated from Project REAP – Chicago in 2018, holds real estate broker licenses in Wisconsin and Illinois. She participates in both the BOMA/Chicago Diversity and Inclusion Committee and the JLL Midwest PM Diversity and Inclusion Committee.

Since the pandemic threw the status quo on its head and rattled it, multifamily has been one of the gleaming aspects of commercial real estate, along with industrial. Rent growth’s capacity to continue justifies lower cap rates and contributes to price increases.

But nothing can remain in one place for ever. The ordinary person still has a salary that trails inflation despite a strong employment market, according to research on multifamily rents. Additionally, when consumers pay more, they frequently expect something worthwhile in return.

The turnover cost is at what is probably a record level when people leave, such as when they relocate to a place that is more inexpensive for them or that they believe offers a value that is more in line with what they pay. Zego estimated that, compared to $3,850 in 2021, the average cost of promotion and marketing, unit maintenance, concessions, and missed rent will be $3,976.

It would take 17.6 months to repay the turnover costs if you increased the $1,500 unit’s rent by $225, or 15%. And as Zego pointed out, according to a Zumper poll, 81.6% of respondents planned to relocate in the following 12 months.

The fundamental tenet of Newtonian physics is that anything that ascends will eventually descend under the force of gravity unless it is caught by a soaring eagle. The Green Street Commercial Property Price Index indicates that, overall, this is what occurred to commercial real estate property prices in the second quarter of 2022.

The index, which is defined as a “time series of unleveraged U.S. commercial property values that captures the prices at which commercial real estate deals are currently being negotiated and contracted,” fell by 3.7 percent between May and June. 4.9 percent of the value has been lost overall from the peak point in March.

Overall, that is a 10% increase over the previous 12 months and a 10% increase since pre-covid periods.

Peter Rothemund, co-head of strategic research at Green Street, stated in prepared remarks that “the repricing that has occurred in bonds and stocks is finally evident in the commercial property market.Price discovery is still taking place, and economic uncertainty and interest rate volatility make that challenging, but prices of most properties are down 5%+ from recent highs. In a few sectors, pricing has held up better.”

By property type, performance varies considerably. Strip retail (down 7%) and net lease were the two worst-performing sectors between May and June (also down 7 percent ). Since before the pandemic, strip retail had increased by 7%, and in the past year while economies were recovering, it had increased by 15%. Before Covid, net lease saw a 6% growth and a 5% 12-month growth.

It’s interesting to note that the third highest decline, from May to June, was in the industrial sector, which has been particularly hot since the epidemic, growing at a rate of 42 percent and rising 15 percent over the past 12 months.

Manufactured home parks have done well generally, with a 17 percent growth over the past 12 months, up 33 percent prior to Covid, and no loss between May and June, despite general stresses on the availability and cost of rental accommodation.

Another industry that has fared well in the face of economic and societal pressures is self-storage, which has grown by 58 percent since before Covid, by 28 percent over the past 12 months, and by a lower-than-average 4 percent during the most recent recorded month.

Office decreased by only 4% in the most recent month, but was down 1% over the previous 12 months and -9% since before the epidemic. Consequently, the net result is negative.

Multifamily has increased by 15% over the past 12 months and by 16% since before the epidemic, although it has decreased by 4% during the past month.

After the sharp rise in prices in so many categories over the previous two years, it was fair to wonder how much higher prices, as well as rents paid by consumers and businesses, could rise. There were numerous indications that price growth was beginning to slow down.

As the pandemic sent corporate America from boardrooms to bedrooms in 2020, long-held assumptions about productivity are now rightfully up for debate. On one side of the spectrum are those that argue that office spaces facilitate an agglomeration of ideas, culture, and productive output. On the other hand, many argue that long commutes into places of work are outdated norms, and the commute time saved by remote work can generate both greater worker productivity and improved quality of life — a classic case of having the cake and eating it too. Now, with 2021 in the rearview, and after two distinct COVID waves derailed back-to-office timelines, there has been little resolution to the so-called big questions from a year ago.

According to The Pew Research Center, as of January 2022, for American adults who report being able to complete their jobs from home, 59% are doing so most or all of the time, and 18% do so some of the time. The VTS Office Index (VODI), which measures new Office leasing demand, remained down by 42% relative to its pre-pandemic benchmark through the end of 2021. As the public health threat lessens, these data will undoubtedly improve, but the question is by how much. In a tight labor market, the desires of workers can quickly transition into leverageable demands.

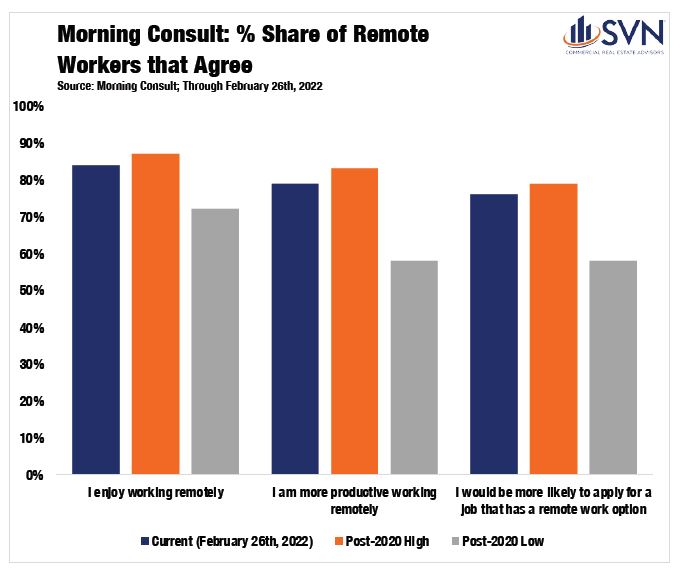

According to Morning Consult’s tracking of remote workers, 84% have enjoyed being remote, 79% feel they are more productive working remotely, and 76% would be more likely to apply for a job that offers remote work.1

SVN® Product Council Office Chair Justin Horwitz notes that “arguably, Office properties were the most negatively impacted of all the product types as a result of the pandemic.” However, he holds that 2021 was a year of recovery as sales volumes came back to peak levels thanks to returning “investor demand for quality office buildings, […] particularly for well-stabilized assets in strong locations.”

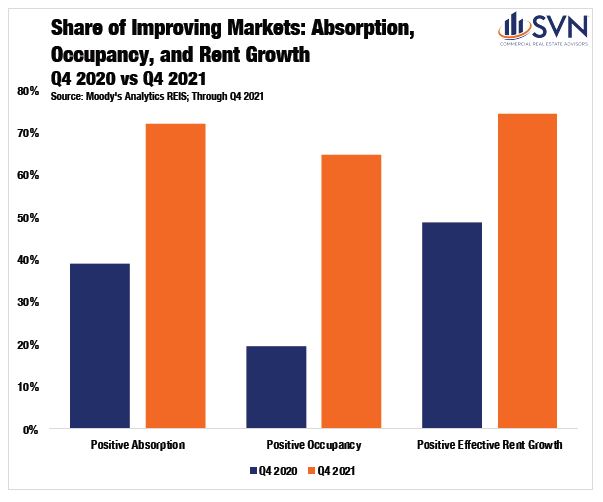

In their Q4 2021 report, Moody’s Analytics REIS attests that while the stage was set for Office sector distress in 2021, the incoming performance data failed to show it.2 Effective rent growth remained negative to begin last year but had returned to growth by the third quarter. Through Q4 2021, of the 82 markets that Reis tracks, 59 had positive absorption, 53 had improving occupancy, and 61 saw improving rent growth — a stark contrast from one year ago.

The open questions over the workplace of the future and its role in our daily lives appear most pertinent to Gateway markets such as New York. According to New York’s MTA, ridership of NYC’s subway system is forecast to be a long way off pre-pandemic ridership levels through 2025.3 Moreover, many of its stations seeing the largest declines in ridership are in Central Business Districts (CBDs) such as Midtown and Manhattan’s downtown Financial District.

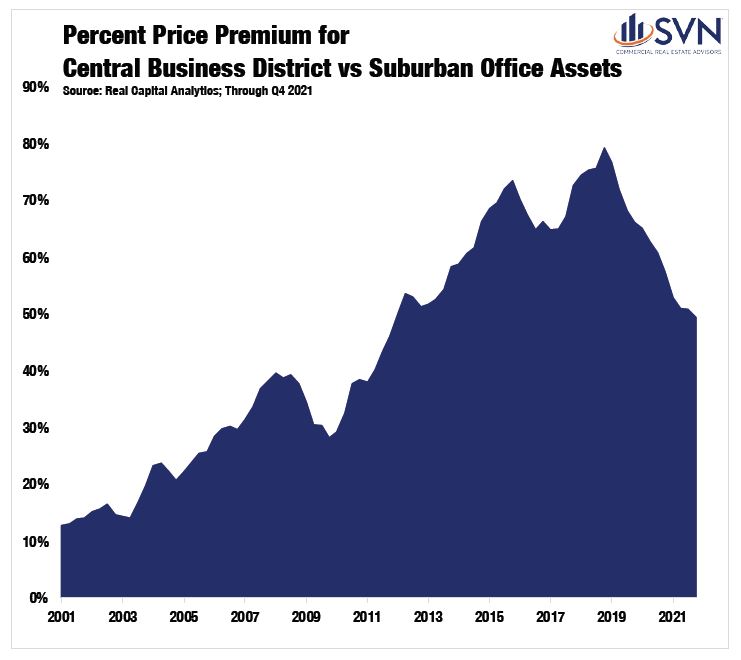

Outside of Gateway markets, the picture on the horizon appears a bit rosier. According to a Chandan Economics analysis of Real Capital Analytics data, Suburban Office valuations continue to soar. Over the past three years, the relative price per square foot premium an Office sector investor would have to pay for a CBD asset over a Suburban asset shrank from 79% to just 49%. Mr. Horwitz notes that “suburban markets are the beneficiary of businesses adjusting to the “new normal.”

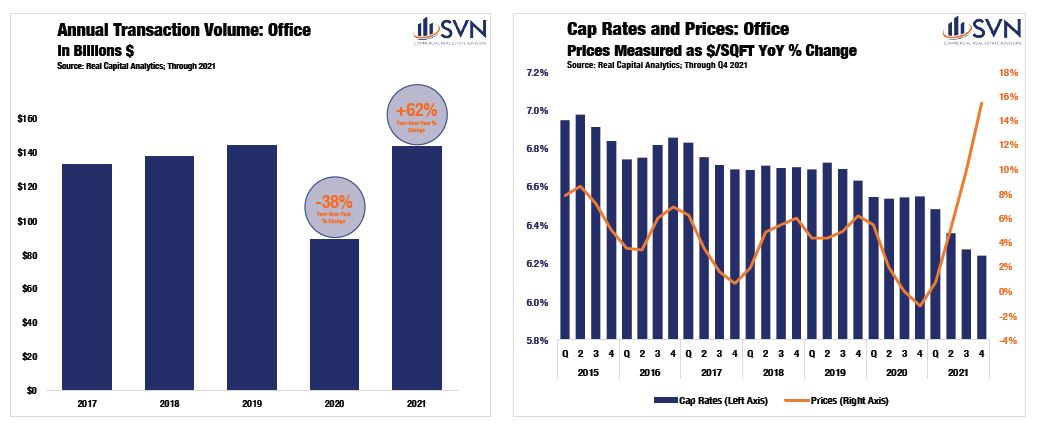

Transaction volumes for Office assets saw considerable improvement in 2021. According to Real Capital Analytics, more than $139 billion of asset value traded hands last year, a 56.5% improvement over 2020’s total. Still, despite the improvement, the Office sector was the only major CRE property type that did not eclipse its 2019 peak in 2021, as transaction volumes fell about $5 billion short.4 While the resumption of strong trading volumes is encouraging, the apparent lack of pent-up demand that has been observed in other property types may signal continued concern for the sector as hybrid work figures to be a market-shaping force for years to come.

Cap rates for Office properties declined steadily throughout 2021, finishing the year with a sector average of 6.2% — down 31 bps year-over-year.5 Suburban Office assets continued their bull run in 2021 as pandemic-induced migration patterns and remote work adoption has proven broadly supportive of suburban commercial real estate at the expense of central cities, especially in Gateway markets. Last year, cap rates for suburban Office assets sank by 38 bps, settling at 6.3%.6 As recently as mid-2019, the cap rate spread between suburban and Central

Business District located Office assets stood as high as 147 bps.7 Through Q4 2021, this spread has fallen to just 55 bps.8 Medical Office assets also saw significant cap rate compression last year, declining 38 bps to 5.9%.9 Meanwhile, Single Tenant Office assets saw cap rates fall by just 4 bps, landing at 6.5%. Central Business District Office assets, the most maligned property group in the sector, saw cap rates rise by 18 bps in 2021, settling at 5.8%.10

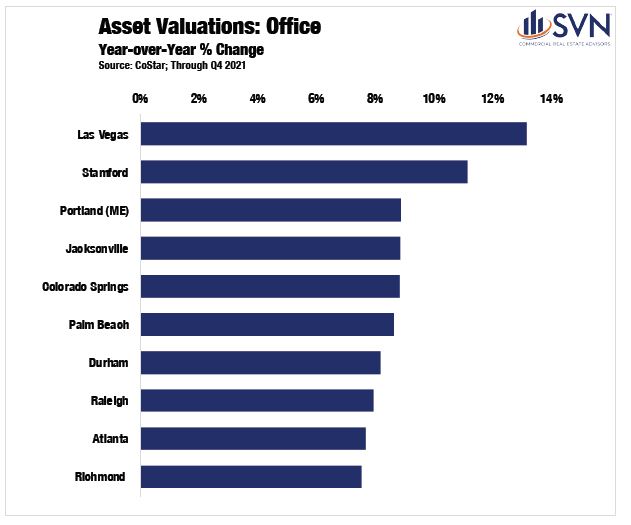

Prices for Office assets finished 2021 up an average of 6.1% from the year earlier. Single Tenant Office assets were the clear laggard of the group, as prices increased by just 5.4% year-over-year through Q4 2021. CBD assets followed next with annual price appreciation rates of 10.4%. Again, Suburban and Medical Office properties were the clear winners in 2021, as prices grew an average of 15.1% and 15.5%, respectively.

The major Office success stories throughout the pandemic have come from outside of the traditional globalized markets like New York, San Francisco, and Los Angeles. Instead, outflowing residents and businesses from the traditional hubs into tertiary alternatives has generated momentum for a number of well-positioned smaller cities.

Nevada continues to be a standout in this area. Las Vegas seemingly has gleaned lessons from the Great Recession, and over the past decade, it has made significant progress in diversifying its labor market. Las Vegas led all other metros for the largest gains in Office sector property valuations last year (+13.2%), according to CoStar. For nearby Reno, it is a similar story. The rising competitiveness of Reno saw its Office sector post the nation’s third-biggest jump in rents (+4.9%) and the fourth largest jump in occupancy rates (+1.6%) last year.11 The Economic Development Authority of Western Nevada credits Reno’s recent success to a decade-long labor diversification plan adopted in Washoe County.12 Reno’s unemployment rate sat at a rock bottom 2.8% at the end of 2021 — 1.1 percentage points better than the national average.13

Moving beyond Nevada, several other secondary cities in the West continue to see their stock rise. San Diego posted a sizable jump in Office space net absorption totals in Q4 2021, coming in at 648,414 square feet, surging from just 2,913 square feet in the same period the year prior.14 Colorado Springs, CO, stands as a rare example of a metro where there are more employees today (310k) than there were entering the pandemic (305k).15 According to CoStar, the relatively small Colorado city posted the fifth biggest jump in Office sector valuations last year, rising a healthy 8.8%.16

In Spokane, WA, short-term headaches created by the pandemic are pitted against long-term improving fundamentals. According to Guy Byrd of SVN | Cornerstone, “Spokane’s CBD has been the weakest performing market in the last year as a significant number of tenants are choosing the increasingly popular hybrid work model.” He goes on to cite that “recruiting top talent and providing attractive work environments for workers who now prefer remote work is a significant new challenge.” Still, Washington State anticipates that Spokane will be a site for significant growth in the years ahead. While Spokane County is home to just over half a million people, the State’s Office of Financial Management projects that its resident population will swell by another 90k by the year 2040.17 Despite the ongoing headwinds, Mr. Byrd notes that vacancy rates improved last year as “users were forced to reinvent the most effective office environment.” Moreover, sales volumes also ticked up in 2021 “due to low interest rates and minimal new office construction,” a trend that forecasts should carry into 2022, “subject to economic conditions vital to the market.”

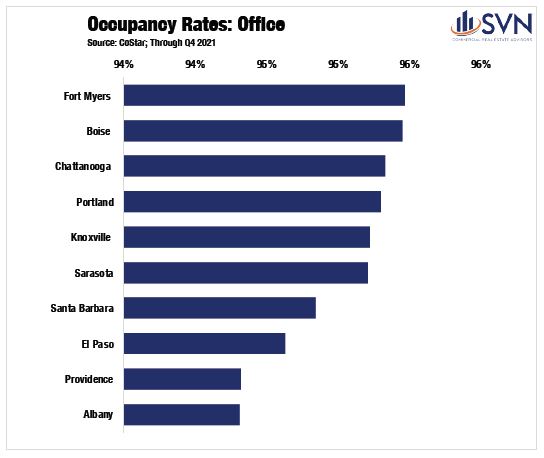

Success begets success. Florida saw its population grow by 211k people in 2021 — more than every state not named Texas.18 With the influx of new residents, there is increased demand throughout all verticals of commercial real estate. After all, these incoming residents need places to live, places to shop, and places to work. Florida’s Office markets, including in suburban settings, saw statewide success in 2021.

Fort Myers, a smaller Office sector compared to Florida’s more developed alternatives, has seen demand far outpace supply as it currently boasts the highest market-level occupancy rate (95.5%) in the country.19 Moreover, between the end of 2020 and the end of 2021, the Office occupancy rate rose by the second-highest clip in the country, growing by 1.8 percentage points.20

According to SVN | Commercial Advisory Group’s Larry Starr, Sarasota is “boasting some of the strongest office rent growth in the country,” a claim that is backed up by CoStar data, which shows rents in the area growing by 5.3% last year.21 “Office demand has remained strong in Sarasota throughout 2021, pushing vacancies to new lows.” In Tampa, a metro that has seen as much commercial real estate success as sporting success over the past half-decade, saw firming demand last year. Mr. Starr notes that Tampa remained a standout as “both asking rents and office demand improved throughout 2021, significantly outperforming the National Index.” Mr. Starr does see the potential for some softness in 2022, suggesting that Tampa’s office sector will be “challenged due to the increase in the amount of space available on the market,” as the pandemic triggered “the largest supply wave in over a decade.” Still, he sees the rising profile of Tampa and its ability to attract re-locating businesses as broadly supportive of the city’s long-term fundamentals, citing that “office investment activity has sharply increased with annual sales volume roughly doubling 2020 levels.”

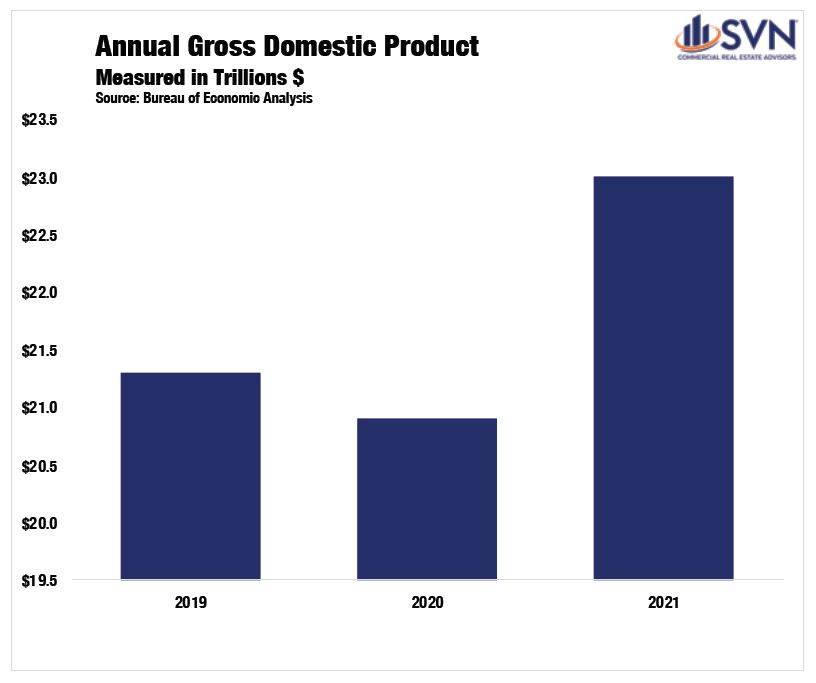

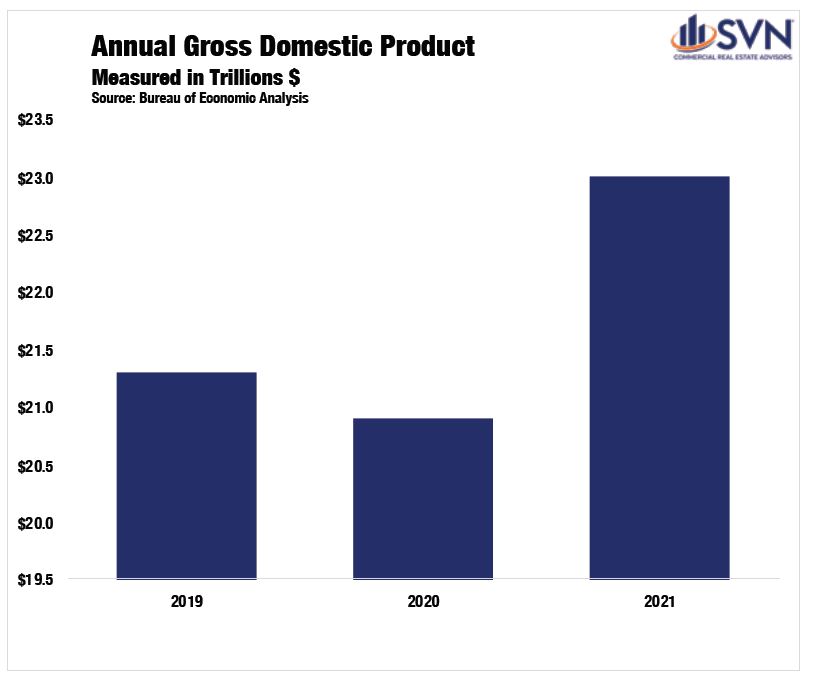

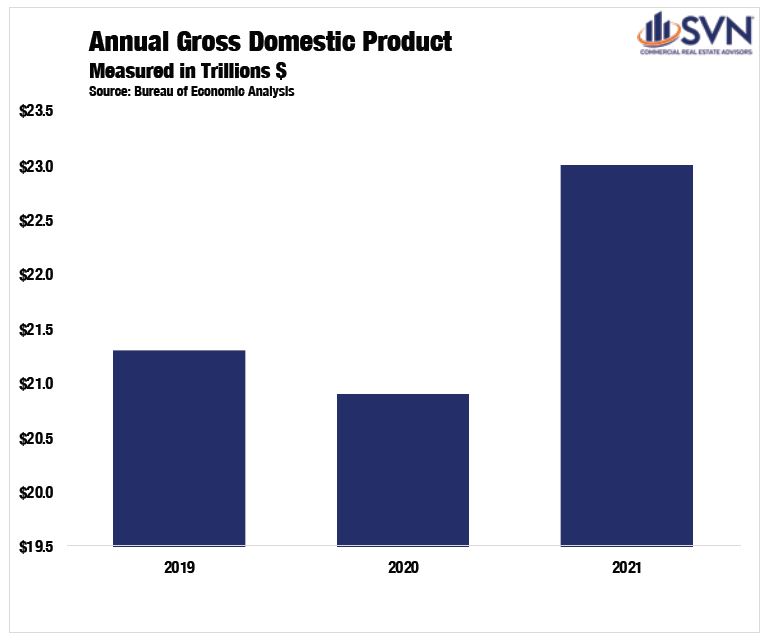

The US economy has experienced a robust recovery from the initial shock of COVID-19. A pandemic-driven shift in consumption away from services and into goods, boosted by a sweeping stimulus effort, reconditioned our economy well before an off-ramp from the public health crisis was in sight. By Q3 2020, inflation-adjusted GDP shrugged off its worst quarterly performance on record to record its best, a 33.4% annualized growth rate.1 In 2021, the total nominal value of all consumption and production reached $23.0 trillion, a 9.1% increase above 2020’s total and 6.9% above 2019’s total. After adjusting for inflation, the US economy is 3.2% larger than its pre-pandemic peak.2

The foundation of the economy’s rebound has been a swift labor market recovery. At its April 2020 peak, the official unemployment total reached a staggering 23 million people.3 By the start of 2021, the unemployment total had improved to just 10.1 million people out of work.4 Over the past year, this level has come down to 6.5 million people, less than one million above the pre-pandemic level of 5.7 million.5

INFLATION & MONETARY POLICY

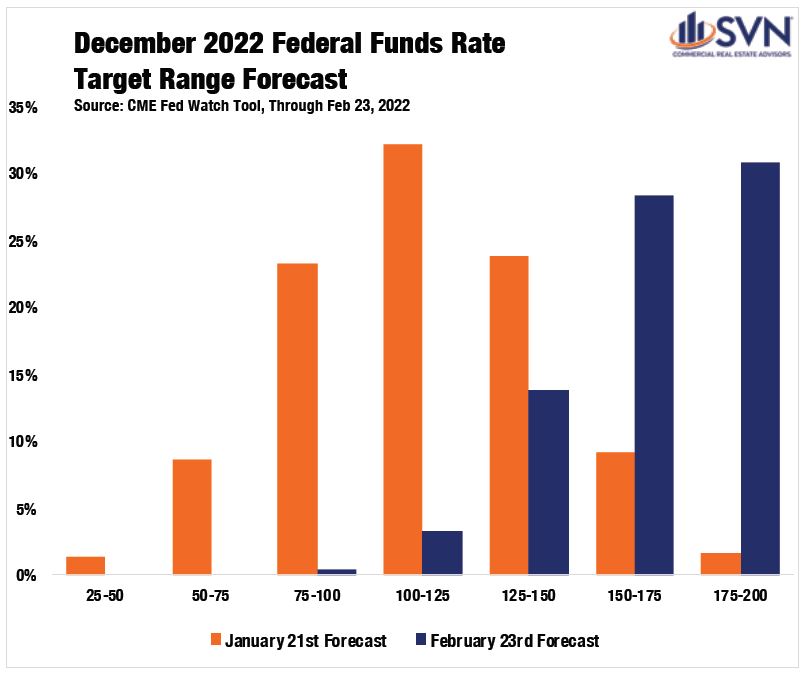

One year ago, the market consensus was that the Federal Open Market Committee (FOMC) would not begin a monetary policy tightening cycle until 2023. However, as demand surges in the face of gummed-up supply chains, rampant inflation has emerged at center stage, forcing shifting guidance from policymakers.

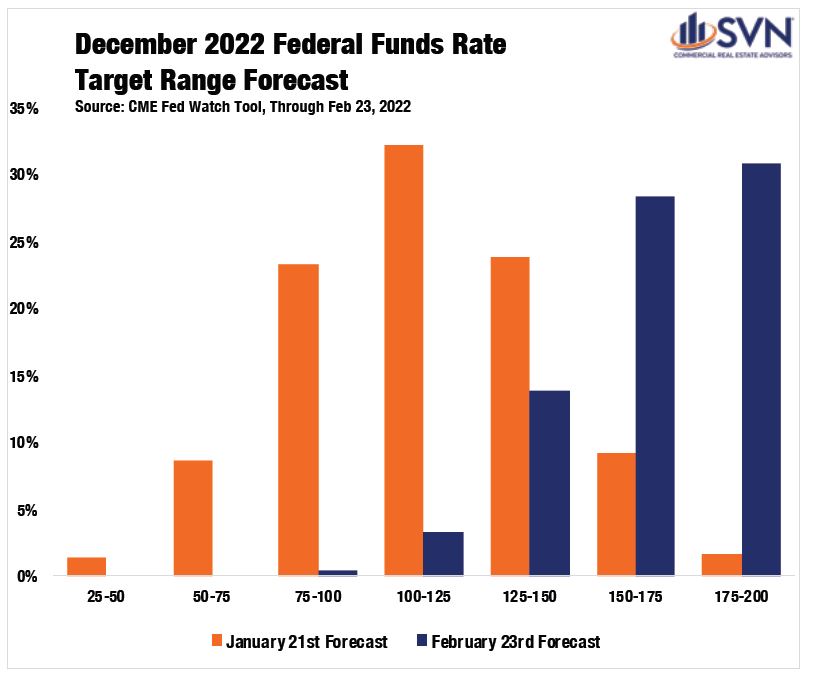

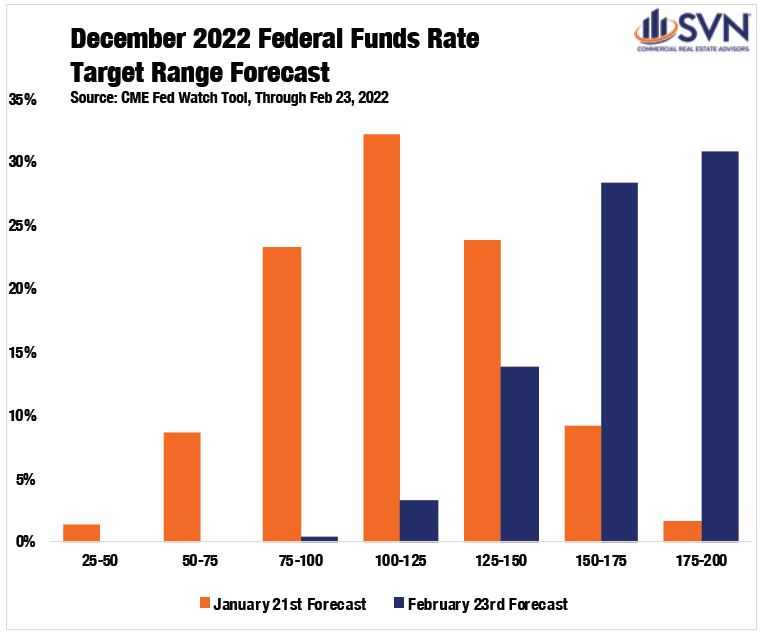

After decades of tepid price increases, in January 2022, the Consumer Price Index (CPI) reached 7.5%, a level not seen in 40 years.6 Core-PCE, the Federal Reserve’s preferred inflation gauge that excludes food and energy prices, reached 5.2% in January, prompting the FOMC to be increasingly committed to an interest-rate hike at its March 2022 meeting.7 In just 24 months, policymakers at the Federal Reserve have repositioned themselves from a tighter monetary policy stance into an accommodative one and back to a tightening one. According to the CME Fed Watch Tool, as of February 23rd, future markets are forecasting seven rate hikes by the end of the year — a sizable shift from even just one month earlier, when future markets were forecasting just four rate hikes in 2022. Volatile swings in the medium-term outlook are symptomatic of the rapid shifts in economic activity that categorized the past two years.

In December, Fed officials looked on cautiously at the near-term outlook as Omicron emerged as a roadblock to economic normalcy. After the Delta variant led to declining activity and sluggish job growth in mid-to-late summer 2021, some officials worried that Omicron, a more transmissible variant of COVID compared to previous waves, would hinder the recovery. While a significant wave of US cases followed, the Omicron wave proved to be less deadly and less straining on the US public health system than previous ones. As a result, an increasing number of US states and municipalities are relaxing masking and vaccine restrictions. On February 25th, the CDC introduced a new slate of guidelines that experts say shifts the US into the “endemic phase” of the pandemic. The new guidelines would put more than half of US counties and over 70% of the population in “low” or “medium” risk designations, bolstering the FOMC’s willingness to remove accommodative monetary policies.

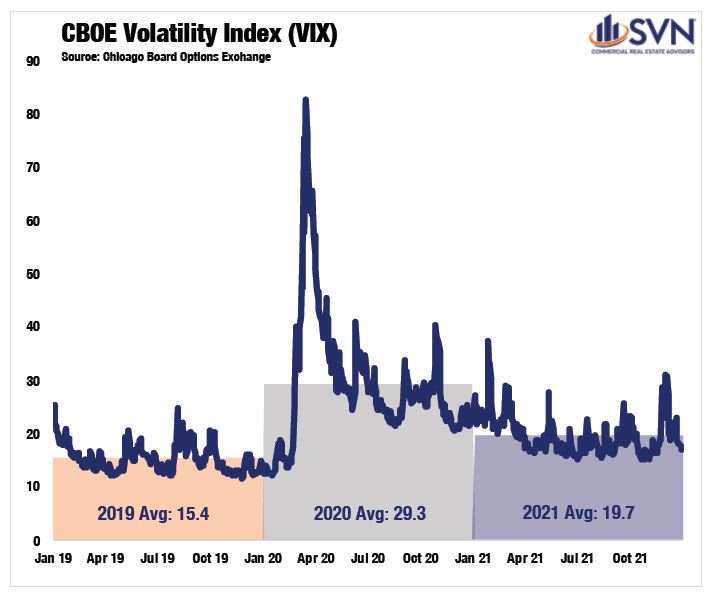

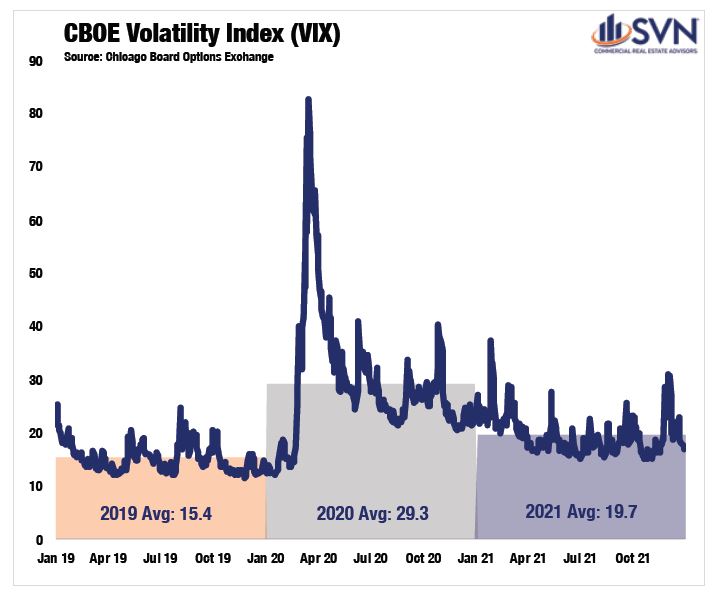

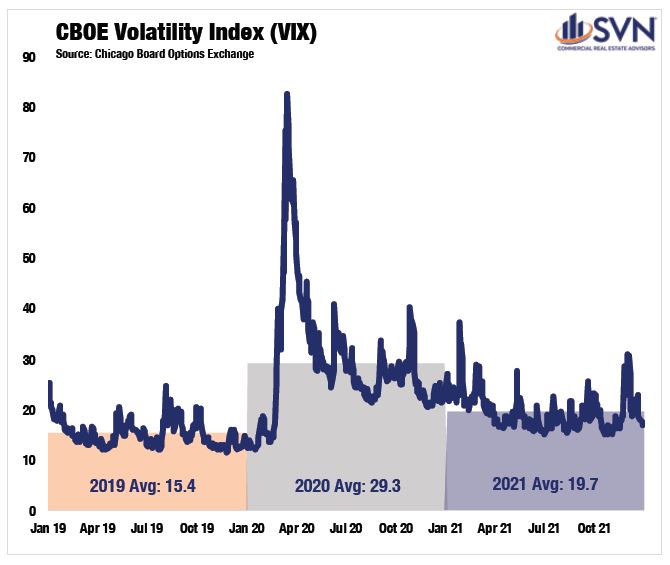

Still, a measurable dose of uncertainty overhangs stock markets and the whole macroeconomy. The VIX, a volatility index captured by the Chicago Board Options Exchange, has remained stubbornly elevated since the onset of the pandemic. Despite moderately retracting during the fall of 2021, the annual average for the VIX in 2021 was 19.7, 27.7% above its 2019 average.8

The SVN Vanguard team can help with your office real estate needs. We can help you find the ideal office property for sale or lease. Interested in discussing a sale-leaseback? Contact us.

NATIONAL OVERVIEW SOURCES

- Morning Consult, as of February 26th, 2022.

- Moody’s Analytics REIS, report found here: https://cre.moodysanalytics.com/insights/cre-trends/q4-2021-office-first-glance/

- https://www.osc.state.ny.us/files/reports/osdc/pdf/report-10-2022.pdf

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- https://knpr.org/knpr/2022-02/northern-nevadas-economic-diversification-helped-soften-impact-pandemic-can-southern

- Bureau of Labor Statistics

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- Bureau of Labor Statistics; Through December 2021

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- https://www.krem.com/article/money/economy/boomtown-inland-northwest/spokane-county-future-growth/293-6859dcc0-bd63-40ef-8f16-c483fa61c9e1

- US Census Bureau

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

MACRO ECONOMY SECTION SOURCES

US Bureau Economic Analysis

US Bureau Economic Analysis

US Bureau Labor Statistics

US Bureau Labor Statistics

US Bureau Labor Statistics

US Bureau Labor Statistics

US Bureau of Economic Analysis

Chicago Board Options Exchange

THE RETAIL SECTOR was already steeped in transformational shakeout prior to the pandemic, rightsizing to how shopping is done in an increasingly digital economy. In what has already been a decade-long process, most analysts thought it would be a decade more before we started to see a turnaround. Of course, the pandemic has updated those timelines dramatically. SVN® Retail Product Chair Ryan Imbrie, CCIM notes that the retail sector “landed on the unfavorable side of COVID-19’s lopsided impact on commercial real estate.” While industrial properties benefited from the surge in online spending, Imbrie says the pandemic advanced the retail sector’s “long slide” with mounting store closings and rising vacancy.

As the old Winston Churchill quote goes, “If you’re going through hell, keep going.” In 2020, with physical restrictions on retail in place, a significant portion of retailing shifted from in-person to online. E-commerce’s share of retail sales has grown by an average of 0.5 percentage points annually since the start of the millennium, but between Q1 and Q2 2020, it shot up from 11.4% to 15.7%1— quantitative proof that Americans were not only buying toilet paper and DIY arts and crafts during the shutdown. Thankfully for the Retail sector, shoppers returned to the aisles in late 2020 and continued doing so throughout 2021. Through Q4 2021, e-commerce’s share of retail sales has fallen down to 12.9%.2

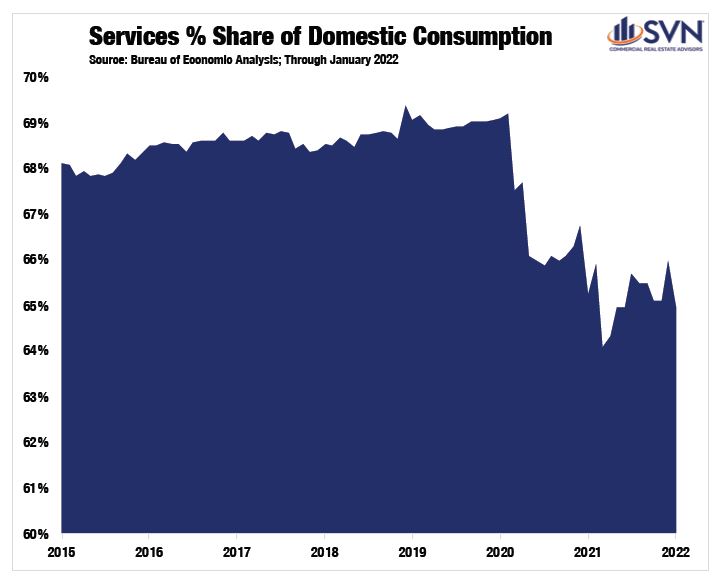

Overall, monthly retail sales reached their highest level on record in January 2022, coming in at a seasonally adjusted $650 billion for the month.3 The sector “has experienced some bright spots where tenants are thriving as seen in grocery-anchored properties, home improvement, and dollar stores,” remarks Mr. Imbrie. Over the short term, the sector should continue to benefit from an apparent shift away from services and towards the consumption of physical goods that have remained present even as the country has lifted most pandemic-era restrictions.

The Retail sector was often compared to a patient on life support heading into the pandemic, and the shock of the shutdown was widely thought to be a knockout blow. Interventions by the Federal Government, namely the Payroll Protection Program, helped to limit the scale of distress. According to Trepp, levels of distress in the sector continue to improve, though investors remain cautious. Through January 2022, the CMBS delinquency rate has improved to 8% — down from 18% during the pandemic’s crisis peak, though still above the sub-4% level where it was entering 2020.4

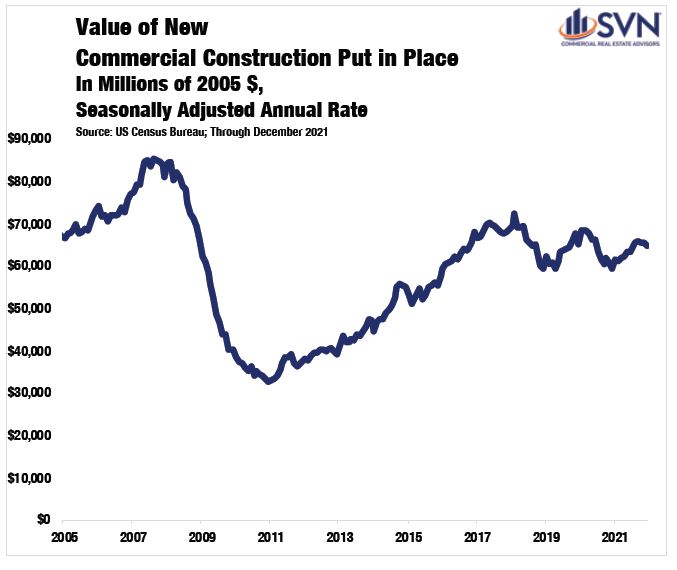

Still, for the first time in a long time, having a healthy dose of optimism for the Retail sector feels appropriate. According to OpenTable’s COVID recovery tracking, the US is arriving right back at its pre-pandemic benchmark for restaurant reservations almost two years after the initial shut down. Moreover, after adjusting for inflation, the value of new commercial construction put in place, a broad category that includes most retail and wholesaling activities, has trended downward since 2018. With less new supply entering the Retail sector, the macro task of repositioning existing stock becomes a bit less herculean. Retail may not be out of the woods just yet, but after following Mr. Churchill’s advice, the temperature dial is starting to improve.

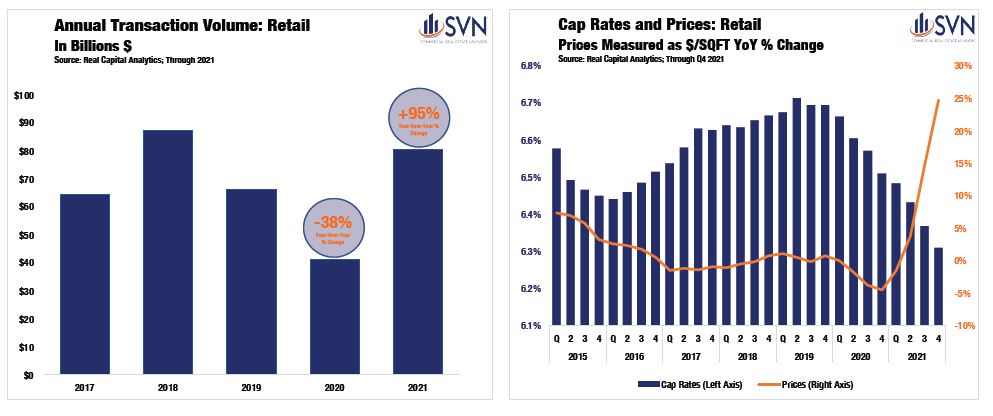

Transaction volumes in the retail sector surged in 2021, following a trend observed throughout all commercial real estate. According to Real Capital Analytics, deal volume for retail assets reached $76.8 billion last year — an 88% improvement from 2020’s pandemic-muted total and 14.1% better than 2019’s mark.5 While new deal activity in 2021 remained down from 2015’s record peak by $13.5 billion, last year saw the most retail deal volume since 2018.6

As was the case in 2020, the Retail sector was a mixed bag of outcomes across its sub-property types. Big Box Retail assets saw a resurgence as new deal activity rose by 88% to $2.6B — roughly equivalent to 2019’s and 2020’s totals combined.7 Lifestyle/Power Centers also saw a large uptick in 2021, posting $5.8 billion of deal volume, marking its highest total since 2014.8 Mall assets have continued to see deal volumes crater as the maligned product type posted just $1.9 billion of trades last year, declining 51% from 2020.9 Drug store assets saw muted growth in 2021 as deal volume grew year-over-year by just 19%.10 However, Drug Store’s lackluster (by comparison) growth total is a function of the product type’s success in 2020, as it was the only asset type seeing investment growth during the pandemic slowdown.

Cap rates for Retail properties continued to post declines in 2021. Through Q4 2021, cap rates are down 6 bps from Q3 and 20 bps from the same time last year.11 Again, retail sub-types saw dramatically idiosyncratic cap rate movements through 2021. Unsurprisingly, Malls were the only sub-asset type to post rising property yields in 2021, growing 47 bps year-over-year through Q4 2021.12 Grocery-anchored followed next, with the property type posting just 11 bps of cap rate compression last year.13 On the other side of the spectrum are Anchored and Big Box retail assets, which posted cap rate compression totals in 2021 of 42 bps and 49 bps, respectively.14

On the pricing front, retail assets across the board saw improving trading valuations in 2021. The average year-over-year price appreciation for all retail assets through Q4 2021 was 24.7%.15 Moreover, retail assets generally are trading at valuations 19.0% above where they stood pre-pandemic and 18.1% above their previous all-time high (2016).16 The best performing retail sub-types by price appreciation in 2021 were Centers and Unanchored assets, which saw valuations grow by 30.5% and 22.6%, respectively.17

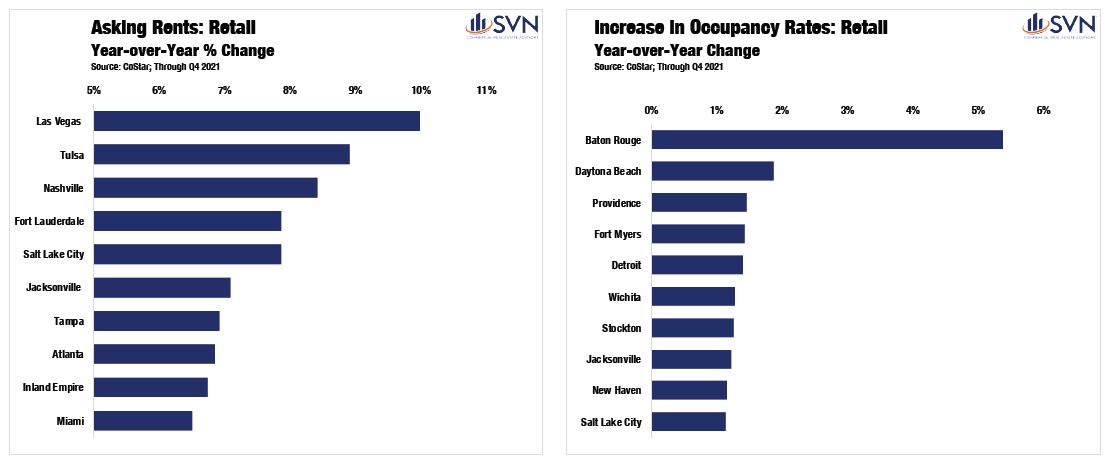

From the coastlines of Florida to the outskirts of the Colorado River, the retail sector in the Sun Belt is cashing in on consumers migrating into the Southern portion of the country. Positive momentum is stretching across state lines and time zones. Nashville closed out 2021 as one of the nation’s top-performing retail markets, posting the third-highest annual rent growth totals (8.4%).18 While Nashville is heralded as the music capital of the country, its tech sector is singing the sweetest tunes of all. Nashville’s expanding tech base is forecast to double the metro’s employment growth rate in the coming years,19 bringing more residents into the area and putting additional upward pressure on available space. Las Vegas, another entertainment industry heavyweight that has cultivated its tech sector, is experiencing a similar trajectory of success. Retail market rents in Sin City finished up 10.0% to close out 2021, the top mark in the country.20

Three of the four largest increases in Retail occupancy last year were found in the Sun Belt — two of which were in Florida.21 Baton Rouge, LA led the entire country with the largest one-year occupancy rate increase.22 Between Q4 2020 and Q4 2021, occupancy rates in

Baton Rouge jumped from 91.4% to an extremely tight 96.8% — an improvement of 5.4 percentage points.23 Moving down the list, Daytona Beach, FL, posted an occupancy rate improvement of 1.9 percentage points, and Fort Myers, FL, rose by 1.4 percentage points.24 Commenting on the Daytona Beach and Ormond Beach area, Carl Lentz of SVN | Alliance Commercial Real Estate Advisors notes that “explosive residential growth and retail traction along the LPGA corridor have been the primary drivers of the momentum.” While warm winters are a consistent selling point throughout the Sunshine State, Daytona’s retail sector has also benefited from its proximity to the region’s booming blend of suburban amenities, a dominating feature of post-pandemic real-estate growth.

Mr. Lentz goes on to mention that “as local and regional retailers continue to see success, many national retailers are paying attention and entering the market.”

The US economy has experienced a robust recovery from the initial shock of COVID-19. A pandemic-driven shift in consumption away from services and into goods, boosted by a sweeping stimulus effort, reconditioned our economy well before an off-ramp from the public health crisis was in sight. By Q3 2020, inflation-adjusted GDP shrugged off its worst quarterly performance on record to record its best, a 33.4% annualized growth rate.1 In 2021, the total nominal value of all consumption and production reached $23.0 trillion, a 9.1% increase above 2020’s total and 6.9% above 2019’s total. After adjusting for inflation, the US economy is 3.2% larger than its pre-pandemic peak.2

The foundation of the economy’s rebound has been a swift labor market recovery. At its April 2020 peak, the official unemployment total reached a staggering 23 million people.3 By the start of 2021, the unemployment total had improved to just 10.1 million people out of work.4 Over the past year, this level has come down to 6.5 million people, less than one million above the pre-pandemic level of 5.7 million.5

One year ago, the market consensus was that the Federal Open Market Committee (FOMC) would not begin a monetary policy tightening cycle until 2023. However, as demand surges in the face of gummed-up supply chains, rampant inflation has emerged at center stage, forcing shifting guidance from policymakers.

After decades of tepid price increases, in January 2022, the Consumer Price Index (CPI) reached 7.5%, a level not seen in 40 years.6 Core-PCE, the Federal Reserve’s preferred inflation gauge that excludes food and energy prices, reached 5.2% in January, prompting the FOMC to be increasingly committed to an interest-rate hike at its March 2022 meeting.7 In just 24 months, policymakers at the Federal Reserve have repositioned themselves from a tighter monetary policy stance into an accommodative one and back to a tightening one. According to the CME Fed Watch Tool, as of February 23rd, future markets are forecasting seven rate hikes by the end of the year — a sizable shift from even just one month earlier, when future markets were forecasting just four rate hikes in 2022. Volatile swings in the medium-term outlook are symptomatic of the rapid shifts in economic activity that categorized the past two years.

In December, Fed officials looked on cautiously at the near-term outlook as Omicron emerged as a roadblock to economic normalcy. After the Delta variant led to declining activity and sluggish job growth in mid-to-late summer 2021, some officials worried that Omicron, a more transmissible variant of COVID compared to previous waves, would hinder the recovery. While a significant wave of US cases followed, the Omicron wave proved to be less deadly and less straining on the US public health system than previous ones. As a result, an increasing number of US states and municipalities are relaxing masking and vaccine restrictions. On February 25th, the CDC introduced a new slate of guidelines that experts say shifts the US into the “endemic phase” of the pandemic. The new guidelines would put more than half of US counties and over 70% of the population in “low” or “medium” risk designations, bolstering the FOMC’s willingness to remove accommodative monetary policies.

Still, a measurable dose of uncertainty overhangs stock markets and the whole macroeconomy. The VIX, a volatility index captured by the Chicago Board Options Exchange, has remained stubbornly elevated since the onset of the pandemic. Despite moderately retracting during the fall of 2021, the annual average for the VIX in 2021 was 19.7, 27.7% above its 2019 average.8

The SVN Vanguard team can help with your retail real estate needs. We can help you find the ideal retail property for sale or lease. Interested in discussing a sale-leaseback? Contact us.

NATIONAL OVERVIEW SOURCES

- US Census Bureau

- US Census Bureau

- US Census Bureau

- https://www.trepp.com/hubfs/Trepp%20Retail%20Report%20February%202022.pdf?hsCtaTracking=8cec15d8-2d6d-4a7e-b3be-47518c19f0f8%7C7edd6f4f-a67b-476b-aaec-43ab495ce73c

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 202

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- Real Capital Analytics; Throughout Q4 2021

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- https://technologycouncil.com/wp-content/uploads/2021/11/2021-State-of-Middle-TN-Tech.pdf?utm_source=Sailthru&utm_medium=email&utm_campaign=2021.11.22%20NASH&utm_term=NASHtoday%20Subscribers%20-%20MASTER

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

MACRO ECONOMY SECTION SOURCES

- US Bureau Economic Analysis

- US Bureau Economic Analysis

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau of Economic Analysis

- Chicago Board Options Exchange

Aside from “location, location, location,” the most cliché phrase in real estate may be “people will always need somewhere to live.” Its overuse is a symptom of its accuracy. The Multifamily sector had every excuse available to post a down year in 2021, yet its performance proved to be nothing short of phenomenal. As noted by SVN® Multifamily Chair Reid Bennett, CCIM, the sector faced “unknowns of the pandemic, rent moratoriums, interest rate hike threats, and inflation at a four-decade high.” Nonetheless, markets across the country range from nearly fully recovered to well ahead of where they were two years ago before the pandemic.

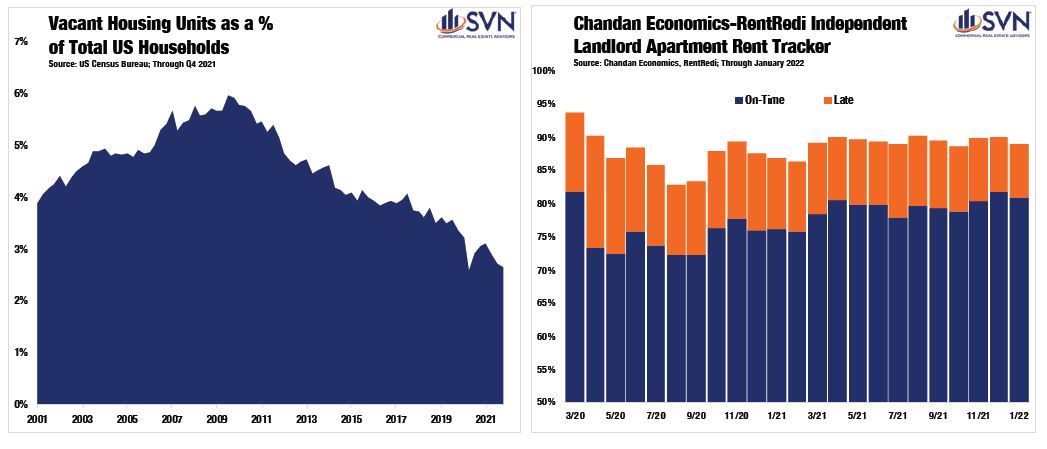

A key reason why rental housing has seen such widespread success in recent years is that the US has undersupplied enough new stock to keep pace with growing demand. Between 2002 and 2010, the amount of vacant housing supply available for sale or rent has typically equaled between 4% and 6% of the total number of US households. 1 Through Q4 2021, after more than a decade of declines, this excess housing supply has slumped to just 2.6%. In other words, supply is (very) tight.2

A major concern when the pandemic started was whether renter households would be able to make their monthly payments on time, if at all. According to the NMHC, rent collections in professionally managed units dipped marginally during the beginning of the pandemic but not enough to be categorized as distress. On the other hand, rental units operated by independent, mom-and-pop landlords proved to be far more sensitive to the shutdown’s economic effects. According to Chandan Economics and RentRedi, on-time rental payments sank by more than 9 percentage points between March and May 2020. Still, despite the pandemic’s multiple waves, 2021 was a year of recovery for small apartment operators. Through January 2022, on-time rent collections were back in line with where they were entering the pandemic.

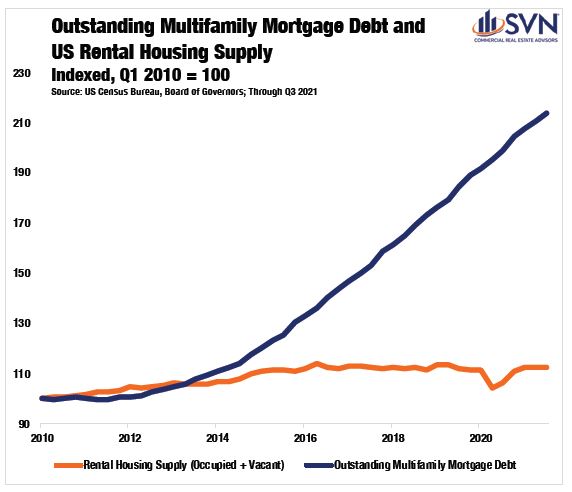

For the year ahead, there is at least some concern over how the sector will absorb higher interest rates as the Federal Reserve readies multiple rate hikes. Since 2010, the number of rented housing units in the US has expanded by about 13%.3 Over the same time, the amount of outstanding multifamily debt in the country has more than doubled (+114%).4 In short, the US rental housing sector has become substantially

more leveraged over the past decade. Given the relative increase in indebtedness and the specter for higher debt servicing costs on the horizon, this is an area that deserves some risk consideration in the year ahead.

Still, all else equal, the balance of factors broadly supports continued investment success in the US rental housing sector in 2022. With an eye on the horizon, Mr. Bennett identifies three underlying factors that should strengthen the sector in 2022:

• A high number of new entrants into the space (including retail buyers, office buyers, and multifamily syndicators) are competing with an already crowded pool of multifamily buyers.

• Household formations and Baby Boomers re-entering the rental pool will continue to support stiff competition for incoming supply.

• This year (2022) will be the last year of 100% bonus depreciation, where many buyers will be overextending to receive this benefit for themselves and their investors.

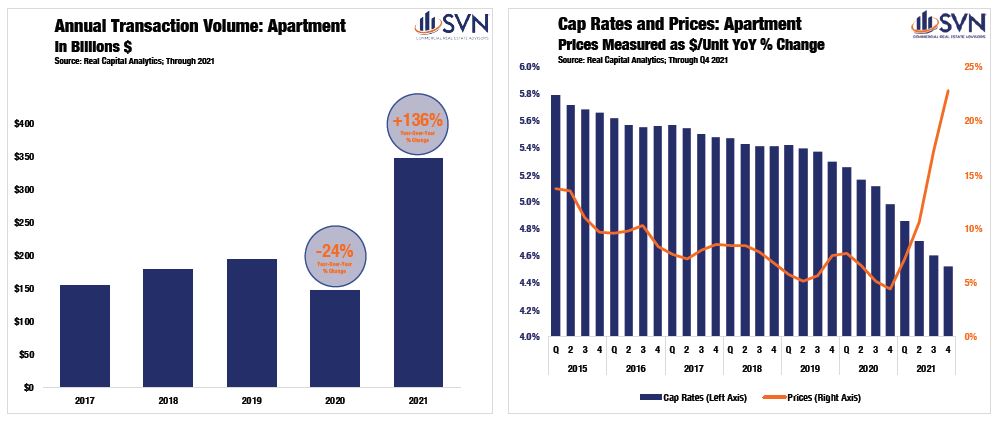

If 2020 was the year where dealmakers were sitting on the sidelines, then 2021 was the year where there were too many players on the field. According to Real Capital Analytics, annual transaction volume in 2021 totaled an incredible $332B — a 128% surge from 2020’s pandemic-impacted total of $147B. Moreover, the 2021 total stands as a 74% increase over the previous all-time high set in 2019.5 While the entire year was marked by consistently higher transaction volumes, the year-end record totals are largely a function of an unprecedented spike in deal activity in Q4. In the last three months of the year, RCA tracked $149B in apartment sales, more than any two other quarters combined last year.

Cap rates for Multifamily properties continued to sink in 2021, reaching new a new all-time low of 4.5% in Q4.6 Similarly, the spread between apartment cap rates and the 10-year Treasury, a measure of the sector’s perceived riskiness, fell to 298 bps in Q4 2021 — the lowest level since Q1 2019.7 In total, apartment cap rates fell 48 bps between the start and the end of 2021, marking the most significant annual cap rate decline since before the Great Financial Crisis (GFC). With benchmark interest rates set to rise in 2022 as the Federal Reserve initiates its monetary tightening cycle, some upward pressure on cap rates may be on the horizon.

Declining cap rates in 2021 led to some significant upward pressure on pricing. As part of Real Capital Analytics’ post-2001 tracking, never have apartment asset values grown faster than 15% on an annual basis— that is, of course, until 2021. As of Q4 2021, average apartment unit prices finished the year at $ 213,761, a record-breaking 19.6% higher than a year earlier.8

Across subsectors, Garden-style apartment units, which tend to be in more suburban locations, once again experienced the most pricing growth in 2021. These Garden units saw asset prices rise by an incredible 21.8% last year, besting the sector-wide average by 2.2 percentage points.9 Meanwhile, Mid/High-rise apartment units saw the least robust price appreciation of all subsectors in 2021, growing by just 10.8%.10 Still, the annual improvement for the most urban-centric property type should not be overlooked. While Mid/High-rise units saw the least amount of price appreciation last year, they saw the most relative improvement. To close out 2020, valuations for Mid/High-rise units sank 3.5% year-over-year, making the 2021 mark a swing of 14.2 percentage points.11

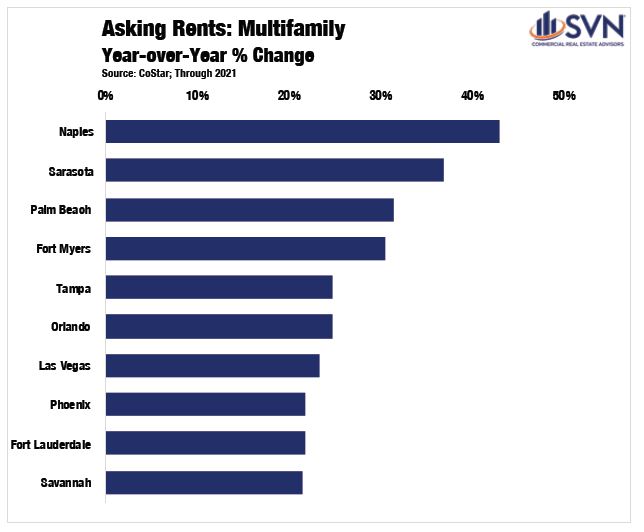

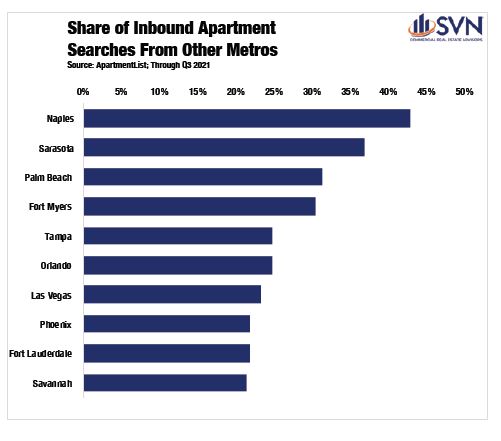

The Sun Belt, and more specifically, the southeastern portion of the country, continues to be the largest hotbed for population growth and new housing demand. According to the latest US Census Bureau data, the South added roughly 816,000 new residents in 2021 alone. On a state-by-state basis, Florida remains the epicenter of the Southeast’s dominating success. In the last decade, the Sunshine State has come a long way to rebrand itself away from the Heaven’s Waiting Room nicknames of the past. Naples, FL, saw the single largest jump in market rents in 2021. According to CoStar, rents in Naples averaged $1,527 at the end of 2020. Fast forward to end the end of 2021, and average rents were nearly 43% higher at $2,183.12 Heading up Florida’s west coast, there are more rent growth accolades to go around. Fort Myers and Tampa ranked fourth and fifth for major metros posting the most rent growth last year, with rent growth coming in at 30.4% and 24.8%, respectively.13

Cut over to Florida’s east coast, and the story is effectively the same. According to Tim Davis, CCIM of SVN | Alliance Commercial Real Estate Advisors, “the housing supply shortage continues to grow in the Daytona Beach market area, generating continued demand for rental product.” Mr. Davis notes that new rental housing is needed across a number of different sub-asset types, including “traditional garden-style development, as well as cottages and BFR options.” In 2021, Daytona beach saw the country’s third-largest rise in Multifamily occupancy rates and the fifth-largest increase in asset valuations.14 Florida’s east coast success is attributable to “job growth along the I-95 corridor related to work from home policies, manufacturing, distribution, and private space exploration,” according to Mr. Davis.

Beyond the Sunshine State, the rest of the Southeast is also seeing widespread success. Durham, NC posted a 5.0 percentage point increase in its market-wide Multifamily occupancy rate through the end of last year, the fourth-best mark in the country.15 Savannah, GA, saw the tenth-largest increase in Multifamily rents across the US, with prices rising an appreciable 21.4% over the year ending Q4 2021.16

A general theme throughout the other top-performing multifamily markets around the country is that they tend to be ascending secondary metros that are more affordable and off either coast (excluding Florida). The two markets experiencing the highest levels of rent growth in the country outside of Florida are Las Vegas and Phoenix, which saw growth totals of 23.3% and 21.8% last year, respectively.17

Austin in recent years has gained the status of a “revolving door” market, a title given by Apartment List for its heavy flow of both inbound and outbound renters. As of Q3 2021, Apartment List reports Austin as the sixth-highest share of renters looking to jump to a new metro, as well as the seventh-highest share of inbound searches coming from renters elsewhere. Generally, this lines up with Austin’s profile rise as a young, tech-centric city where early-career professionals call home for a few years. Rent growth in Austin was robust last year, with prices growing 20.6%.18

Head due north from the Lone Star, and you’ll find another State seeing a fair share of success: Oklahoma. According to Raymond Lord of SVN OAK Realty Advisors, in 2021, “the Oklahoma City and Tulsa Multifamily market like many US Markets was incredibly active in apartment transactions.” Mr. Lord goes on to note that “Oklahoma City set a record at $961.8 million in 2021, […] [surpassing] the previous record of $541.3 in 2019.” In Tulsa, the story was more of the same, as it “also had record transactions in 2021 at $503.6 million versus $208.6 million in 2020.”

The US economy has experienced a robust recovery from the initial shock of COVID-19. A pandemic-driven shift in consumption away from services and into goods, boosted by a sweeping stimulus effort, reconditioned our economy well before an off-ramp from the public health crisis was in sight. By Q3 2020, inflation-adjusted GDP shrugged off its worst quarterly performance on record to record its best, a 33.4% annualized growth rate.1 In 2021, the total nominal value of all consumption and production reached $23.0 trillion, a 9.1% increase above 2020’s total and 6.9% above 2019’s total. After adjusting for inflation, the US economy is 3.2% larger than its pre-pandemic peak.2

The foundation of the economy’s rebound has been a swift labor market recovery. At its April 2020 peak, the official unemployment total reached a staggering 23 million people.3 By the start of 2021, the unemployment total had improved to just 10.1 million people out of work.4 Over the past year, this level has come down to 6.5 million people, less than one million above the pre-pandemic level of 5.7 million.5

One year ago, the market consensus was that the Federal Open Market Committee (FOMC) would not begin a monetary policy tightening cycle until 2023. However, as demand surges in the face of gummed-up supply chains, rampant inflation has emerged at center stage, forcing shifting guidance from policymakers.

After decades of tepid price increases, in January 2022, the Consumer Price Index (CPI) reached 7.5%, a level not seen in 40 years.6 Core-PCE, the Federal Reserve’s preferred inflation gauge that excludes food and energy prices, reached 5.2% in January, prompting the FOMC to be increasingly committed to an interest-rate hike at its March 2022 meeting.7 In just 24 months, policymakers at the Federal Reserve have repositioned themselves from a tighter monetary policy stance into an accommodative one and back to a tightening one. According to the CME Fed Watch Tool, as of February 23rd, future markets are forecasting seven rate hikes by the end of the year — a sizable shift from even just one month earlier, when future markets were forecasting just four rate hikes in 2022. Volatile swings in the medium-term outlook are symptomatic of the rapid shifts in economic activity that categorized the past two years.

In December, Fed officials looked on cautiously at the near-term outlook as Omicron emerged as a roadblock to economic normalcy. After the Delta variant led to declining activity and sluggish job growth in mid-to-late summer 2021, some officials worried that Omicron, a more transmissible variant of COVID compared to previous waves, would hinder the recovery. While a significant wave of US cases followed, the Omicron wave proved to be less deadly and less straining on the US public health system than previous ones. As a result, an increasing number of US states and municipalities are relaxing masking and vaccine restrictions. On February 25th, the CDC introduced a new slate of guidelines that experts say shifts the US into the “endemic phase” of the pandemic. The new guidelines would put more than half of US counties and over 70% of the population in “low” or “medium” risk designations, bolstering the FOMC’s willingness to remove accommodative monetary policies.

Still, a measurable dose of uncertainty overhangs stock markets and the whole macroeconomy. The VIX, a volatility index captured by the Chicago Board Options Exchange, has remained stubbornly elevated since the onset of the pandemic. Despite moderately retracting during the fall of 2021, the annual average for the VIX in 2021 was 19.7, 27.7% above its 2019 average.8

The SVN Vanguard team can help with your multifamily real estate needs. We can help you find the ideal multifamily property for sale or lease. Interested in discussing a sale-leaseback? Contact us.

NATIONAL OVERVIEW SOURCES

- Chandan Economics analysis of US Census Bureau Data

- Chandan Economics analysis of US Census Bureau Data

- US Census Bureau

- https://www.osc.state.ny.us/files/reports/osdc/pdf/report-10-2022.pdf

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- Real Capital Analytics; Through Q4 2021

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

- CoStar; Through Q4 2021. Note: Measured across the top-100 markets

MACRO ECONOMY SECTION SOURCES

- US Bureau Economic Analysis

- US Bureau Economic Analysis

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau Labor Statistics

- US Bureau of Economic Analysis

- Chicago Board Options Exchange