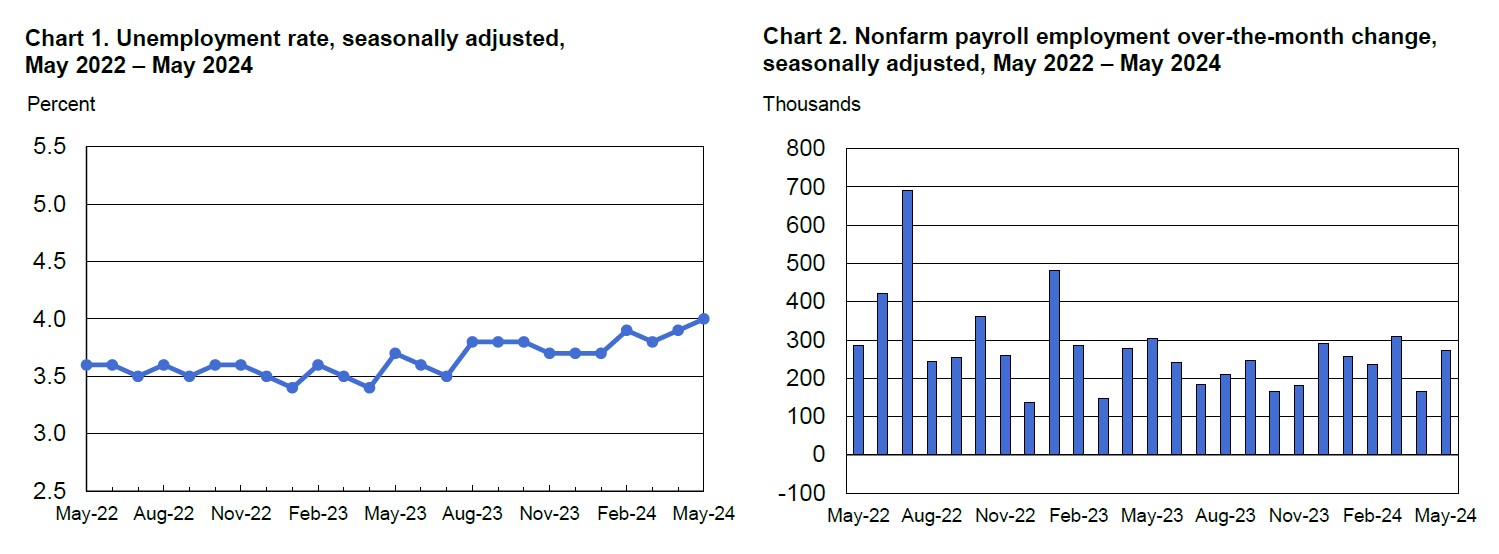

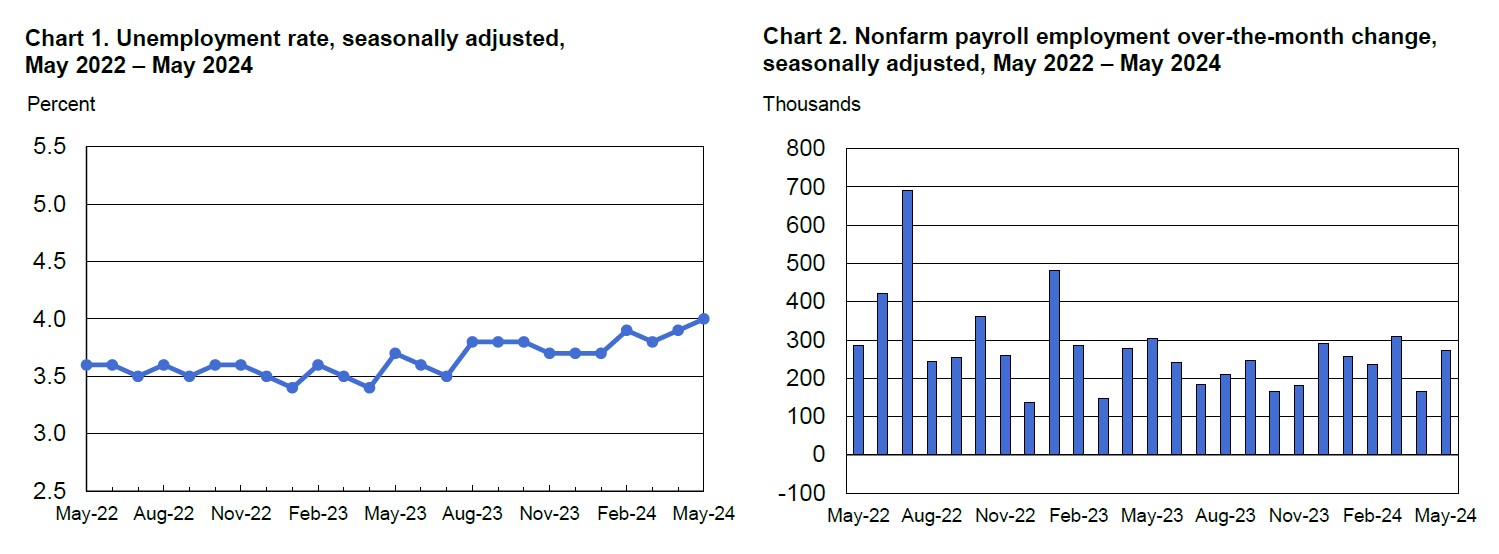

1. SEPTEMBER JOBS REPORT

- The Bureau of Labor Statistics (BLS) reported that the US added 254k jobs in September, drastically defying expectations following a summer of worsening labor market conditions.

- The consensus forecast from economists heading into the data release was that the economy would add just 142,500 payrolls in September following massive downward revisions of previous months’ jobs data and anecdotal signs of labor market deterioration.

- Contrarily, the pace of job growth skyrocketed in September to its highest monthly level since March, while the July and August jobs reports were revised upward.

- The unemployment rate was little changed at 4.1%, while employment continued to rise in food and drinking places, the health care sector, government, social assistance, and construction.

- Wage growth rose by an impressive 0.4% month-over-month and 4.0% year-over-year.

2. FOMC MEETING MINUTES

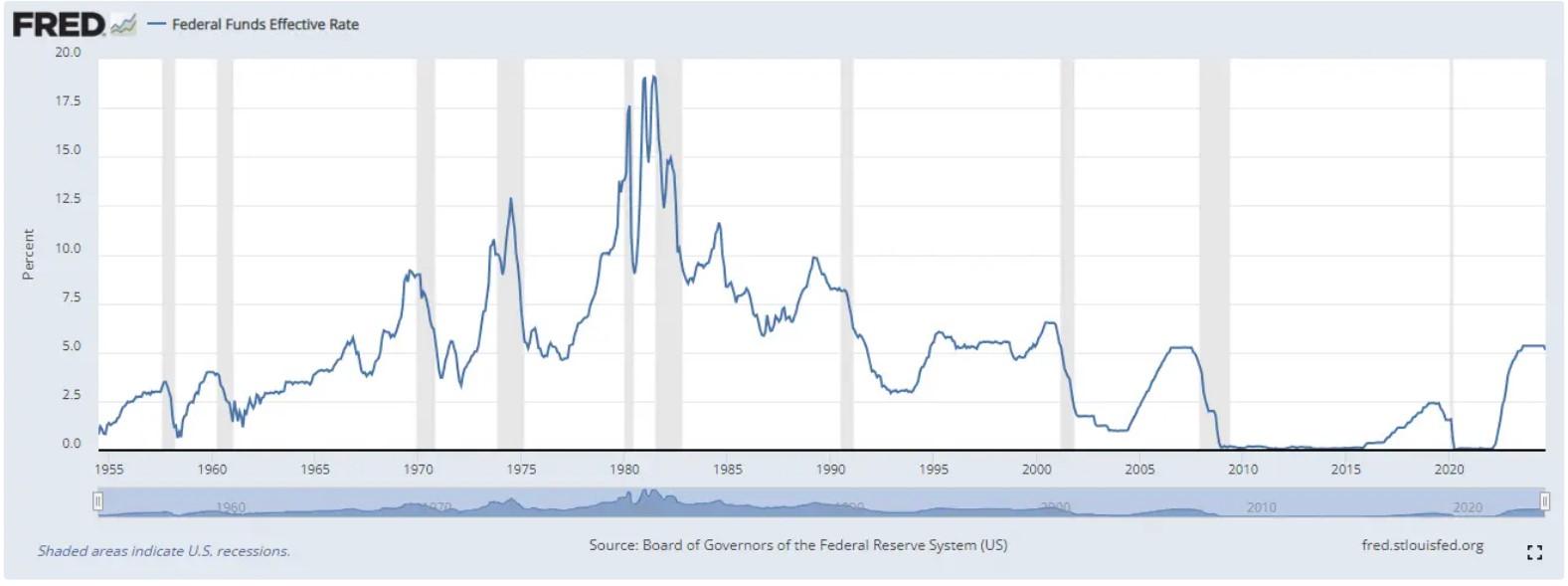

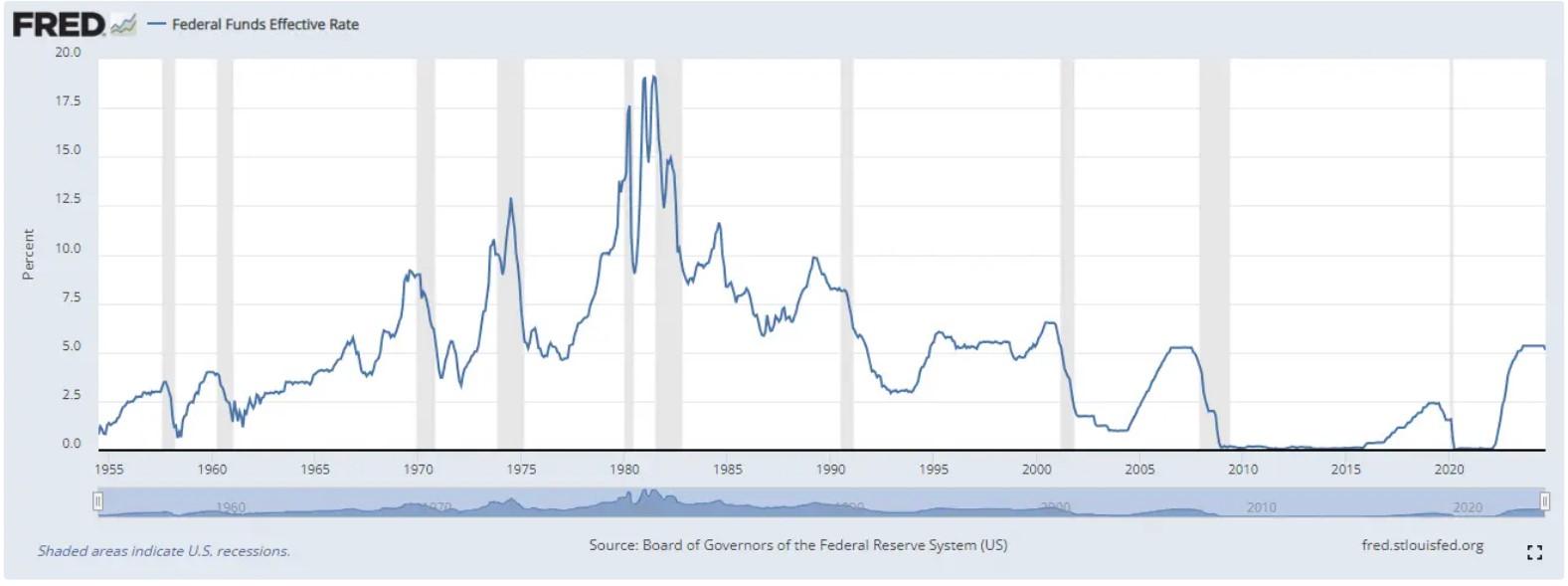

- Key points from the minutes of the FOMC’s September meeting reveal where and how consensus was formed as the committee decided to move forward with a 50-basis point (bp) interest rate cut in September.

- According to the minutes, a “substantial majority” of voting members backed a 50 bp cut rather than a 25 bp cut as the committee pivoted to looser monetary policy. Further, there was a broader consensus that such a decision would not lock officials into future rate-cut decisions.

- As the minutes reveal, officials coalesced around a 50 bp cut as many believed it would align with the recent loosening of labor market conditions and signal a re-anchoring to the Fed’s commitment to both sides of the dual mandate.

- It was also crucial to some officials to move in a way that, on the one hand, signaled to markets their attention to labor market loosening but did not indicate that the central bank was anticipating a more negative economic outlook.

3. “SOFT LANDING” IMPACT ON CRE

- Results from Altus Group’s Q3 US CRE Industry Conditions and Sentiment Survey (ICSS) show overall greater optimism surrounding commercial real estate compared to last quarter, including a higher share of respondents indicating an intent to deploy capital in the short term.

- Survey respondents remain evenly split on the likelihood of a recession within the next six months, while most respondents will focus on managing their existing portfolio over the next six months rather than seek expansion opportunities.

- Still, 31% of participants said their primary focus for the next six months will be deploying capital—a significant jump from 20% in the Q2 survey.

- While it’s too soon to conclude that the Fed has executed a “soft landing” for the US economy following its two-plus year battle against inflation, the labor market has remained remarkably resilient as prices have gradually decelerated, boosting optimism in the economy’s short-term health.

- Further, most ICSS respondents expect that if a recession arises, it will be “shallow and short-lived.”

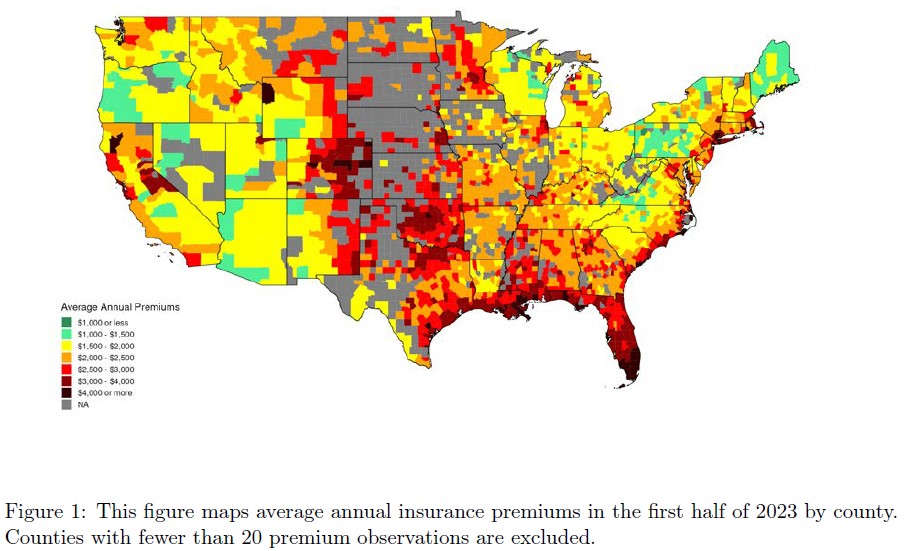

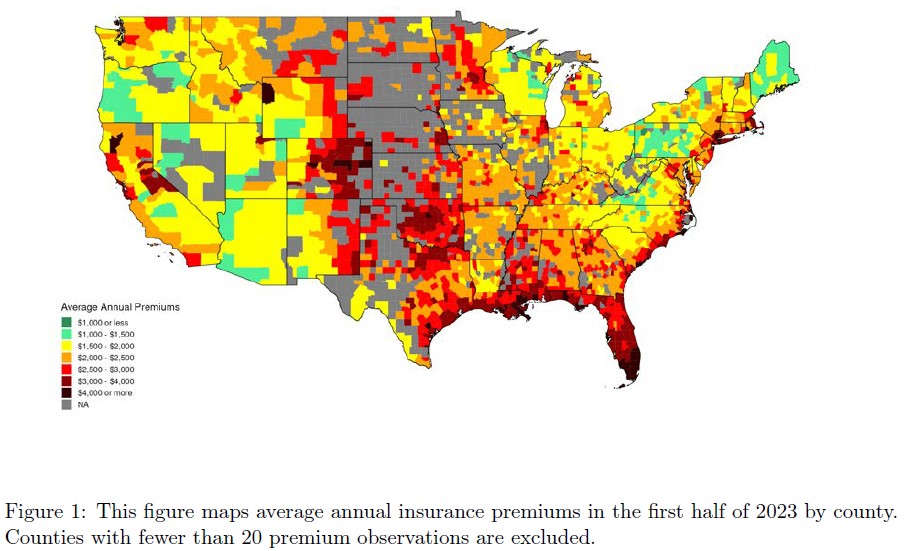

4. DISASTER RISK AND RISING HOME INSURANCE PREMIUMS

- A recent working paper by the National Bureau of Economic Research shows that average property insurance premiums have climbed more than 30% since 2020 with large location-based variation.

- Intuitively, premiums have risen fastest for homeowners in areas with a higher risk of natural disasters such as hurricanes or wildfires. Still, the relationship between disaster risk and premiums has grown stronger over time as the rate of natural disasters rises and long-term trends become less predictable.

- Analyzing data on escrow payments, the researchers built a dataset of roughly 47 million observations of insurance costs in the US between 2014 and 2023. The analysis found that between 2020 and 2023, average home insurance costs rose by an inflation-adjusted 13%.

- Moreover, increases in the ZIP codes with the highest disaster risks were significantly larger, with neither change in home values nor changes in state-specific regulations accounting for such variation.

- Digging further, the researchers find that the rise in risk premiums between 2018 and 2023 coincides with a doubling of US property and casualty reinsurance costs. They point to several reasons for this “reinsurance shock,” including an uptick in migration of the US population towards increasingly risky areas, rising interest rates, and an overall reassessment of climate risks by re-insurers.

5. CPI INFLATION

- According to the Bureau of Labor Statistics, the Consumer Price Index rose by 2.4% year-over-year in September, exceeding expectations but registering a two and a half year low.

- The headline CPI metric rose 0.2% from August, with the shelter index – a key contributor to overall price pressures, rising by the same amount. food prices rose 0.4% month-over-month in September, which, combined with the shelter metric, accounted roughly 75% of the increase in overall inflation.

- Core-CPI, which excludes volatile food and energy prices, rose 3.3% annually and 0.3% month-over-month in September, also slightly above the consensus forecast. The elevated core-inflation numbers over headline inflation is largely contributed to a fall in energy prices, which fell by 1.9% month-over-month in September following a 0.8% decline in August.

6. HAS OFFICE HIT ITS BOTTOM?

- The Q2 2024 results of MSCI RCA’s Commercial Property Price Index showed that US Office market prices had declined by 12.5% year-over-year through the quarter. While distress in the sector remains palpable, price declines have decelerated from late 2023 levels.

- In late 2023 and early 2024, many developers opted to extend maturing loans rather than sell at major losses, hoping to hold onto their assets until prices recovered.

- However, a recent Reuters article found that some market analysts are seeing signs of a pickup in sales of stressed office properties as expectations of financial condition loosening take shape.

- An August report by Moody’s also showed an uptick in office prices sold at a discount during Q2—seven sold at a discount of $100 million or more compared to just one sold with such a discount in Q1. Only two such sales took place during the whole of 2023.

- While $100 million discounts may sound daunting, the uptick in Office transactions suggests that activity in the sector is thawing. Even as prices are unlikely to climb anytime soon, the pace of price declines appears to be turning a corner.

7. CONSTRUCTION SPENDING

- US construction fell in August by a monthly rate of 0.1%, following a revised 0.5% decline in July, according to the latest data from the US Census Bureau.

- August was the third consecutive monthly decline in construction spending, with private spending down 0.2%, driven by a 0.3% decline in the residential segment.

- Within residential, single-family projects saw the most significant slowdown in August, with construction activity in the space falling by 1.5% month-over-month.

- Activity in the non-residential segment also slowed in August, shrinking by 0.1%. Declines in the non-residential segment were primarily driven by declines in educational (-1.1%) and healthcare (-0.8%) related construction.

- Contrary to the trend, public spending rose by 0.3% in August, driven by a 1.6% increase in public residential construction and a 0.3% rise in non-residential construction.

8. GEOPOLITICAL RISKS

- Blackrock’s recent quarterly Geopolitical Risk Dashboard indicates that geopolitical risks remain structurally elevated, driven by deeper fragmentation between global economic blocks, a less predictable world order and accelerating changes in globalization norms.

- The dashboard highlights risk of a Middle East Regional War as key emerging risk as the conflict between Israel, Iran, and its proxies in the middle east heat up with tensions forecasted to remain high well into next year.

- US-China strategic competition remains a high-level risk according to Blackrock. The report notes that as the US gears up for the 2024 election and China looks to stimulate stagnant domestic markets, both countries have favored stability, but intense competition continues in the background, particularly in the South China Sea. Global technology decoupling also shows little sign of slowing down.

- Russia-NATO conflict risk also remains high in the eyes of the analysts. Ukraine’s recent advance into Russian territory and Russia’s military ramp up in response to it has lowered the likelihood of a ceasefire or diplomatic solution to the conflict in the short term.

- A cascading of global risks could have serious implications on the global economy, which could arise from several channels such as energy markets, supply chains, migration patterns, and market confidence.

9. LOGISTICS MANAGERS’ INDEX

- The Logistics Manager’s Index experienced its highest monthly uptick in two years during September, signaling that demand in the logistics sector is picking up.

- The index has climbed for ten consecutive months through September — though it appears to have ramped up in anticipation and response to the September interest rate cut and the consumer activity that looser financial conditions could induce.

- Inventory levels increased during September, primarily due to restocking activity by downstream retailers. Growth in inventory levels also caused inventory costs to rise during the month.

- Transportation capacity declined in September, hitting 50 for the second time this year. An Index level of 50 indicates that transportation capacity is neutral, neither expanding nor contracting.

- Warehousing capacity slowed, while transportation utilization and prices expanded at slower rates than the previous month.

- Meanwhile, warehousing utilization and prices are expanding more quickly than in August.

10. JOB OPENINGS AND LABOR TURNOVER

- According to the BLS, job openings rose to 8.04 million in August, rising 329k from an upwardly revised 7.71 million in July and exceeding the consensus expectation of 7.66 million.

- Signals from the US labor market appear to be taking a U-turn following a summer of deterioration. The rebound in job openings in August and upward revisions in July coincides with an unexpectedly strong jobs report in September and upward revisions in payroll numbers from July and August.

- The largest increases in job openings were in construction (+138k) and state and local government, excluding education (+78k).

- Both the number of hires and total separations were little changed at 5.3 million and 5.0 million, respectively. Within separations, quits declined to 3.08 million, its lowest since August 2020.

SUMMARY OF SOURCES

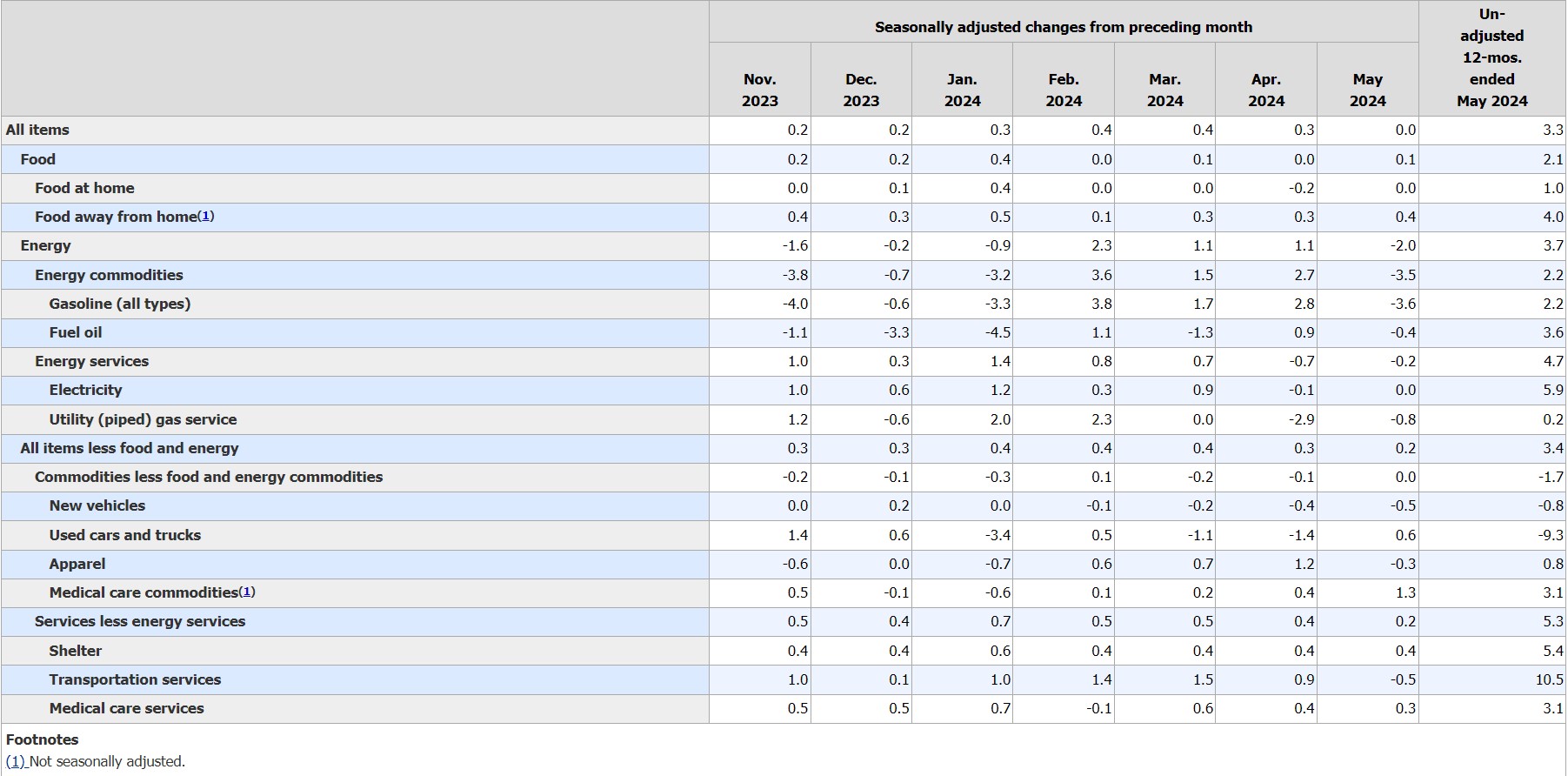

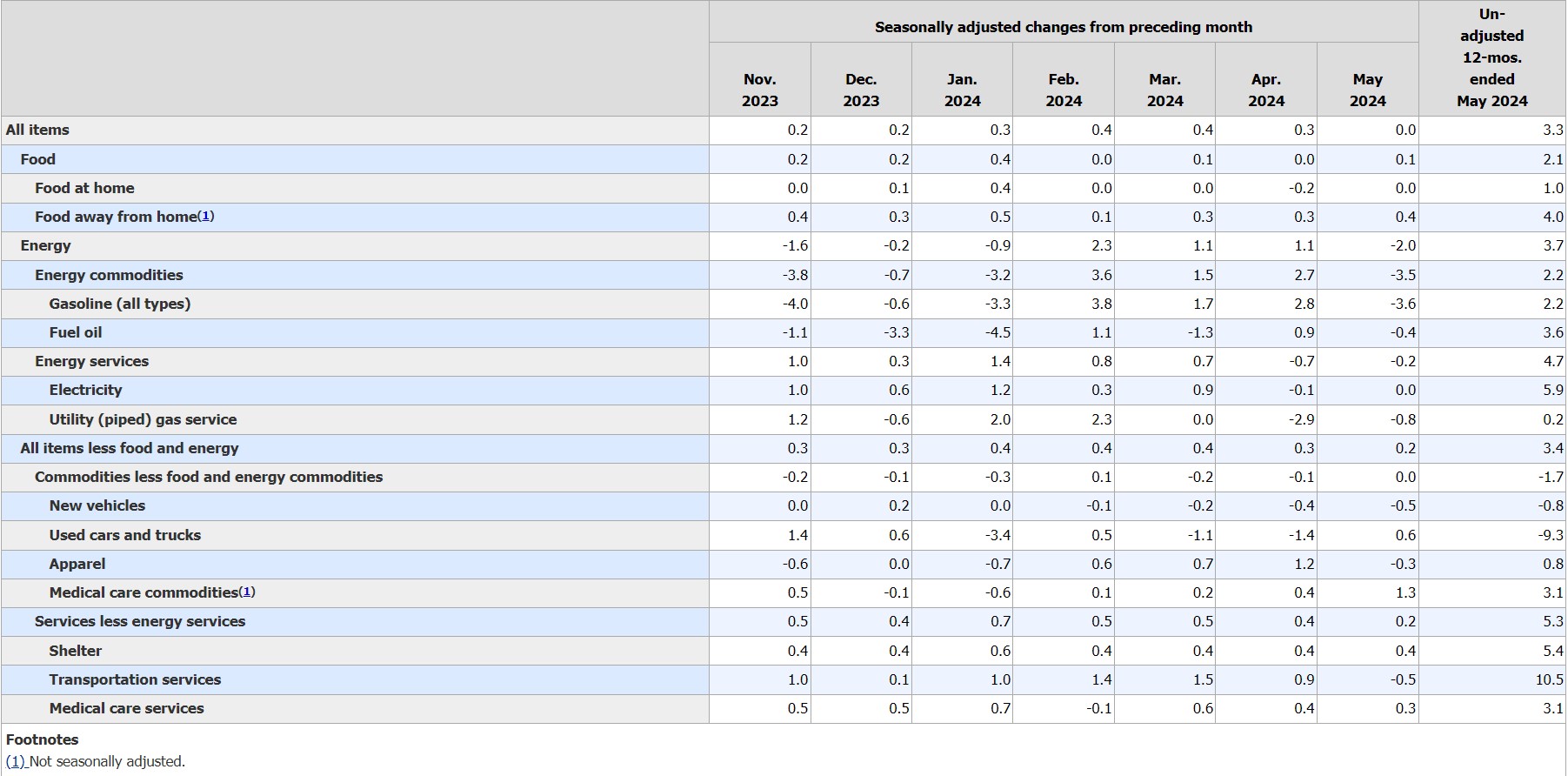

1. CPI INFLATION

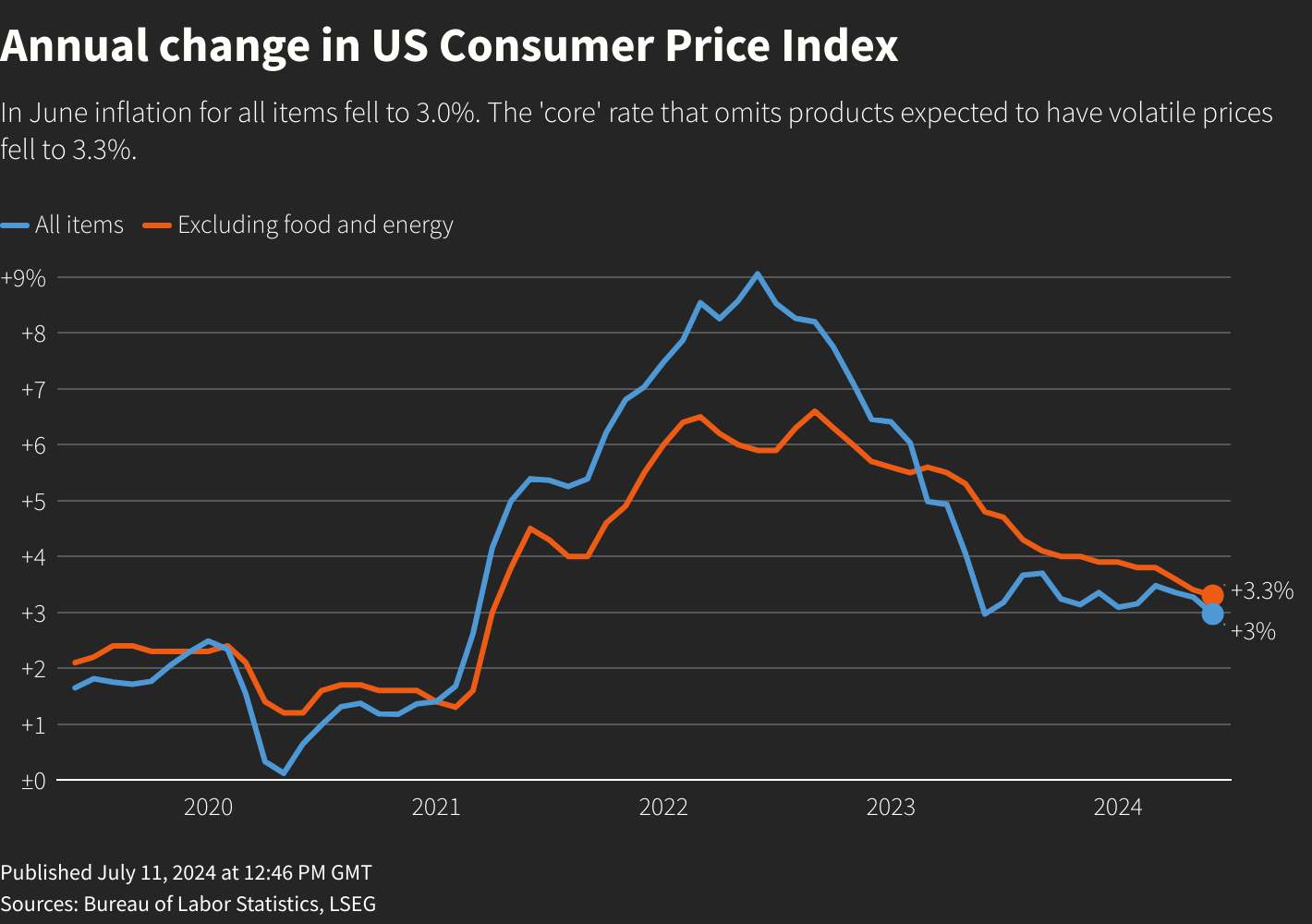

- According to the US Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) increased 0.2% month-over-month (MoM) in August, repeating July’s pace and in line with the consensus forecasts that led up to the data release.

- The annual CPI measure fell for the fifth consecutive month to 2.5%, its lowest since February 2021.

- Over the past 12 months, energy prices have been the main force driving down the headline inflation rate, which is down by 4% year-over-year (YoY). Transportation prices have also kept the inflation rate elevated, up 7.9% annually, yet they have decelerated from the previous month.

- Core-CPI inflation, which excludes the more volatile food and energy components from the index, rose by 0.3% MoM in August, marginally above July’s 0.2% pace.

- Monthly, core inflation was higher than expected, boosted by an acceleration in shelter and airfare price increases. Annually, core price inflation matched its three-year low of 3.2% reached in July.

- Shelter remains the critical component of CPI, which is still elevated on an annual basis and continues to accelerate — up 5.2% YoY and up ten basis points from July. Airfare price acceleration can be attributed to more robust travel demand during the summer, which should ease in the coming months.

- While the PCE price index is the Federal Reserve’s preferred measure of inflation for influencing monetary policy decisions, August’s CPI report is more evidence that inflation is trending downward and likely cements the outlook for a September rate cut.

2. CRE POISED FOR CUTS

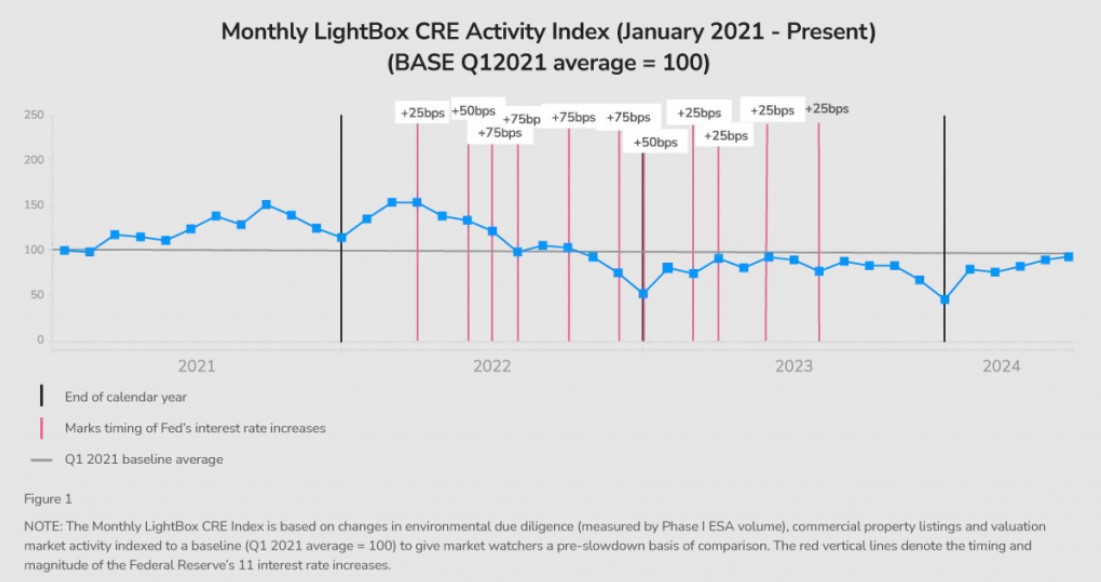

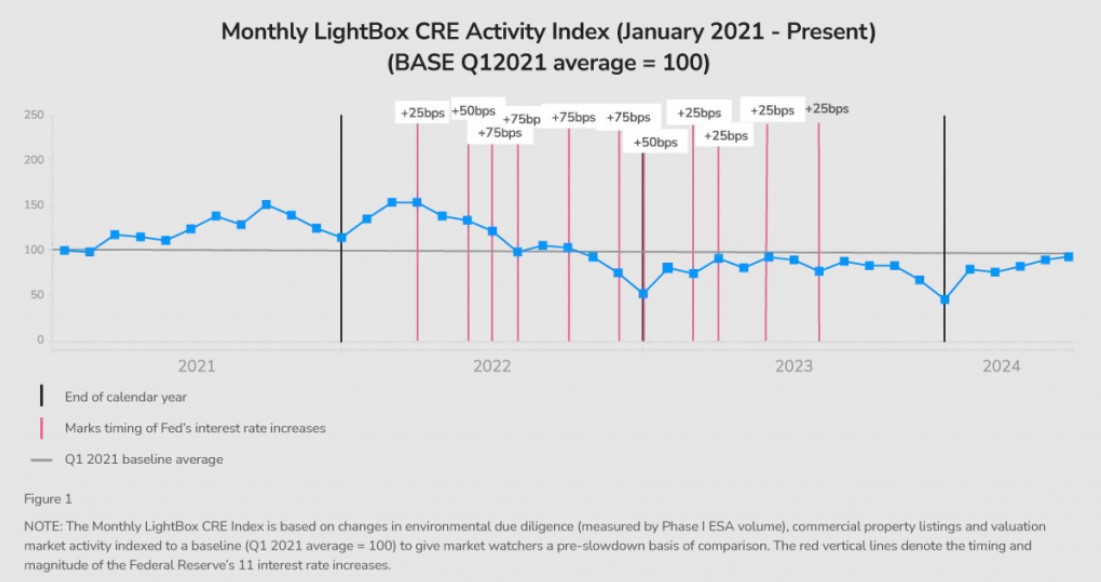

- According to Lightbox’s monthly CRE Activity Index, CRE transaction activity has inched up every month since March, and the sector appears poised for a strong Q4, with the market anticipating one or more rate cuts by the end of 2024.

- The index softened slightly in August, interrupting a five-month trend of modest increases. However, the analysts of the report did not consider the downtick a concern, with the August level still nine points above its level one year ago.

- The year-over-year climb in activity reflects a CRE transaction landscape that is gradually thawing from a pricing standoff between buyers and sellers. As rate cuts filter into commercial mortgage borrowing rates, investors are likely to deploy more capital if current patterns hold, causing transaction activity to rise.

- Still, investors will need to keep watch of a softening labor market and its potential implications on consumer spending and demand. It remains to be seen whether the Fed is ahead of or behind the curve on a rate pivot and can stave off an economic recession.

3. MULTIFAMILY AWAITS IMPACT OF SEPTEMBER RATE CUT

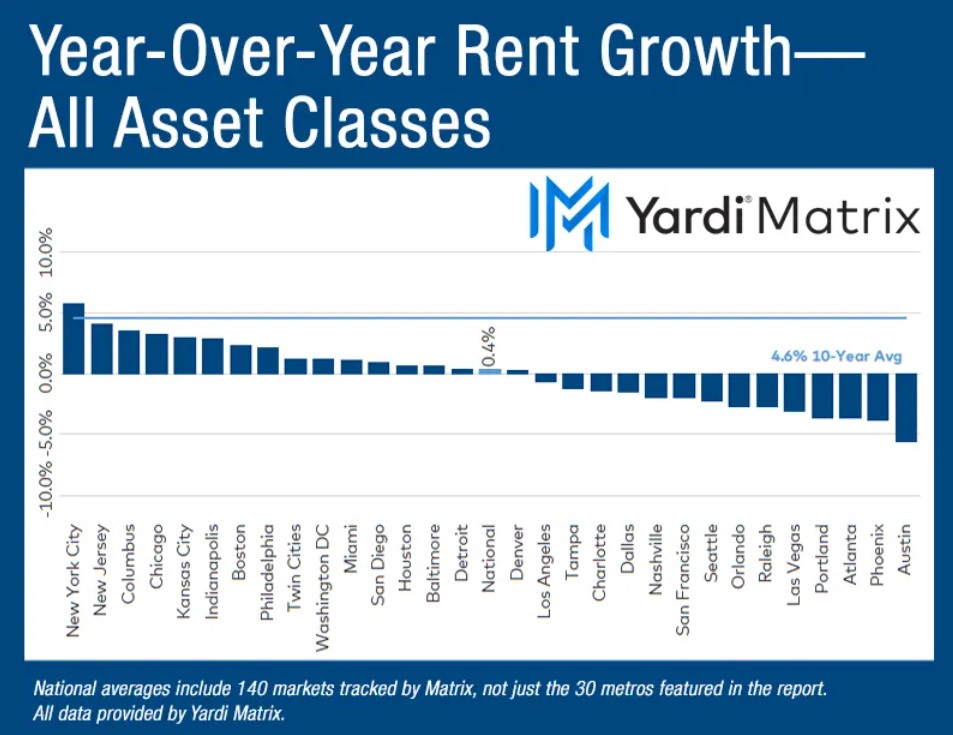

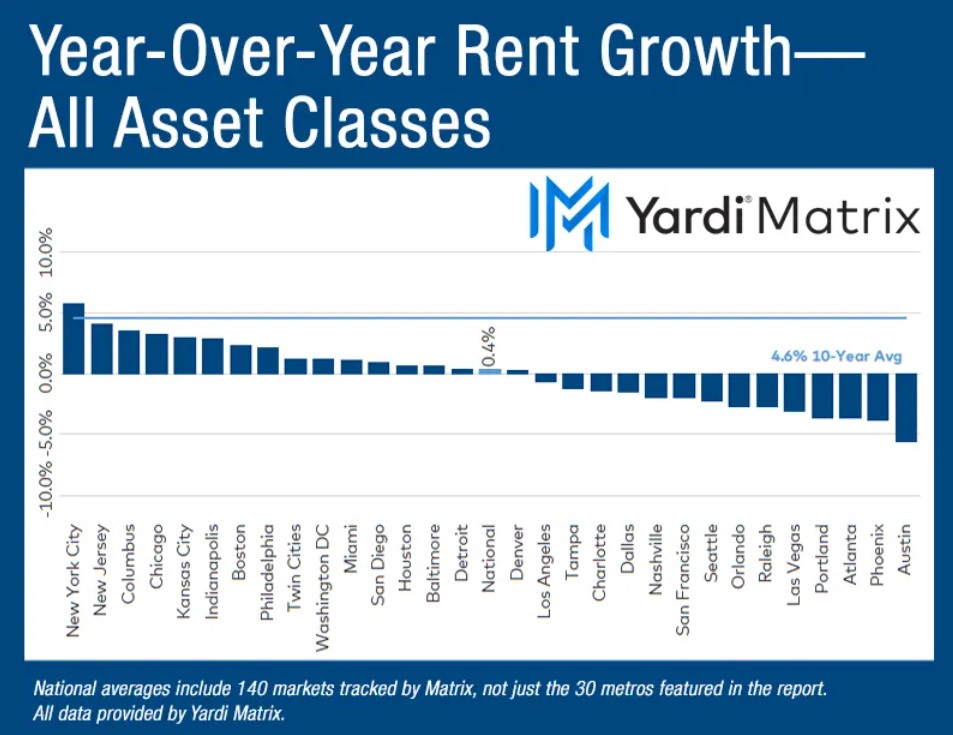

- Multifamily rent growth was flat in August as shifting seasonality trends ended a six-month streak of growth, according to the latest Multifamily National Report by Yardi Matrix.

- According to the report, the apartment sector is in a holding pattern as the market awaits an imminent September rate cut. Following the Fed’s anticipated move, a thawing of transaction and refinancing activity is expected to follow. An interest rate cut is also likely to reduce the pressure on underwater properties.

- Still, as rates are poised to come down, the economy is showing signs of cooling, with slowing job growth and weaker wage growth compared to recent years. As the Multifamily market feels rate relief, a slowing labor market may place a drag on consumer and apartment demand.

4. ELECTION VOLATILITY

- According to a recent analysis by Chandan Economics, market volatility typically spikes in the months leading up to a US presidential election, usually beginning to shift around July.

- On average, during calendar years when there is a presidential contest, volatility, as measured by the CBOE Global Market’s Volatility Index (VIX), has tended to decline over the first seven months of the year before shifting higher during the final three months of the campaign.

- In September and October of election years, the VIX has had an average value of 19.2 compared to an average of 18.2 during July.

- The volatility experienced in stock markets over the past several weeks may, in part, reflect the typical election impact on markets and a market tendency that is in part independent of recent economic developments.

5. AUGUST JOBS REPORT

- According to the BLS, the US economy added 142,000 jobs in August, above July’s downwardly revised increase of 89,000 but indicative of additional labor market cooling, with another downward revision in August likely.

- The unemployment rate fell slightly to 4.2% last month, which put an end to a months-long increase in the unemployment rate that began in March.

- Education, healthcare, leisure & hospitality, and government positions accounted for 117,000 of the 142,000 jobs added in August. However, new healthcare and government jobs have slowed notably. Professional & business services and information-related jobs remain subdued.

- The number of people employed part time for economic reasons was little changed at 4.8 million, but the measure is still up from 4.2 million one year ago.

- Average hourly earnings increased by 14 cents, or 0.4%, in August and are up 3.8% over the past year. Annual wage growth has gradually slowed from a post-2020 peak of 5.9% in March of 2022.

6. BEIGE BOOK

- According to the Federal Reserve’s latest beige book of economic activity, nine (9) of the 12 Federal Reserve districts reported slow or declining activity, up from five (5) in the previous period.

- Employment levels were steady across most districts, but there were notable reports of firms lowering overall employment through reducing hours, attrition, or only filing necessary positions.

- Consumer spending fell after remaining steady throughout the previous period. Meanwhile, manufacturing activity declined in most districts.

- On average, most districts reported mixed residential construction and softer home sales, while commercial construction and real estate activity were mixed.

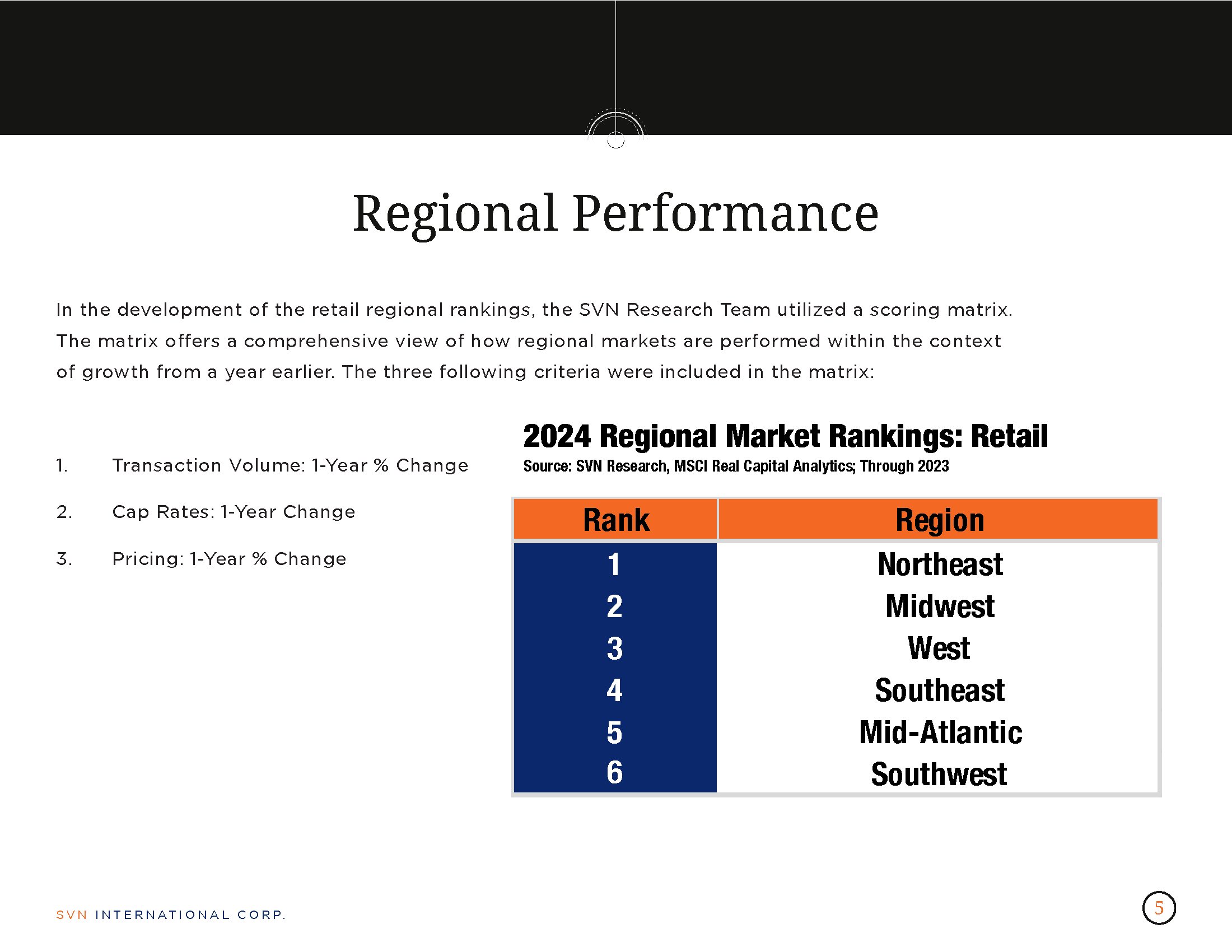

7. RETAIL DURING THE POST-PANDEMIC PERIOD

- As detailed in a recent analysis by Brookings on commercial real estate trends during the post-pandemic period, Retail was the most stable sector throughout the pandemic, balancing steady value growth with stable occupancy levels.

- Despite a sharp rise in sector distress during the early days of the pandemic lockdown, retail demand has grown from its pre-pandemic levels, and rental properties have generated competitive returns.

- Nationally, the Retail vacancy rate is at a five-year low and is the only product type for which aggregate vacancy has declined since 2019.

- Still, these vacancy rates vary locally, and the variation often reflects increasing vacancies in downtown areas and retail inequality in minority-majority neighborhoods.

8. TRANSIT-ORIENTED DEVELOPMENT STUDY

- A recent GlobeSt look into a study conducted by the University of North Texas Economic Research Group describes the impact of transit-oriented development on local economic activity in Dallas.

- The study examined the impact of real estate developments near Dallas Area Rapid Transit (DART) light rail stations and found an increase in direction spending and job creation in those areas.

- Focusing on 21 real estate developments built near DART stations between 2019 and 2021, the study found that collectively, the projects generated $980 million in direct spending and 10,747 jobs.

- The projects encompassed a mix of commercial, residential, and public developments. They generated $144.7 million in federal tax revenue and another $49.6 in state and local tax receipts, according to the results of the analysis.

9. LOGISTICS MANAGERS INDEX

- The US Logistics Managers Index ticked down slightly in August compared to July, but the report continued to point to a moderate pace of growth in the logistics sector.

- Most notably, there was an increase in inventories as firms gear up for the holidays and Q4 spending season. August ended three consecutive months of contractions in inventory levels. The report also suggests that firms may be anticipating a return to the traditional patterns of seasonality not experienced since before the pandemic.

- The effect of increased warehousing capacity and transportation capacity partly softened the rise in inventories.

- According to the analysis, this is consistent with reports that firms are keeping most of their inventory near points of entry, waiting for them to move to retailers. Transportation prices eased compared to the previous month, while warehousing prices were up.

10. NFIB SMALL BUSINESS OPTIMISM INDEX

- According to the National Association of Independent Business, small business optimism in the US declined in August to its lowest level in three months.

- Inflation remains at the top of owners’ minds, and sales expectations have fallen significantly. Overall, rising uncertainty continues dominating movements in the index, with the outlook on future business conditions gradually worsening.

- 24% of small business owners cited inflation as their number one concern, while the net percent of owners expecting higher sales volumes fell to a net -18%. Meanwhile, 20% plan to raise compensation in the next three months, an uptick from the latest report.

SUMMARY OF SOURCES

1. INFLATION

- According to the BLS, the US Consumer Price Index (CPI) reaccelerated on a monthly basis in July but continued to decelerate annually. Prices rose by 0.2% between June and July, following a decline of 0.1% the previous month. Prices decelerated to 2.9% year-over-year before seasonal adjustment.

- The monthly uptick in Core-CPI, which excludes volatile food and energy prices, mirrored that of headline CPI, with core prices up 0.2% in July compared to 0.1% the previous month. Core prices climbed 3.2% year-over-year— ten (10) basis points below the June pace.

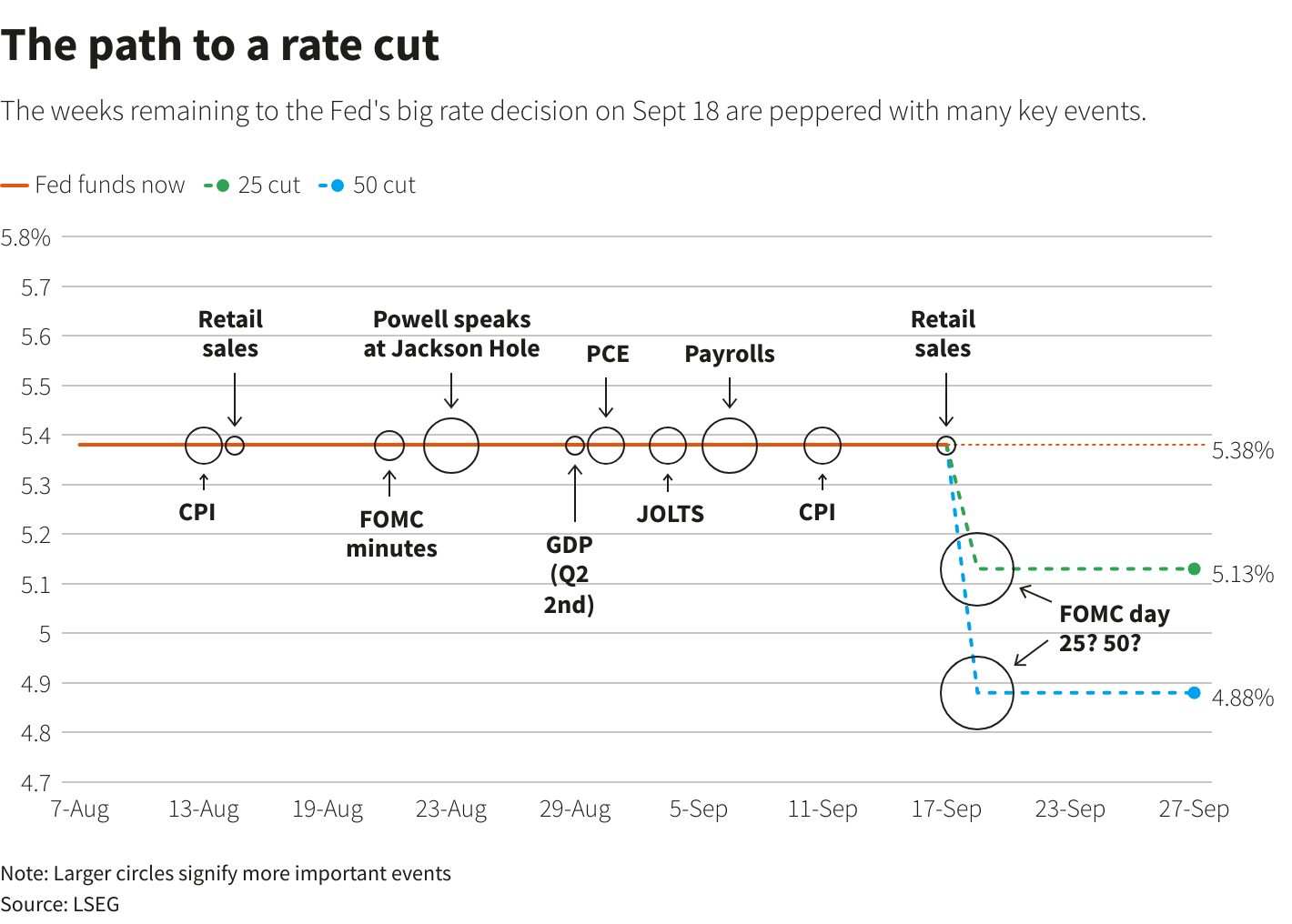

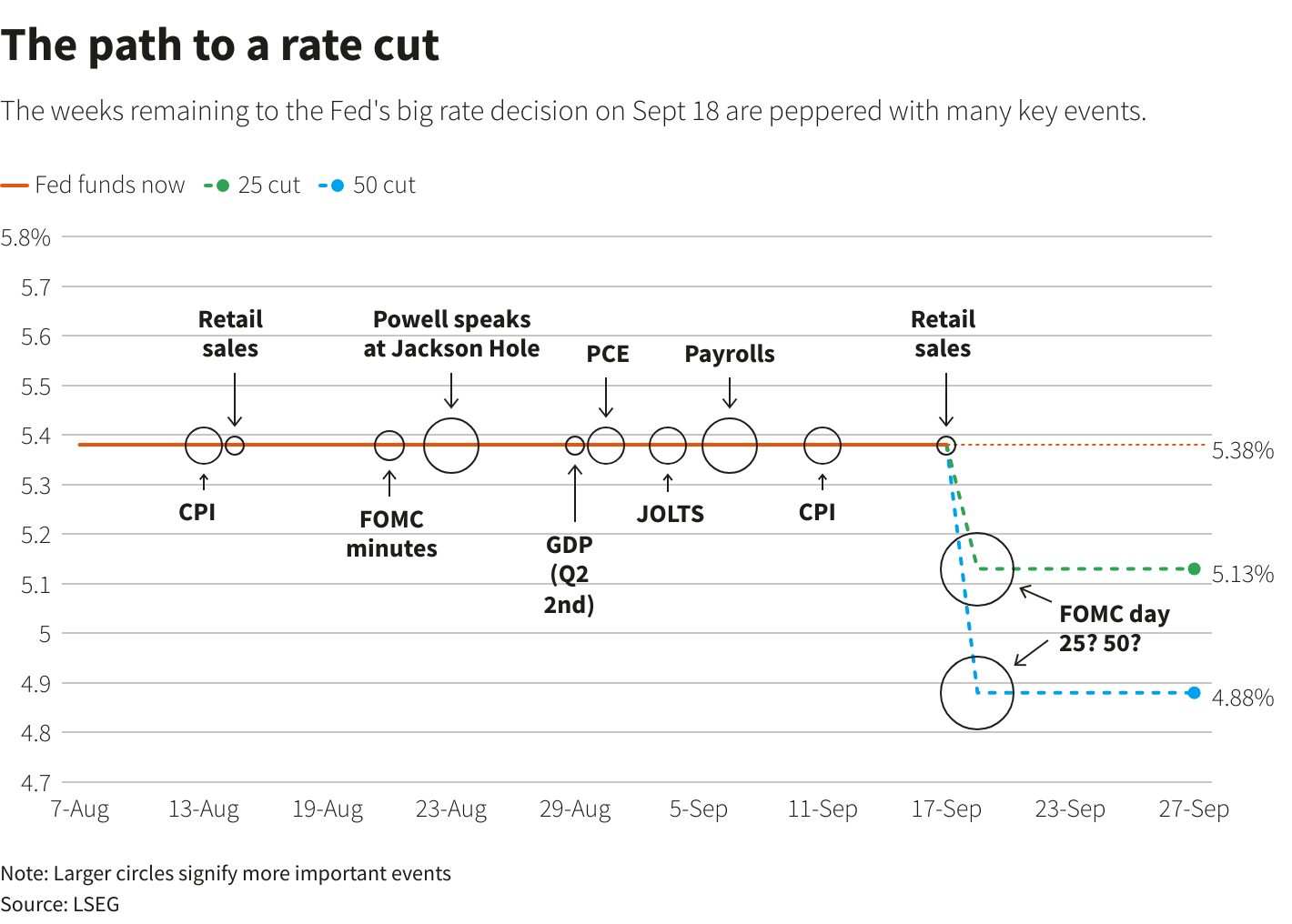

- The uptick will unlikely throw the Fed off an anticipated rate cut at their upcoming September meeting. Recent cooling in the labor market, alongside the downward trend of inflation this year, will encourage the Fed to refocus its efforts to fulfill its dual mandate toward maximum employment compared to price stability. As of Wednesday, August 14th, futures markets price in a 100% chance of a rate cut in September.

2. EMERGENCY RATE CUT, INTEREST RATE PROJECTIONS

- As panic settled into markets earlier this month when emerging economic data pointed to a rising chance of a US recession, some experts and observers floated the idea that the FOMC could produce an emergency inter-meeting rate cut to shore up market certainty.

- The potential for the move, which is uncommon and is primarily deployed in response to sudden shocks in the economy, has largely evaporated in recent days as the futures market grounds itself in the likely reality that policymakers will stick with a previously anticipated September timeline for an initial rate cut.

- The CME Group’s FedWatch tool, which tracks market-based interest rate forecasts, has experienced notable fluctuations in the past week as markets digest the flurry of data and developments hitting the news cycle in early August.

- Markets priced in an 85% probability of a 50-basis point cut at the September meeting by Monday, August 5th, its most dovish signal yet, but it receded to a 47.5% probability by Monday, August 12th. Meanwhile, expectations of a 25 basis-point cut—which had dominated forecasts coming into the month—fell as low as 15% one week ago before climbing back to 52.5% as of August 12th.

- This volatility shows how uncertainty has dominated the economic outlook in the past couple of weeks. Still, the falling likelihood of an inter-meeting cut and the coalescing of expectations around a 25-basis point cut in September appear to show that the fog has begun to clear.

3. JULY JOBS REPORT

- According to the Bureau of Labor Statistics (BLS), US job growth slowed to 114,000 added payrolls in July, well below estimates. Meanwhile, the unemployment rate edged up to 4.3% — its highest level since October 2021.

- On the one hand, some cooling in the labor market affirmed the market’s expectation of an anticipated September rate cut by Fed policymakers. Still, these data, combined with falling corporate earnings and a sharp uptick in initial unemployment claims during the final week of July, sent a chill throughout markets, fearing that the Fed has waited too long to pivot.

- Notably, July’s jobs report triggered the Sahm Rule, which is considered in play when the three-month unemployment rate average reaches 0.5% or more than its 12-month low and signals that the economy is in recession.

- However, several observers of the Sahm Rule, including the namesake economist Dr. Claudia Sahm, caution that like other recession indicators that have seemingly been triggered in the past couple of years, the Sahm Rule’s emergence may be a false signal that is more indicative of the unusual disruptions in the post-pandemic economy.

- Digging deeper, the number of Americans working part-time for economic reasons rose to its highest level since June 2021, while those reporting being out of work for 27 weeks or more rose to its highest level in 2022.

4. INITIAL CLAIMS

- After reaching their highest level in a year (250k) during the previous week, initial unemployment claims fell by 17k to 230k during the week ending on August 3rd, based on the latest data from the US Department of Labor.

- While the release should calm fears of inevitable labor market deterioration, the latest count remains above the year-to-date average and confirms emerging weakness in the job market.

- The four-week moving average for initial claims also climbed to its highest level in a year, while continuing unemployment claims increased to its highest level since November 2021.

5. RECESSION CHANCES

- Some Wall Street analysts, including Goldman Sachs, have recently increased the probability of a US recession in 2025 in light of recent signs of a labor market and corporate earnings slowdown. However, most continue to stress that while the odds have increased, it remains the more unlikely scenario.

- Shortly before the July Jobs report was released, Goldman Sachs raised its odds for a recession in 2025 from 15% to 25%, notably in anticipation of a not-so-bad July Jobs report. Goldman analysts have noted that risks remain limited partly because economic data has moderated but not spiraled out of control, and Fed policymakers appear poised to adjust their sails accordingly.

- Conversely, UBS, who released their forecast following the employment update, cut their odds of a US recession, albeit from a significantly higher probability of 60% down to 53%.

- UBS’ forecast diverges from those of other investment bank heavyweights, with Goldman Sachs and JP Morgan trending in the opposite direction.

- The origin of the divergence is likely related to the focal points of each bank’s modeling. Goldman and JP Morgan’s models have digested recent data as signs of deterioration that raise the chance of a recession. Meanwhile, the UBS model likely weighs this deterioration as an increasing likelihood that the Fed’s rate cut schedule will speed up, increasing the chance that we will avoid recession.

6. MORTGAGE REFINANCING CLIMBS

- Adding to the inflection point characterization of recent economic data trends, mortgage refinancing activity surged by 35% in the past week as average mortgage rates fell to their lowest levels in close to 2 years by some measures.

- According to Fannie Mae, the average contract interest rate on a typical 30-year fixed-rate mortgage fell from 6.72% to 6.47% during the week ending August 7th, its lowest level since September 2022.

- The Mortgage Bankers Association reports that the refinance share of mortgage activity increased from 41.7% to 48.6% of applications across a similar period. As interest rates have tightened over the past few years, new mortgage applications took up an increasing share of overall mortgage activity as refinances fell steeply. The recent uptick in the refinancing share of mortgage activity points to some thawing in the housing market as markets eye a monetary policy pivot.

7. LOGISTICS ACTIVITY AND INDUSTRIAL DEVELOPMENT

- The US logistics sector rose to its highest activity level in four months in June, according to the latest data from the Logistics Managers’ Index. Transportation prices rose to their highest since May 2022, while transportation capacity also expanded.

- Both warehousing utilization and prices rose in June from the previous month, while inventory levels contracted for a third consecutive month as retailers moderated stock levels. Conversely, manufacturers, wholesalers, and distributors have built up their inventories in recent months out of anticipation of an uptick in demand as the holiday season approaches.

- Industrial vacancies have been on the rise for six straight quarters, a cyclical consequence of the large volumes of new supply that have come online to meet the burgeoning demand of the past decade. However, the recent positive trend in the logistics sector may signal a turning point.

- Still, uncertainties lie ahead. GlobeSt reports in a recent article that several manufacturing projects envisioned under the Inflation Reduction and CHIPS and Science Acts have stalled and have created a cloud of uncertainty around sector demand.

- How consumer dynamics evolve in the coming months and whether interest rate policy shifts toward a more accommodative financing environment will have important implications for the Industrial sectors’ medium-term outlook.

8. NET LEASE VOLUME FALLS

- According to a recent report by Newmark, net lease transactions plummeted in Q2 2024, down 14.71% from the same period last year.

- Utilizing data from Real Capital Analytics, the report notes that the dollar volume of net lease transactions dropped from $10.71 in Q2 2023 to $8.93 billion in Q2 2024.

- Ignoring dollar volume and focusing solely on transaction volume, activity is down a much less pronounced 6.49%, suggesting that deal prices are falling faster than overall deal volume.

- Revisiting dollar volume but on a property type level, Office transaction value is down 20.47%, Retail is down 18.22%, and Industrial is down 10.74%. However, while Office has seen the steepest fall, it transacted $2.02 billion in Net Lease deals in the second quarter, while Retail charted the lowest with just $1.84 billion in deals.

9. HOMEOWNERSHIP CLIMBS FOR LOW-INCOME HOUSEHOLDS

- A recent analysis by the Federal Reserve of Minneapolis shows that despite high mortgage rates and record house prices, US homeownership is rising, particularly among America’s lowest-income households.

- According to the analysis, in 2023, 47.1% of households in the bottom 1/5th of the income distribution were homeowners, approaching the all-time high of 47.7% reached in 2005.

- Homeownership rates among the lower-income cohort fell relatively consistently from 2005 to 2015, but they rose by six percentage points between 2015 and 2023, which analysts point out mirrors a similar expansion that occurred between the mid-1990s and mid-2000s.

- Age is a key factor in the trend. Between 2015 and 2023, the average age of a head of household in a lower-income home, regardless of ownership, increased by three years. In other words, the trend may be more indicative of an aging US population staying in their homes for longer rather than younger Americans increasingly owning homes.

10. GLOBAL REIT RETURNS

- According to Nareit’s Mid-Year report released in July, global REIT returns were down 3.8% year-to-date through June 30th — an improvement from the -9.4% pace that emerged through the middle of April.

- Healthcare, residential, and data center-focused REITs have outperformed the rest in 2024 and may reflect where investors see the most significant upside as CRE looks to turn the page from today’s high-rate environment. Healthcare REIT returns are up 8.6% year to date, residential REITs are up 3.7%, and data centers REITS are up 1.8%.

- Other key sectors, timberland, telecom, and industrial, which collectively account for about 38% of Nareit’s index, have declined by 16.3%, 11.9%, and 11.7%, respectively.

- Zeroing in on North America, REITs on this continent outpace average global performance even as returns are down by 1.1% year-to-date.

SUMMARY OF SOURCES

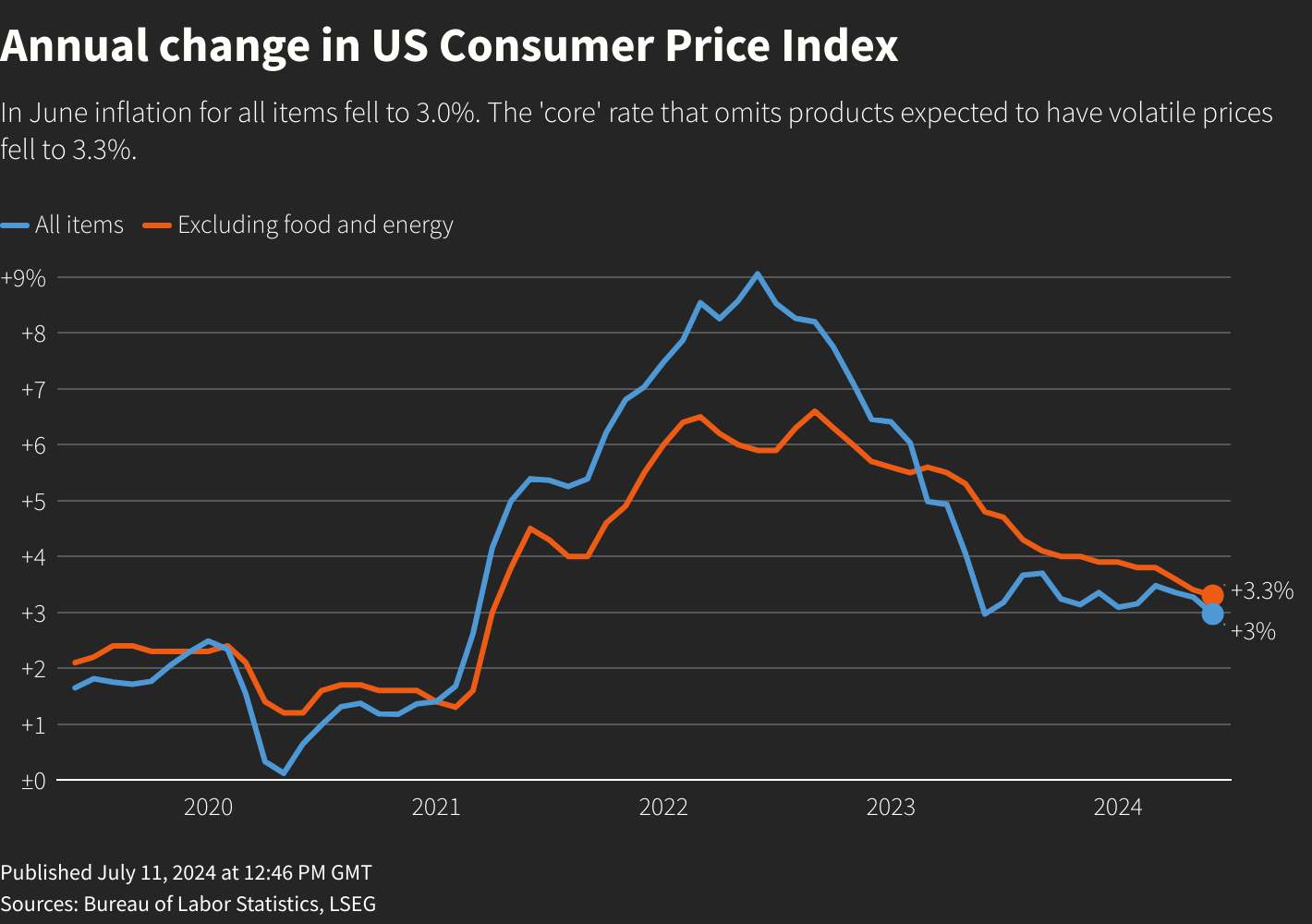

1. CPI INFLATION

- The Consumer Price Index fell by 0.1% month over month in June, its first monthly downtick in over four years, according to the latest data from the Bureau of Labor Statistics.

- Prices continue to climb annually, rising 3.0% year-over-year, but slowed, falling from an annual increase of 3.3% in May.

- Falling gasoline prices helped put downward pressure on overall prices, offsetting much shallower increases in food and shelter prices. Notably, shelter prices have remained a persistent factor behind inflation pressures, and while they were still an upward factor to inflation during this month’s report, the recent slowdown in shelter prices is a welcomed sign.

- Core-CPI, which excludes food and energy prices, continued to increase monthly, climbing 0.1% from May. However, core prices climbed by their slowest annual pace of inflation since April 2021, rising 3.3% from one year ago.

2. FOMC MEETING MINUTES

- According to minutes of the Federal Reserve’s June policy meeting, officials indicated that while inflation is heading in the right direction, greater confidence is needed before beginning rate cuts.

- There was a greater degree of disagreement among policymakers relative to the previous meeting, with some indicating a willingness to raise rates again to re-anchor inflation expectations. Others emphasized the need for the Fed to stand ready should any unexpected weakness emerge in the US economy.

- Officials continued to emphasize that they would not lower rates before more data emerged that gave them greater confidence that inflation was cooling. This signaled that the most recent mix of macroeconomic data at the time of the meeting had yet to reasonably shift their overall confidence.

3. CRE CONDITIONS & SENTIMENT: Q2 2024

- The latest edition of Altus Group’s quarterly survey on commercial real estate conditions and sentiment showed a slight rise in recession concerns among respondents alongside expectations that the financing environment will remain challenging. Still, expectations for income growth improved, and distress is expected to fall over the next 12 months.

- The survey respondents, who come from a mix of organization types and functions, expect financing costs to continue increasing marginally over the next 12 months, alongside a decrease in net returns to equity. On the one hand, more than a third of respondents expect capital availability to increase in the next year, but a slightly higher share expects the cost of capital to grow over the same period.

- Many expect to remain focused on de-risking in the coming quarters, with capital expenditures expected to stabilize relative to the past 12 months. The continued focus on de-risking comes alongside a slight uptick in recession concerns compared to the previous quarter.

- However, a plurality of respondents (49%) do not anticipate a recession in the short term. More notably, those who identified as having a ‘core strategy’ remain the least expectant of a recession within the next six months, while respondents deploying more opportunistic strategies tended to view the near term with more pessimism.

- Generally, participants expect revenue and NOI growth to be stable over the next 12 months, while 72% of respondents expect CRE distress to fall over the same period.

4. INVESTORS EYE OFFICE MARKET BARGAINS

- Distress signals have become an increasing focus as close to $1 trillion of commercial real estate debt is set to mature this year under a fundamentally different post-pandemic office sector. However, some well-positioned investors are focused on the opportunity to scoop up bargains amid the frenzy.

- According to Bloomberg’s reporting on data compiled by Prequin, private equity firms have set aside an average of 64% of their dry powder to invest in office properties.

- As traditional Office market lenders pull away from CRE amid higher interest rates and falling values, a credit availability gap is widening, presenting opportunities for alternative investors. PGIM estimates that there’s a gap of roughly $150 billion between the volume of loans coming due and credit availability from traditional lenders.

- While the structural fundamentals that underlie recent trends in CRE valuations are still salient to investors’ outlook, the opportunity to snap up bargains during the current downcycle remains attractive to those with lower barriers to financing.

5. JUNE JOBS REPORT

- According to the Bureau of Labor Statistics (BLS), the US economy added 206,000 jobs in June, beating the consensus forecast of 200,000 but a downtick from May’s 218,000 job adds.

- The unemployment rate rose to 4.1% during the month, its highest rate since October 2021. The previous month’s robust jobs report was notably revised downward from the initial 272,000 reported. The data will weigh heavily on the Fed’s upcoming policy decisions as officials look for persistent signs of inflation pressures cooling before moving to cut rates.

- The labor force participation rate, which measures all working-age adults who are either employed or looking for work, rose during the month to 62.6%. The concurrent rise in unemployment signals that working-age adults who are out of the labor force are being encouraged to re-enter. The broader unemployment rate, which includes discouraged workers and those who are part-time for economic reasons, held steady from May.

- Annual wage growth rose by 0.3% month over month and 3.9% from one year ago, each in line with the consensus estimate.

6. LOGISTICS MANAGERS’ INDEX

- According to the Logistics Managers’ Index, US logistics activity expanded for the seventh consecutive month in June but slowed as inventories fell and warehousing utilization dropped.

- Inventory levels fell for the second consecutive month, simultaneously slowing inventory cost inflation and overall warehousing utilization. Meanwhile, warehousing and transportation capacity fell out of expansion for the first time since March 2022, which was notably the final month preceding a prolonged freight downturn.

- The tightening of transportation capacity led to an increase in transportation prices, which now sit at their highest level since September 2022. Considering the trend of transportation prices expanding at a faster rate than transportation capacity in recent months, an expected upcoming seasonal peak could end a more than two-year freight recession.

7. CONSTRUCTION SPENDING

- US construction spending fell by 0.1% from the previous month in May, the latest month of data availability from the US Census Bureau. The increase in spending charted below consensus estimates and follows a 0.3% increase in April. Construction spending is up 6.4% year-over-year.

- The private spending segment of the market fell by 0.3% month-over-month, led by a decline in non-residential construction, particularly educational (-3.4%), religious (-2.9%), and healthcare (-2.2%). Residential construction also fell, down 0.2% from the previous month, led by a 0.7% drop in single-family projects.

- Public construction spending rose by 0.5%, led by a 2.6% increase in residential construction spending and a 0.4% rise in non-residential spending.

8. NFIB BUSINESS OPTIMISM

- According to the latest report from the National Federation of Independent Businesses, small business optimism in June reached its highest level since December 2023, rising to an index level of 91.5.

- Despite the increase, the index remains below its historical average of 98, while the report’s analysts note that, overall, Main Street businesses largely remain pessimistic about the economy this year.

- The share of small business owners reporting job openings that they could not fill fell five points from May. Still, more than eight in ten owners who are actively hiring continue to struggle to find qualified applicants to fill their positions.

- A smaller share of owners reported capital outlays in the last six months than the previous month, while a net negative 12% of owners reported higher nominal sales over the past three months.

- The frequency of reports of positive profit trends stood at a net negative 29% (seasonally adjusted) in the June report, a slight improvement from May but still underwhelming. 34% of small business owners reporting lower profits blamed weaker sales, 17% blamed material cost increases, 12% cited labor costs, and 9% indicated lower selling prices.

9. BANK CRE LOAN PERFORMANCE

- According to a Trepp analysis using anonymized loan-level repository data, commercial mortgage origination volumes for bank-held CRE loans fell in Q1 2024, decreasing to a total of $3.2 billion from $4.0 billion in Q4 2023.

- Metrics measuring loan performance, such as net charge-offs, delinquency rates, and occupancy rates, largely reflected higher levels of distress in CRE lending.

- The industrial sector is experiencing the lowest quarterly average in origination volume relative to its pre-COVID average compared to all other sectors, down by 82% from 2019. The office sector is experiencing the second-largest decline relative to pre-COVID levels, down by 73%.

10. Q3 2024 GLOBAL ECONOMIC OUTLOOK

- A new report by Capital Economics suggests that while the global economy continues to face headwinds in its recovery, some of the most adverse effects of the post-pandemic inflation surge appear to be subsiding, possibly allowing central banks to begin shifting towards a relatively looser stance in the near future.

- The report notes that GDP picked up in Europe and several emerging markets to begin 2024, which lagged the United States in the initial post-COVID recovery over the past few years while also contending with high inflation.

- Recent falls in inflation have boosted real incomes in most economies. Meanwhile, labor markets remain resilient with relatively low unemployment rates amid supportive fiscal policy regimes.

- The report also notes that there is little sign that higher interest rates will have a lagged recessionary effect on a global stage. It notes that lending standards have tightened across the board over the past two years, with credit conditions, delinquency rates, and consumer confidence levels each moving in relation. However, despite these shifts, growth has remained resilient in most economies.

- Capital economics projects that by the middle of 2025, 20 of the most 30 major central banks will be cutting interest rates, which will have a stimulating effect in most economies throughout next year.

SUMMARY OF SOURCES

1. INTEREST RATES

The Fed’s preferred inflation gauge

- The FOMC voted to leave rates unchanged at its June policy meeting, which aligned with market expectations. On Wednesday, markets braced for the convergence of May’s Consumer Price Index data, which arrived just a few hours before the Federal Reserve’s June policy decision, where policymakers voted to hold interest rates in place.

- Driving the Fed’s decision is a cautiousness about a policy pivot, as while inflation pressures and expectations have come down, they remain above the Fed’s preferred 2% target necessitating a wait and see approach.

- National economic data preceding the Fed meeting showed the US economy and labor market continued expanding. According to the Federal Reserve’s May 29th Beige Book, most Fed Districts report slight or modest growth during the six-week survey period, though two noted no change. Meanwhile, May’s job report from the Bureau of Labor Statistics reported that 272,000 jobs were added in the month, sharply beating expectations.

- According to the Chicago Mercantile Exchange’s Fed Watch tool, two rate cuts remain on the docket this year. However, all will depend on the path of inflation and expectations throughout the second half of the year.

2. SUMMARY OF ECONOMIC PROJECTIONS

- According to the FOMC’s latest summary of economic projections, released at the Fed’s June policy meeting, policymakers see just one rate cut between now and the end of 2024.

- After leaving interest rates steady at 5.25%-5.50% for the seventh consecutive meeting in June, the FOMC’s dot plot showed that policymakers see only one rate cut this year and four in 2025. Projections shifted from the Fed’s last release in March when the dot plot coalesced around a projection of three rate cuts in 2024, followed by another three in 2025.

- Notably, the Fed’s projections differ from those gathered from Fed futures markets, which still forecast two rate hikes in 2024 following the release of the Fed’s latest projections.

- The Fed made no revisions to GDP growth projections and still sees the economy expanding by 2.1% in 2024, 2% in 2025, and 2026. The projection for PCE inflation was revised to 2.6% in 2024, while that for Core PCE inflation was revised to 2.8% in 2024.

3. CONSTRUCTION SPENDING

- US Construction spending fell by 0.1% month-over-month in April 2024, following a 0.2% decrease in March. However, construction spending grew by 10% annually.

- Markets forecasted an increase of 0.2%; however, both private and public spending shrank in April, falling by 0.2% and 0.1, respectively.

- In the public segment, both residential (-0.3%) and non-residential (-0.2%) experienced a decrease during the month. Within the private segment, there was a 0.3% decline in the non-residential, while primarily amusement and recreation fell by -3.5%. The educational segment fell by -3.1% and healthcare by -2.9%. Conversely, the residential segment rose by 0.1%, with spending on single-family projects increasing by 0.1%. Meanwhile, outlays on multifamily housing projects fell by 0.3%.

4. INVESTORS TAKE ON CRE

- A recent Bloomberg review of investor sentiment examines investors’ more candid views on the state of Commercial Real Estate, as the industry remains strong amid a number of emerging risks.

- Standing out is the longer-term risk of higher interest rates. Early on during the Fed’s tightening cycle, there was hope—and market expectation—that interest rates would rise for some initial period of time before coming back down as inflation snapped back toward pre-pandemic levels. However, this hasn’t happened, leaving interest rates higher for longer than some had expected and forcing some shifts in investment strategies.

- CRE assets, which often require refinancing after long loan periods, are susceptible to the recent increases in lending rates, especially those in sectors and places strongly altered by the pandemic, such as downtown office spaces.

- Notably, one take in the article noted that as Fed policymakers keep an eye on CRE risks, they face the reality that the shifts in certain parts of the market largely reflect a secular supply and demand shift caused by the COVID-19 pandemic. As a result, there is so much that monetary policy can sustainably do to address the risks posed.

5. FORECLOSURES RISE

- Data from ATTOM shows a nationwide uptick in foreclosures in May compared to the month before but that foreclosures are down on an annual basis.

- There were roughly 33,000 foreclosure filings in May, up 3.0% from April but down 7.0% from May 2023. The trend signals a mixed market, with pockets of distress emerging in a relatively resilient landscape.

- New Jersey, Illinois, and Delaware posted the highest monthly foreclosure rates. From a metro-level perspective, Chicago, Philadelphia, and Riverside (CA) led foreclosure filings in cities with populations of 1 million or higher. In cities with populations between 200,000 and 1 million, Longview, TX, Trenton, NJ, and Atlantic City, NJ, charted the highest rates of foreclosures.

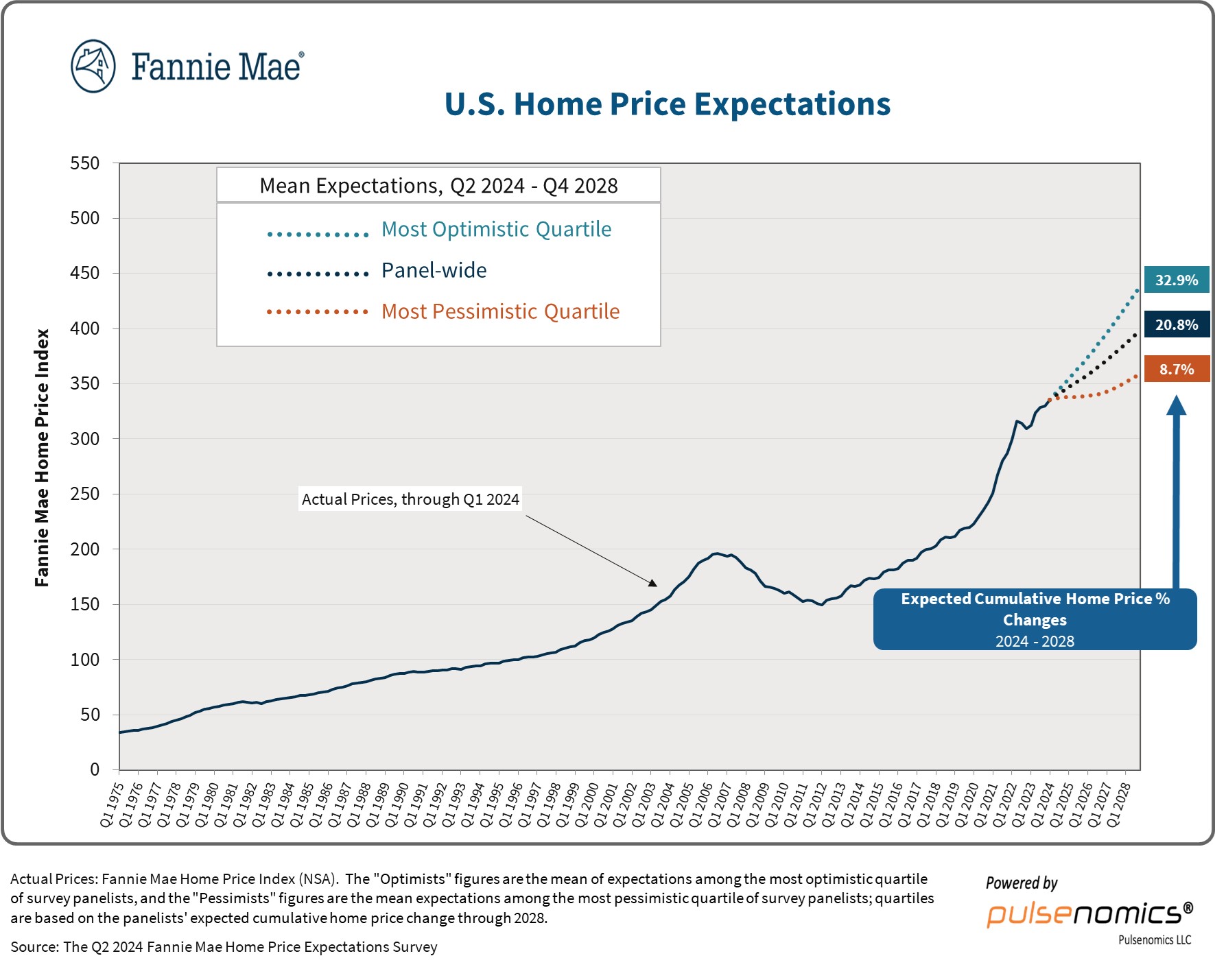

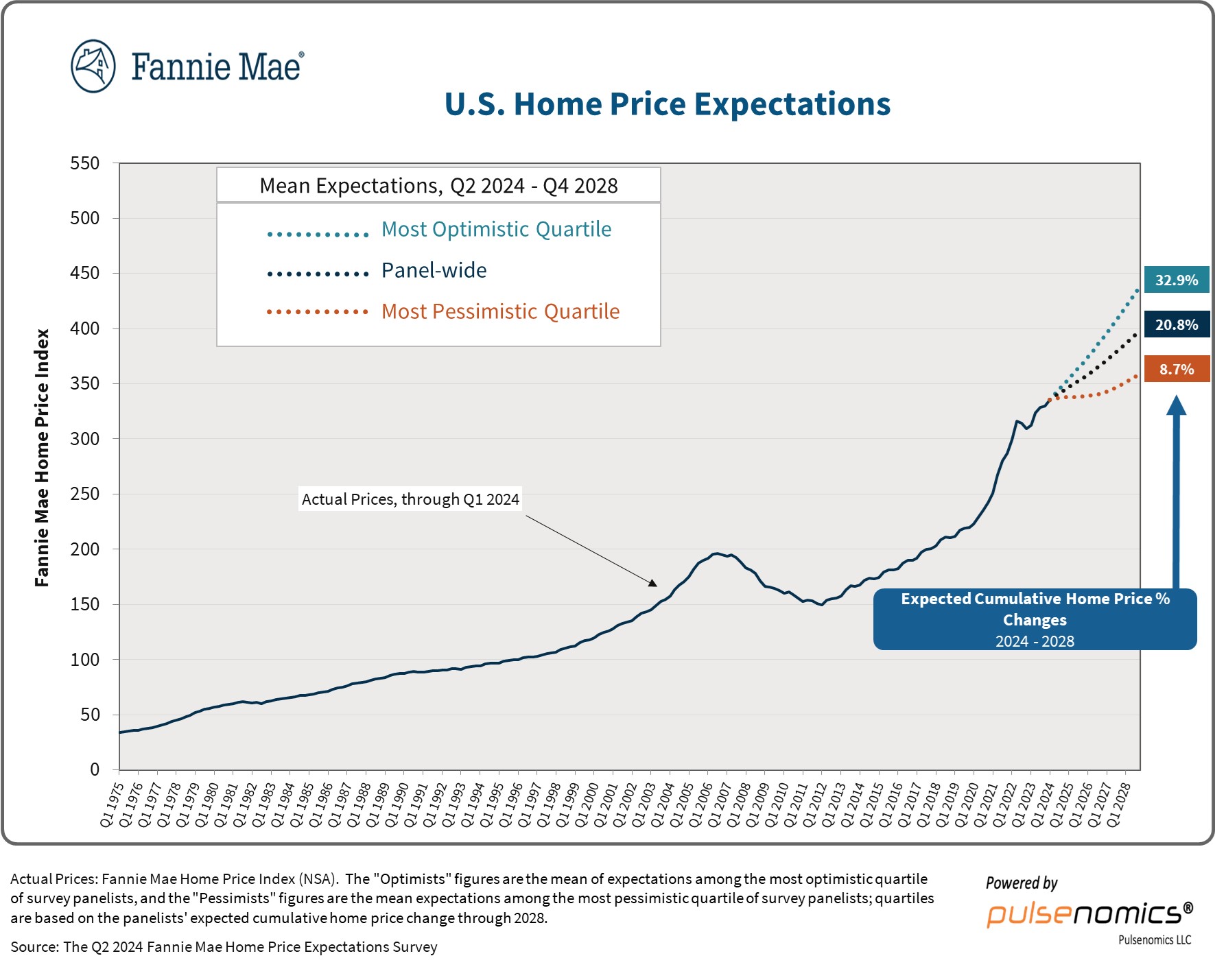

6. HOME PRICE EXPECTATIONS

U.S. Home Price Expectations, Fannie Mae

- According to Fannie Mae’s Q2 2024 Home Price Expectations Survey (HPES), produced in collaboration with Pulsenomics, home price growth is expected to remain robust through 2025.

- The HPES forecasts that US home prices will finish 2024 up 4.3% before slowing to 3.2% in 2025. These projections come off the heels of data from Core-logic in May showing that the nation’s 20 largest metros experienced a record 6.5% annual through March.

- Further, special reporting in Fannie’s analysis details that the “lock-in effect” may be fading. As mortgage rates rose to generational highs, the housing market began to experience a “lock-in effect” where existing homeowners locked into older contracts that were, on average, underwritten with lower interest rates became increasingly incentivized to stay out of the for-sale market.

- Citing data from Realtor.com, newly listed homes are up 12.2% since the start of the year through April. 84% of respondents in the HPES believe that the lock-in effect will continue to diminish and bring more would-be buyers and sellers into the market.

7. CPI INFLATION

- According to the US Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers (CPI-U) remained steady in May after increasing by 0.3% in April. The consumer price index fell slightly on an annual basis, ticking down to 3.3%, a positive shift relative to earlier in the year but still not enough to sway Fed policymakers further toward rate cuts.

- Core CPI rose by 0.2% in May, its slowest pace since October 2023. Meanwhile, shelter costs rose 0.4% month-over-month, their fourth consecutive month at that level. Gasoline prices fell.

- Overall, markets viewed this month’s report positively, hoping that rate cuts could be on the way with inflation decelerating.

- Still, with policymakers holding rates constant at their June meeting later that day, by the end of the trading day, federal funds futures priced in just two rate cuts between now and the end of the year. The forecast is a significant shift from the three-rate hikes projected as the year began, but markers have gradually recalibrated expectations as inflation pressures persisted.

8. SECOND QUARTER CONSTRUCTION INSIGHTS

- According to data from CoreLogic, Southern states have led the US in building permit approvals for single-unit homes through the second quarter of 2024, with Texas and Florida as key standouts.

- Construction cost growth was similarly higher in the South, coinciding with solid building permit activity. Overall, residential reconstruction costs rose roughly 3% from January to May 2024.

- The price activity for materials In the US has been mixed, with only half of all materials tracked in the report reflecting increases while the rest decreased. Notably, lumber prices have declined by up to 3%, while carpet and clay bricks have risen more than 6.0%.

- Labor costs have also gone up. Through May 2024, roofers, electricians, and painters are each experiencing wage growth above 2% annually. Laborers and insulation installers had the lowest wage growth, but all occupations saw wage growth of at least 1%.

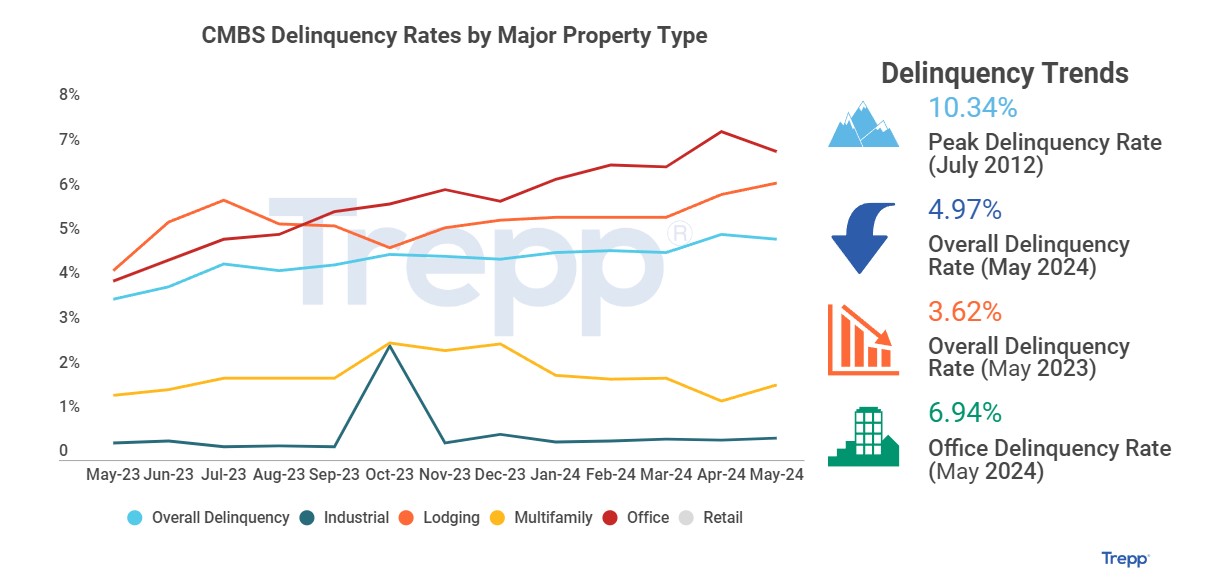

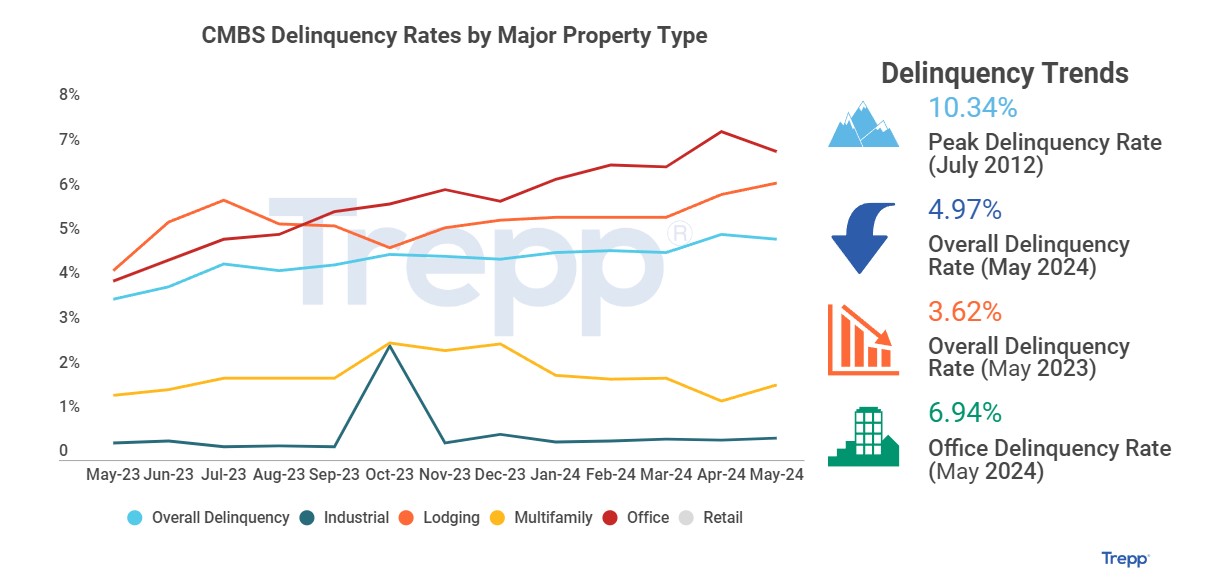

9. CMBS DELINQUENCIES

CMBS Deliquency Rates, Tepp

- According to Trepp, in May 2024, the overall CMBS delinquency rate fell below 5% to 4.97%, driven by significant resolutions in the office sector. Approximately $2 billion in office loans were resolved, reducing the overall delinquency rate.

- However, the impact was offset by $1.2 billion in newly delinquent office loans and new delinquencies in Retail ($995 million), lodging ($238 million), and multifamily ($245 million). Including loans beyond maturity but current on interest, the delinquency rate would be 6.00%. The 30-day delinquency rate rose to 0.35%.

- CMBS delinquency rates remain highest for office properties (6.94%). Lodging (6.22%) and Retail (5.94%) follow closely behind with delinquency rates in the same stratosphere. However, while the retail delinquency rate remains elevated, Retail is the lone sector to have seen improvement in the past year, falling from 6.67% twelve months ago. Multifamily and industrial continue to see the lowest CMBS delinquency rates through May, holding at 1.70% and 0.50%, respectively.

10. MAY JOBS REPORT

- According to the Bureau of Labor Statistics (BLS), the US economy added 272,000 jobs in May, sharply beating the consensus forecast of 185k. However, the unemployment rate rose to 4.0 during the month.

- Employment increases were led by education and healthcare (+86k), government (+43k), and leisure and hospitality (+42k). Construction employment increased by 21,000 during the month.

- Annual wage growth picked up substantially, rising to 4.1% in May, potentially adding to inflation pressures.

- Meanwhile, US job openings dropped to 8.1 million in April, their lowest in over three years, potentially indicating a labor market slowdown. The unemployed-to-job opening ratio decreased to 0.68 — which is still well below 0.93 before the pandemic.

SUMMARY OF SOURCES

1. LARGE FUNDS INCREASE CRE FOOTPRINT

- A recent analysis by Reuters details how large funds are increasing their CRE market share as traditional lenders such as banks pull back.

- Stricter capital rules for banks and recent regional bank failures in the US have led to a retreat from traditional lenders in the real estate space, increasing demand for alternative lenders.

- Large firms such as PGIM, LaSalle and Nuveen, and Brookfield, among others, recently expressed their plans to increase their credit exposure to property markets as they bet on an end to the recent decline in real estate prices.

- Logistics, data centers, multifamily apartments, and high-end office properties are garnering the most attention from funds looking to expand their footprint.

2. FORECLOSURES FALL

- According to the latest data tracked by ATTOM, nationwide foreclosure activity fell slightly in April after increasing in March.

- US foreclosure filings, which include default notices, scheduled auctions, or bank repossessions, are down 4.0% month-over-month and an equivalent decline from one year ago.

- Maryland, Illinois, and Nevada posted the highest foreclosure rates in April, while Cleveland, Baltimore, and Chicago posted the highest rates among major US metros.

- To further contextualize the market’s direction, ATTOM’s report shows that foreclosure starts fell by 7.0% during the month while foreclosure completions rose by 8.0%. If the trend holds, foreclosures may remain elevated in the short term before dropping off.

3. LOGISTICS MANAGERS’ INDEX

- Cell phone activity data tracked by the University of Toronto School of Cities show that between March 2023 and March 2024, downtown US and Canadian cities saw a median increase of 9.3% in foot traffic.

- While the findings do not detail the type of places where new activity occurs, they suggest that most downtown areas continue to gradually recover from the pandemic.

- Of the metros tracked, 50 cities have downtown areas experiencing a recovery compared to 14 that are trending downward.

- Notably, the report points out that among the metros trending downward are cities that had previously topped their rankings, suggesting that many of them recovered more quickly.

- The top five metro areas by year-over-year downtown activity growth were Minneapolis (+45.7%), Ottawa (+39.5%), Montreal (+38.6%), Chicago (+36.6%), and Louisville (+31.9%).

4. CMBS DELINQUENCIES SPIKE

- According to Trepp data, the CMBS delinquency rate spiked in April, climbing 40 basis points to 5.07%, its highest rate since September 2021.

- The uptick reversed a slight decrease registered during the previous month and was driven mainly by increases in office, lodging, and retail delinquencies, each experiencing their most significant monthly increases in almost a year.

- Further, over a dozen loans with outstanding balances exceeding $100 million became delinquent during the month.

- Industrial and Multifamily experienced a slight month-over-month decline in delinquencies during April, with each reversing increase in March.

5. RETAIL FOOT TRAFFIC REBOUND

- A recent analysis of data from Forrester suggests that lease negotiations in the Retail real estate sector are occurring at earlier points in advance of lease expirations compared to previous years, shifting the market in favor of landlords and likely a bullish signal for asset prices.

- Offline sales rose by 78.1% in 2022 as nationwide in-person activity rebounded from pandemic lows and remained robust in 2023. Foot traffic in prime trade areas is expected to return to pre-pandemic levels in the third quarter of this year and surpass them in 2025.

- The report notes that several downtown shopping districts continue to be hampered by increased crime rates and declines in office attendance, but rents for prime retail space are up 9% in US markets compared to 4.8% globally.

- Moreover, while online sales have become an increasingly influential part of the overall retail market, the report estimates that brands with a physical location increase their digital sales by an average of 6.9% while closing stores depress sales.

6. CPI INFLATION

- Inflation, as measured by the Consumer Price Index (CPI), experienced a slight easing in April following three consecutive months of increases or unchanged rates on a monthly basis, according to the latest data from the Bureau of Labor Statistics.

- CPI rose 3.4% over the past 12 months, roughly aligned with expectations. Meanwhile, core inflation rose 3.6% annually, its lowest reading since April 2021.

- While the relief in price pressures will be a welcome sign from Federal Reserve policymakers, inflation in April was primarily driven by rises in shelter and energy.

- Shelter costs have been a critical focus of policymakers, given their significant contribution to price pressures over the past several years. The shelter index of CPI rose by 0.4% month over month and 5.5% year over year, well above the levels needed to drive inflation back down to 2%.

7. REPUBLIC FIRST FAILURE

- According to a recent analysis from Commercial Observer, Republic First’s recent bank failure will have a limited impact on CRE markets.

- The Philadelphia-based bank, which finished 2023 with $5.87 billion in total assets, was shut down by Pennsylvania regulators in April. This renewed concerns over the instability of the banking system that began one year ago following the failures of three regional banks: Silicon Valley Bank, Signature Bank, and First Republic.

- Sam Chandan, director of NYU’s Chen Institute for Global Real Estate Finance, suggests that the failure will have limited impact on real estate portfolios where the bank operated. Still, Chandan notes that the market remains “particularly sensitive to signals of instability” and that recent attention toward the bank failure may be more noteworthy than the failure itself as markets work to “discern whether or not the failure has a bearing on or is relevant to our thinking about broader bank stability.”

- Republic First’s assets and deposits were acquired by Fulton Financial Corp, a Lancaster, PA-based bank, in an action overseen by the FDIC.

8. INTEREST RATES

- The FOMC held interest rates unchanged at its April 30th-May 1st policy meeting, the seventh time in its last eight meetings that it decided to do so. The Federal Funds rate is currently set to 5.25% to 5.5%.

- The decision continues the committee’s “wait-and-see” approach, which has seen Fed policymakers move away from actively raising interest rates and toward a more moderate stance that digests month-to-month inflation dynamics before signaling the direction of rates moving forward.

- The committee’s latest decision to hold comes on the heels of higher-than-expected inflation rates in recent months, including a 3.5% year-over-year uptick in the Consumer Price Index in March.

- Further, recent Q1 GDP data suggests that consumer spending has remained elevated since the start of 2024, potentially sustaining price pressures even as interest rates sit at generational highs.

- At the beginning of this year, consensus estimates predicted three quarter-percent rate cuts in 2024 beginning in March, which have moderated in recent months as Fed officials cautioned against a premature pivot and the US economy continues to expand at an impressive pace. Through May 15th, the majority of futures markets now see just two quarter-percentage points cuts in 2024.

9. APRIL JOBS REPORT

- According to the Bureau of Labor Statistics, nonfarm payrolls rose by 175,000 in April, below consensus estimates, and a significant slowdown in hiring activity was seen at the start of the year.

- April’s job numbers were the slowest pace of hiring in six months and coincided with a ten basis point increase in the unemployment rate to 3.9%. Meanwhile, wage growth eased, with average hourly earnings falling below a 4% annual pace for the first time since June 2021.

- Despite the slowdown in hiring, the US labor market appears to be on solid footing as initial unemployment claims remain at moderate levels.

- April’s slowdown may give the Federal Reserve some breathing room. Officials are monitoring leading indicators such as employment growth in hopes that inflation can return to its longer-run target of 2%.

10. CONSUMER SENTIMENT

- Consumer sentiment fell in May to its lowest level in six months, according to preliminary data from the University of Michigan.

- Both the sub-indices measuring current conditions and expectations declined during the month, with consumers expressing worries that inflation, unemployment, and interest rates may each be heading in an unfavorable direction.

- Inflation expectations for the next twelve months rose to 3.5%, up from 3.2% in April and a six-month high. The five-year inflation outlook also rose to a six-month high at 3.1%.

SUMMARY OF SOURCES

SHAREABLE FLIPBOOK DOWNLOADABLE PDF

1. HOMEBUYERS ADJUSTING TO HIGHER INTEREST RATES

- A new survey by Fannie Mae suggests that home buyers are gradually adjusting to higher mortgage rates despite increasingly negative sentiments about the housing market.

- Fannie Mae’s Home Purchase Sentiment Index dropped in March for the first time since November, primarily driven by mortgage rates that remain near generational highs despite expectations last fall that rate-cute could be on the horizon.

- While the delay of rate cuts is likely fueling pessimism, underneath these data, consumers appear to be recalibrating their expectations around interest rates.

- Data from the survey show that the measurements for questions asking if it’s a “good time to buy” or a “good time to sell” both moved higher, suggesting that the higher rate environment is starting to be seen as a “new normal” by both buyers and sellers.

- Still, while responses moved in a positive direction, most consumers (80%) still say now is a bad time to buy a house. However, this suggests that even a slight reduction in interest rates could bring buyers and sellers off the sidelines.

2. WHY HAVEN’T RATE HIKES REDUCED SPENDING?

- While the Federal Reserve’s interest rate hikes have successfully reigned in borrowing by households and businesses, it has not meaningfully reduced consumer spending or output—the critical mechanism policymakers rely on to calm inflation pressures.

- In a recent analysis, economist Matthew C. Klein suggests that this is explained in part by consumers’ reduced reliance on debt in the aftermath of the Great Financial Crisis (GFC)

- As financers recalibrated their credit standards post-GFC, new spending became increasingly financed by income growth rather than debt reliance relative to before the GFC.

- Incomes have grown rapidly during pandemic and post-pandemic years while balance sheets remain healthy as increasing asset values reduce the strain of rising debt servicing costs.

- Klein points out that today’s spending activity has been financed mainly by more people working and at higher pay rates. This both reduces the potential impact of rising interest rates on consumption levels and suggests that spending levels are sustainable relative to employment.

3. LOGISTICS ACTIVITY SURGES, FASTEST IN 19 MONTHS

- According to the Logistics Managers’ Index, US logistics activity experienced its fastest monthly expansion since September 2022 during March, reaching an index level of 58.3.

- While growth levels remain at the lower end, this signals a healthy turnaround for industries that impact warehousing and transportation. According to the report, recent growth is attributed to “long-planned inventory expansions and improved efficiency in warehousing and transportation.”

- An increase in inventory levels drove the overall expansion in the index in March as inventories reached their highest mark since October 2022.

- Consequently, warehouse capacity contracted, its first since January 2023. Absorption of warehouse capacity is a sign of strengthening demand, a bullish signal for the Industrial real estate market.

- Nonetheless, transportation prices continue to outpace capacity, indicating that we may still be in the midst of a freight recession.

- Overall, the analysis notes that recent data suggests that firms are gearing up for a continuation of strong consumer spending levels in the future.

4. HAS OFFICE ACTIVITY REACHED ITS FLOOR?

- A recent Moody’s review of Placer AI data reports that while employee office visits fell by 31.3% between February 2020 and February 2024, they have risen by 18.6% over the past 12 months. Whether or not office activity has reached its floor may have important implications for office valuations.

- In the San Francisco metro, where office buildings have experienced the most extensive post-pandemic drop-in activity (-46%), visits have rebounded by 24% compared to February 2023, the second largest increase nationally, behind Dallas.

- However, when comparing the Placer AI data with their own commercial real estate insights, Moody’s finds that higher visits do not necessarily translate into higher occupancy rates in the short term but do so over more extended periods of analysis.

5. CPI INFLATION

- Consumer prices increased more than expected in March, rising 0.4% from February and 3.5% year-over-year, according to the latest data from the Bureau of Labor Statistics.

- On average, economists surveyed by Dow Jones forecasted monthly and annual inflation rates of 0.3% and 3.5%, respectively. Futures markets fell following the report while US Treasury yields rose.

- The core Consumer Price Index (CPI), which excludes food and energy, also rose by 0.4% in the month but accelerated faster than headline CPI on an annual basis, increasing by 3.8% from one year ago.

- Shelter costs rose 0.4% from February and 5.7% year-over-year. The Shelter component of CPI has been one of the most stubborn sources of inflation pressures throughout the post-pandemic period. Fed policymakers are keen to see shelter cost pressures decelerate before moving forward with a policy pivot.

6. FOMC MEETING MINUTES

- Minutes from the FOMC’s March policy meeting reflect that officials remain cautious about the timing of a potential policy pivot, noting that inflation rates weren’t moving lower quickly enough.

- The committee held the benchmark federal funds rate unchanged at its latest meeting in March, continuing its wait-and-see approach regarding any decision to begin rate cuts.

- Comparing language from the March meeting minutes with those from the previous meeting in January, officials again expressed that they need to have “gained greater confidence” that inflation was on a path towards their 2% targeting before cutting rates.

- At the time of the meeting, the US economy had come off of back-to-back higher-than-expected inflation readings in January and February. Since the Fed’s March meeting, consumer prices have again charted higher than estimates suggested, validating officials’ concerns about recent trends.

- Officials also cited geopolitical turmoil and rising energy prices as persisting inflation risks.

7. SUMMARY OF ECONOMIC PROJECTIONS

- In The FOMC’s latest Summary of Economic Projections, policymakers kept the end-of-year federal funds and PCE inflation rate forecasts constant. Still, they shifted their projections on 2024 growth, the year-end unemployment rate, and core inflation rates.

- FOMC officials project that the federal funds rate will fall to 4.6% by year’s end, which aligns with December’s forecast. The current federal funds rate stands at 525-550 and would require three quarter-rate cuts in 2024 to reach the committee’s projection by the end of the year.

- Helping explain the static interest rate forecast is a similarly unchanged projection for headline inflation, which the committee expects to fall to an annual rate of 2.4% by the end of the year.

- However, policymakers have become slightly more hawkish on core inflation since their last projections to close 2023. In the latest reading, projections for core-PCE were raised from 2.4% to 2.6%.

- Higher economic growth forecasts help explain the uptick in core-rate projections—projections for real GDP at the end of 2024 are up from 1.4% to 2.4%. Consequently, officials expect the unemployment rate to fall more steeply this year, revising their projection down by ten basis points to 4.0%.

8. CONSTRUCTION SPENDING

- According to data from the US Census Bureau, construction spending fell by 0.3% month-over-month and increased by 10.6% annually in February, the latest reporting month.

- The drop follows a 0.2% decline in January and surprised forecasters who projected a 0.7% increase during the month.

- The decline was led by a 1.2% fall in public construction spending, while private construction spending was mostly unchanged.

- Within private construction, the residential segment rose 0.7%, but this was offset by a 0.9% decline in nonresidential construction spending.

9. MARCH JOBS REPORT

- Job growth soared past economists’ consensus expectations in March as employers added 303,000 new positions, the largest monthly tally since May last year.

- The historic post-pandemic trend in US job growth has defied many expectations, with many who thought that by now, the pandemic recovery would be finished and job growth would have slowed to its pre-pandemic trend.

- Nonetheless, the US labor market has remained resilient amid 11 interest-rate hikes and stubbornly elevated inflation. The unemployment rate ticked down ten basis points to 3.8% in March.

- Annual wage growth softened from 4.3% in February to 4.1% in March. The trend will be welcomed by Federal Reserve policymakers looking for a decline in inflation’s leading indicators, of which employee wages constitute a significant part.

10. BLACKSTONE GOES ON INVESTMENT “OFFENSIVE”

- The Wall Street Journal (WSJ) recently reported on a deal by Blackstone to purchase Apartment Income REIT (AIR Communities) for upwards of $10 billion.

- The deal is significant in that it is the largest Multifamily market transaction in the firm’s history and reflects bullish sentiments by larger firms on commercial real estate more broadly.

- In addition to positive investment sentiment about the rental housing market, the report suggests that Blackstone believes that commercial real estate may be reaching its cyclical floor, making now a good time to buy.

- Referencing data from Commercial Mortgage Alert, WSJ notes that while real estate transaction activity has cratered in the past year, CMBS issuance during Q1 2024 was roughly three times (3x) the volume in Q1 2023. Remerging bullishness in the CMBS market could indicate an improving outlook for the broader financing market. Still, much depends on the future path of interest rates.

SUMMARY OF SOURCES

- (1) https://www.investopedia.com/us-economy-news-today-april-8-8628199#toc-2024-04-08t182001942z

- (2) https://substack.com/@matthewcklein?utm_source=substack&utm_medium=email

- (3) https://www.the-lmi.com/

- (4)https://cre.moodysanalytics.com/insights/cre-news/relationship-between-office-visits-and-occupancy/

- (5) https://www.bls.gov/news.release/cpi.nr0.htm

- (6) https://www.federalreserve.gov/newsevents/pressreleases/monetary20240320a.htm

- (7) https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20240320.htm

- (8) https://www.census.gov/construction/c30/c30index.html

- (9) https://www.bls.gov/news.release/pdf/empsit.pdf\

- (10) https://www.wsj.com/real-estate/blackstone-making-10-billion-multifamily-purchase-going-on-the-real-estate-offensive-f3126928

Danielle Willard serves as an Advisor for SVN Vanguard in Los Angeles. Danielle has more than 25 years’ experience specializing in real estate and property management with a focus on commercial, multi-family, residential property management, sales, and investments. As a native to Southern California, over the course of her career, Danielle has worked in various real estate markets with extensive leasing experience and local knowledge of residential market rates in cities throughout Los Angeles County and Orange County. Her skills and experience have led her to successfully manage and enhance the value of a portfolio by combining up to the minute core market knowledge, masterful negotiation skills, real estate transaction and business expertise, asset management, tactical goal setting, and solid real estate opportunities.

Danielle is most proud of building long term relationships and creating investment strategies with her clients. She is passionate about assisting new investors of any age to create wealth and passive income by building their real estate portfolio as well as working with seasoned investors to procure additional investments, manage and add value to their current real estate investments.

Danielle loves living by the beach in Belmont Shore and spends her free time with family, traveling and exploring with her twins. However, her commitment and passion to serving her clients equals real opportunities so reach out to her today to discuss how she can assist you in creating your success story to retire early.