SHAREABLE FLIPBOOK DOWNLOADABLE PDF

1. SMALL BUSINESS OPTIMISM DECLINES

- According to the National Association of Independent Business (NFIB) in March, small business optimism experienced its most substantial decline in nearly three years, driven by a collapse in expectations around future business and sales conditions.

- The share of owners who expect better future business conditions fell by its largest monthly amount since December 2020, declining to just 21%. Meanwhile, just 3% of owners expect real sales to be higher in the short term, down from 14% in February.

- Notably, the identical items that saw the largest boost to sentiment following the November 2024 election experienced the steepest declines in March.

- Other components that measure ongoing business conditions, such as the share of owners reporting plans to increase employment, capital outlays, or expand their business, remain roughly in line with where it was pre-election.

2. CONSUMER CONFIDENCE TRACKING

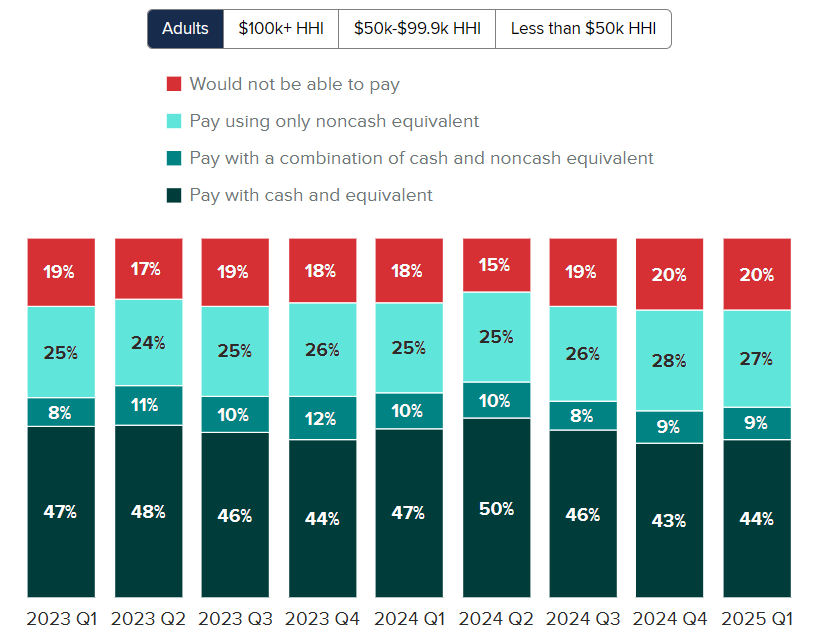

- Morning Consult’s daily index of consumer sentiment (ICS) shows that from April 3rd to April 7th, consumer confidence experienced its second-largest three-day drop since tracking began in 2018, behind only reactions to the onset of COVID-19 in March 2020.

- The April 7th reading was the lowest since July 2024. Following the 2024 election, US consumer confidence experienced a rapid upswing, reaching a five-year high by January 21st, but has fallen steadily in the past several weeks.

- Consumer and business confidence indices have recently reacted to the US administration’s tariff announcements, but the impact on spending is less clear. Consumer spending was weaker than expected in February, but some forecasters foresee an Easter spending pick-up despite higher uncertainty.

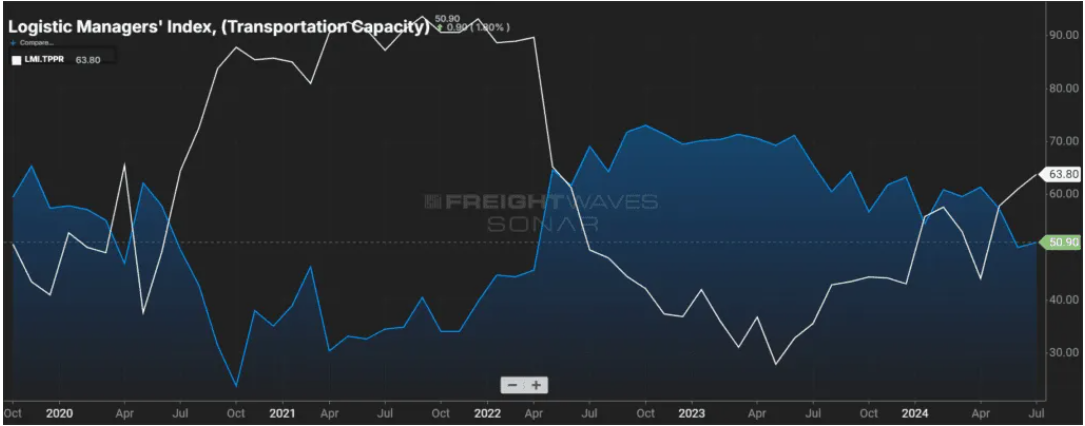

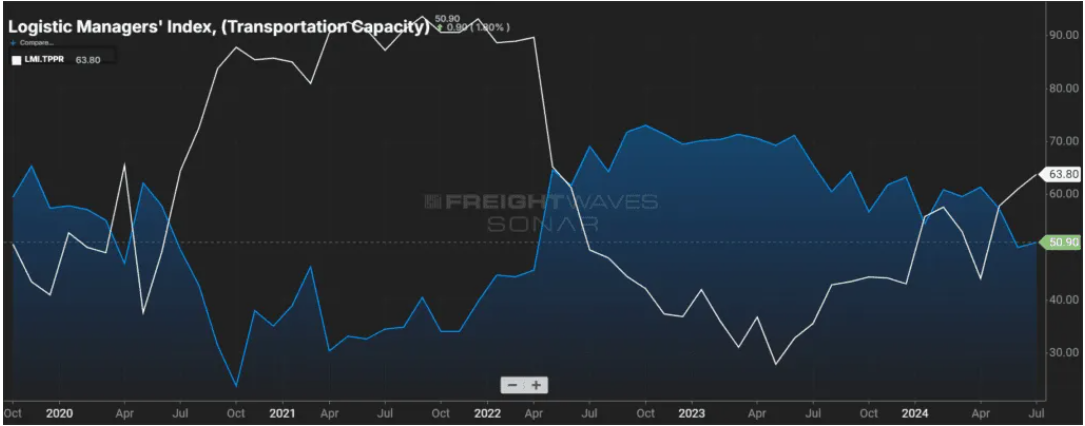

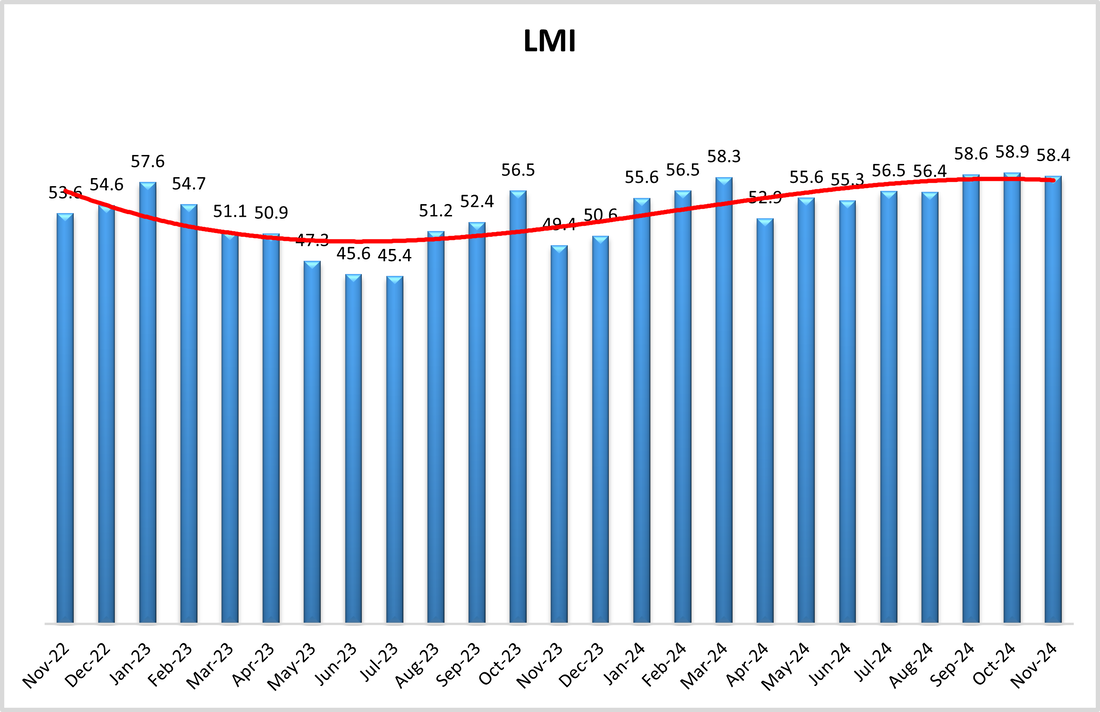

3. LOGISTICS MANAGERS’ INDEX

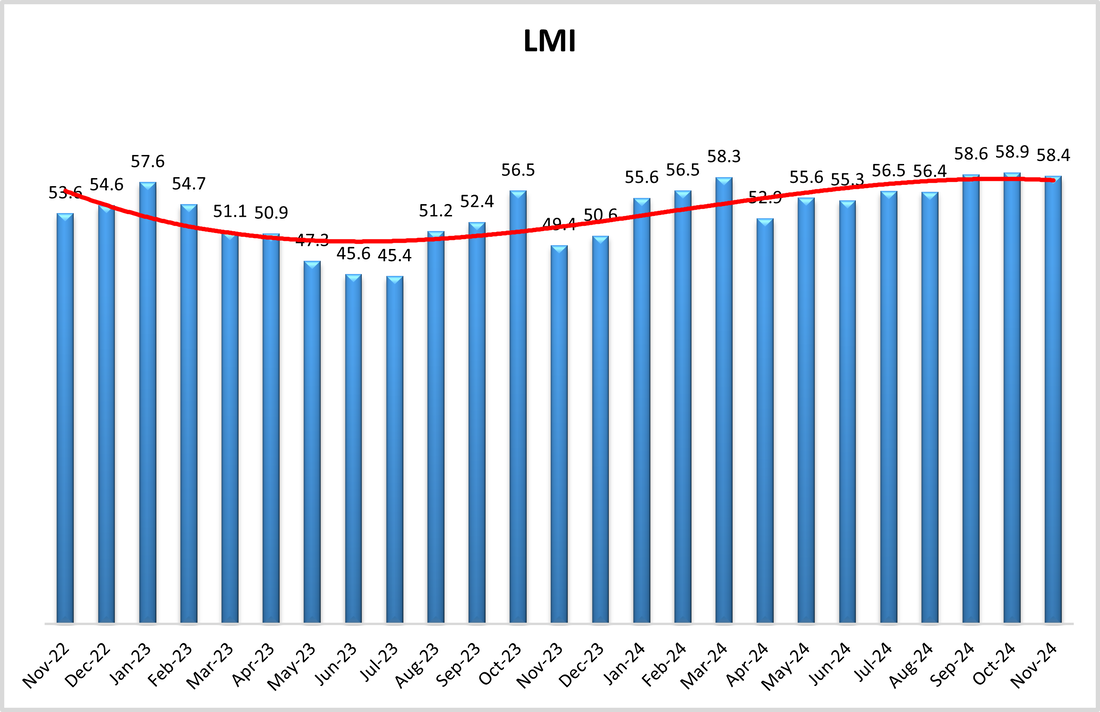

- The US Logistics Managers’ Index (LMI), a leading indicator for Industrial Real Estate activity, fell from 62.8 in February to 57.1 in March. A mark above 50 indicates that logistics activity is expanding.

- This month’s drop is the third largest in the index’s history and marked the shortest expansion in logistics activity in seven months. However, for context, February’s LMI reading was the highest since June 2022.

- The decline was led by an across-the-board drop in index components prices, including inventory costs, warehouse prices, and transportation prices.

- The broad price decrease lends credibility to the view that logistics activity ramped up to start the year in anticipation of tariff risks, but that activity has since subsided.

- Additionally, inventory levels and warehouse and transportation capacity each expanded at a slower pace in March.

4. MEDICAL OUTPATIENT SPACES

- Medical outpatient buildings (MOB) are emerging as an opportunity in an otherwise challenging market, as explored in a recent piece by Globe Street.

- Asking rents rose 2.5% in 2024, slower than the 3.7% in 2023, but premium properties continue to drive rent growth in the sector.

- Properties with rents in the 90th percentile of Revista’s top 100 markets achieved an average of 2.4% in NOI growth between 2019 and 2024 compared to an average of 1.8% growth for properties near the 50th percentile.

- Tenant retention has also been key to MOB’s appeal. Healthcare providers typically operate on longer lease terms while renewing at high rates.

- According to data from Green Street, over 80% of tenants renewed MOBs in Q3 2024. New leases average a commitment of 107 months, nearly nine years. Meanwhile, vacancy rates remain relatively low, at just 6.9% through Q4 2024.

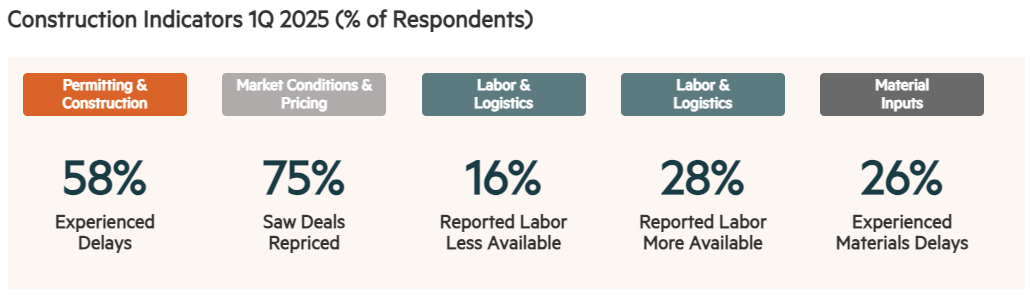

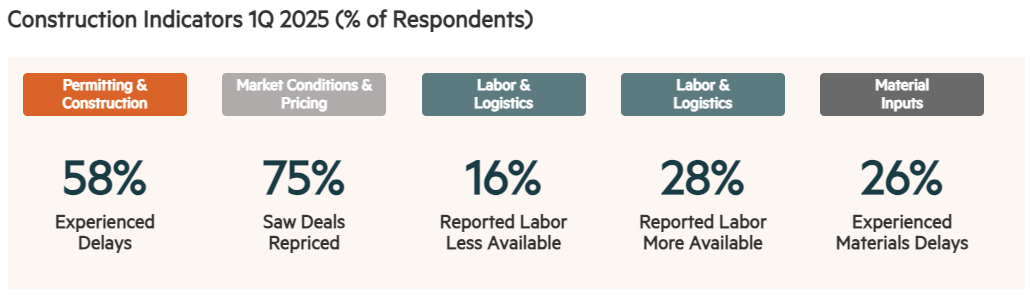

5. APARTMENT CONSTRUCTION & DEVELOPMENT ACTIVITY

- According to the National Multifamily Housing Council (NMHC)’s latest quarterly construction survey, 58% of respondents reported experiencing construction delays during the first quarter, down from 78% at the end of Q4 2024.

- The Southeast stands out as an area where delays are more widespread, followed by Texas and, to a slightly lesser extent, the mid-Atlantic and the Rockies.

- Of those experiencing delays during Q1, 79% are experiencing permitting delays, a drop from a record high of 95% of respondents in Q4 2024. The share of respondents reporting delays in starts rose from 90% to 93%, its highest share since June 2022.

- The most frequently cited causes of delays in starting during the first quarter were economic uncertainty and economic feasibility, each at 68% of respondents. Permitting, entitlement, and professional services are also cited to a slightly lesser extent but still affect more than half of all respondents.

- Availability of construction financing and staffing shortages continue to decline as reasons for delayed starts.

6. MARCH JOBS REPORT

- According to the Bureau of Labor Statistics (BLS), the US added 228k jobs in March, well above projections of 140k jobs and climbing from 117k in February. The unemployment rate increased 10 basis points (bps) to 4.2%.

- Health care, transportation, and warehousing were once again among the key sectors driving employment growth.

- Federal government jobs continued to shrink in March as large cuts to the federal workforce that began in February continued to take shape. Federal government jobs declined by 4,000 in March following an 11,000 decline in February.

- Despite payrolls coming in higher than expected, futures markets shifted toward a more dovish outlook for policy following the data release.

- Year-end projections for the Federal Funds rate went from a 78.7% probability of no more than four (4) rate cuts between now and the end of the year to a 51.1% probability of at least five rate cuts.

7. EASTER SHOPPING SEASON

- The National Retail Federation projects that Easter shoppers are expected to spend $23.6 billion during the spring 2025 holiday, up from the $22.4 billion estimated total in 2024.

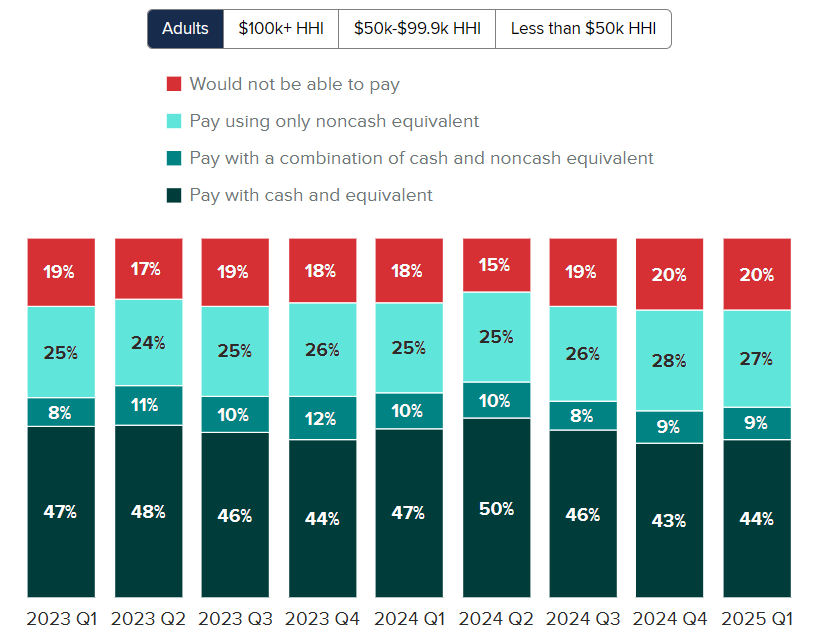

- The report forecasts that Americans will increase their spending this year despite a recent uptick in economic uncertainty.

- Discount stores are expected to once again be the top destination for seasonal shopping. The price of eggs, a traditional item used for Easter festivities, has nearly doubled in the past year.

- Major retailers, who experienced robust sales numbers during the December 2024 holiday season, are expecting a similar pattern during the upcoming holiday, believing that consumers who feel constrained by other costs may view the holiday season more favorably.

8. TOP STATES FOR UNDER-35 HOMEOWNERS

- According to a Chandan Economics analysis of the American Community Survey, Texas, California, and Florida have the greatest number of households headed by someone under 35.

- Meanwhile, Utah (11.6%), Alaska (10.2%), and Iowa (10.1%) maintain the highest proportion of U35 homeowners as a share of all households in the nation, with North Dakota (10.0%) and Wyoming (9.6%) rounding out the top 5.

- The states with the highest totals tend to also have the most homeowners under 35 and generally rank near the top for renters.

- Conversely, the highest shares of U35 homeowners as a percent of all households reveal where young, first-time homebuyers face fewer barriers to ownership.

- States that rank in the bottom ten for a share of U35 homeowners are among some of the highest for average hourly wages. This includes DC, which is the lowest in terms of U35 homeowner share (3.5%) but highest in average hourly wage ($55.02). Also ranking in the bottom five are California (4.6%) and New York (4.8%), followed by Hawaii (5.1%) and Nevada (5.4%).

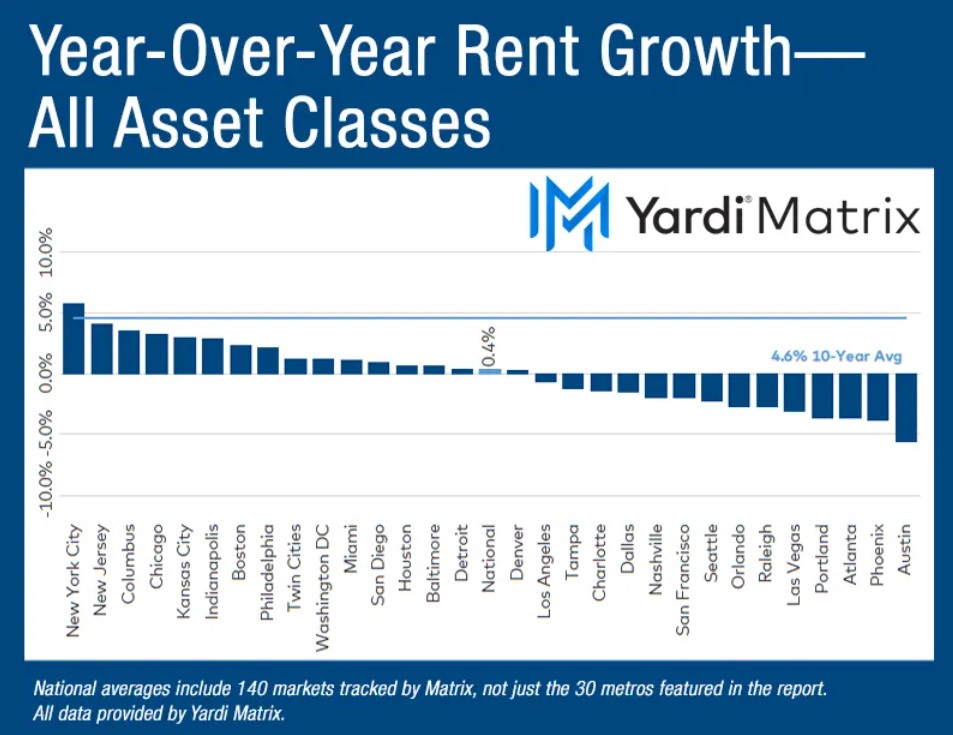

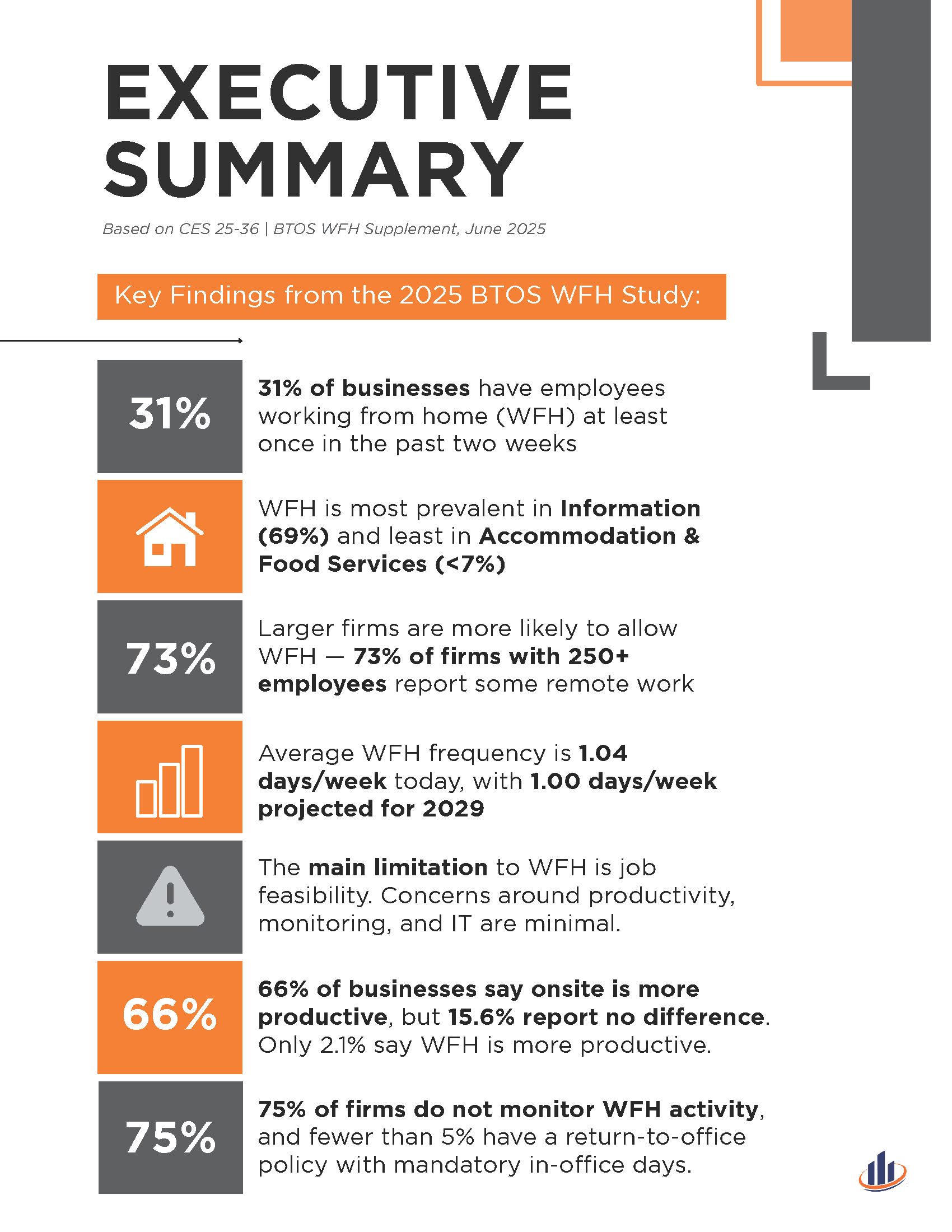

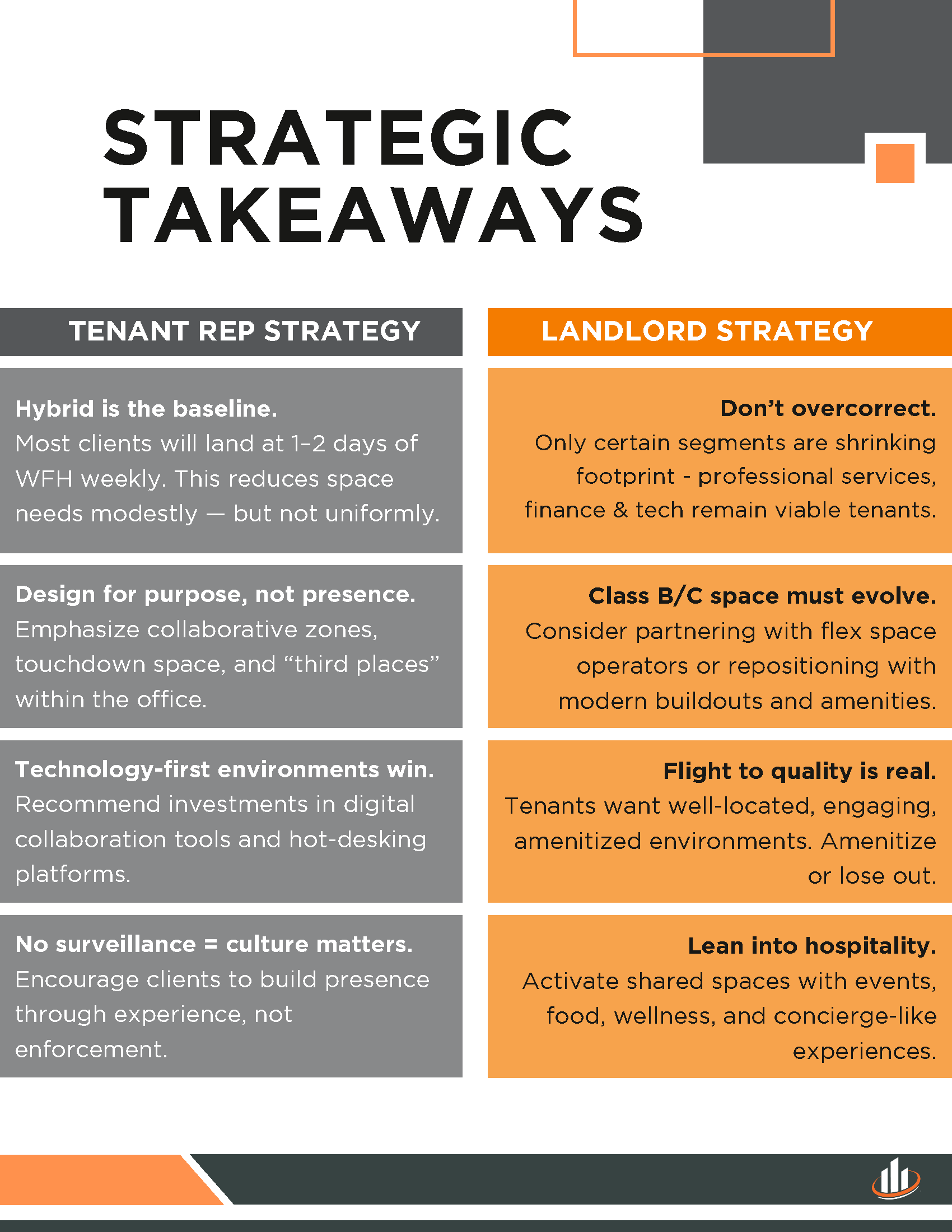

9. WFH RENTAL DEMAND

- According to a Chandan Economics analysis of the US Census Bureau’s American Community Survey, there are 4.0 million rental units in the US headed by someone who works from home (WFH), down from 4.5 million in 2022, representing a 9.9% decline.

- It’s the second consecutive year that WFH rentals have fallen, following the peak of 5.0 million households in 2021. Between 2021 and 2023, WFH rental demand has slid by a total of 1.0 million households (-20.1%).

- WFH renters skyrocketed by more than 200% in 2020 and rose again by about 18% in 2021.

- Despite the past two years of declines, the nature of remote vs. in-person work remains in a very different place than it was entering the pandemic. Through 2023, the total number of full-time WFH workers (22.6 million) remains up by 152% compared to pre-pandemic.

- The disentanglement of local rent prices from local wage dynamics had a major impact on rental markets in the aftermath of the pandemic. Now, while the reversion process will be more gradual, a re-anchoring appears underway.

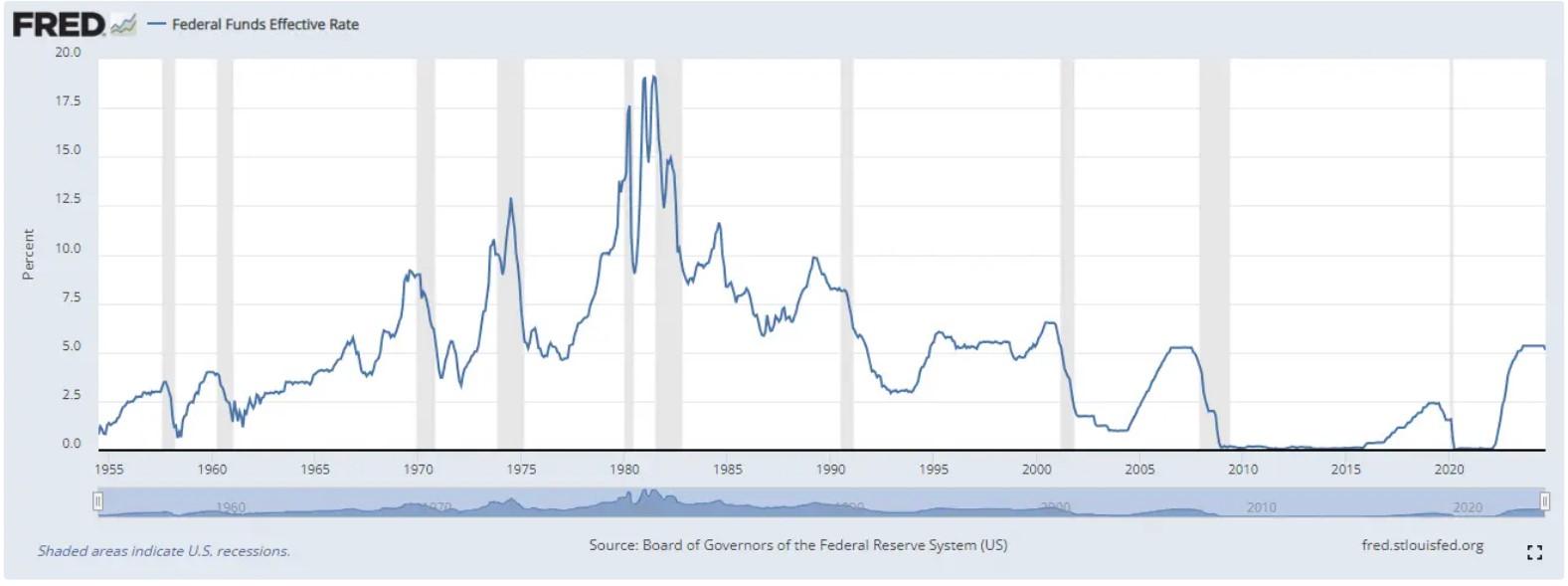

10. FOMC MEETING MINUTES

- According to the recently released minutes from the Fed’s March policy meeting, there was broad agreement to keep rates unchanged while policymakers continue to assess the outlook for labor markets and growth in 2025.

- Members, on average, expect inflation to be pushed higher this year due to the impact of tariffs. However, the committee collectively acknowledges that there is much uncertainty around the magnitude of tariff effects or their duration.

- Meanwhile, a majority of officials believe that inflation pressures more broadly could be more persistent than previously anticipated.

- Most FOMC members view inflation risks as tilted to the upside, while employment risks are facing the downside.

SUMMARY OF SOURCES

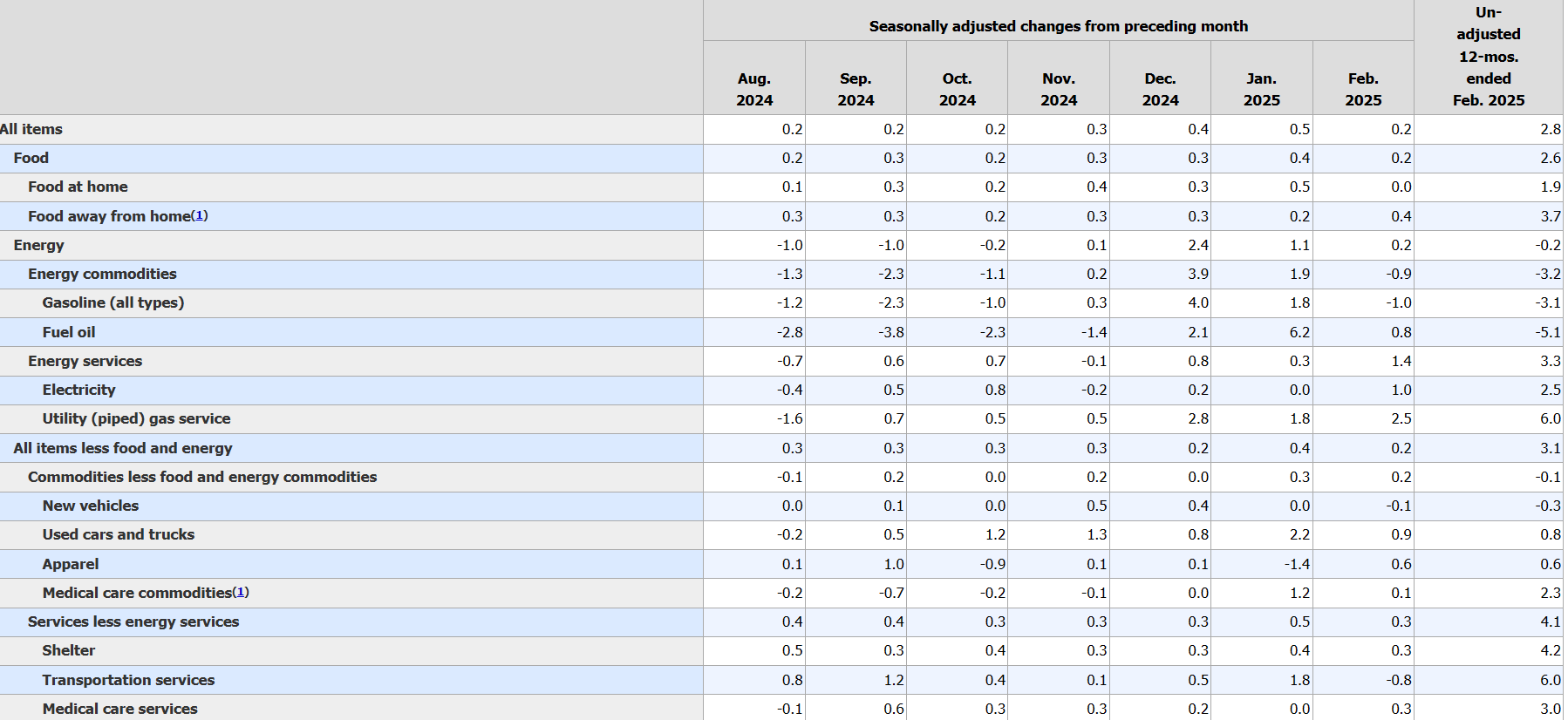

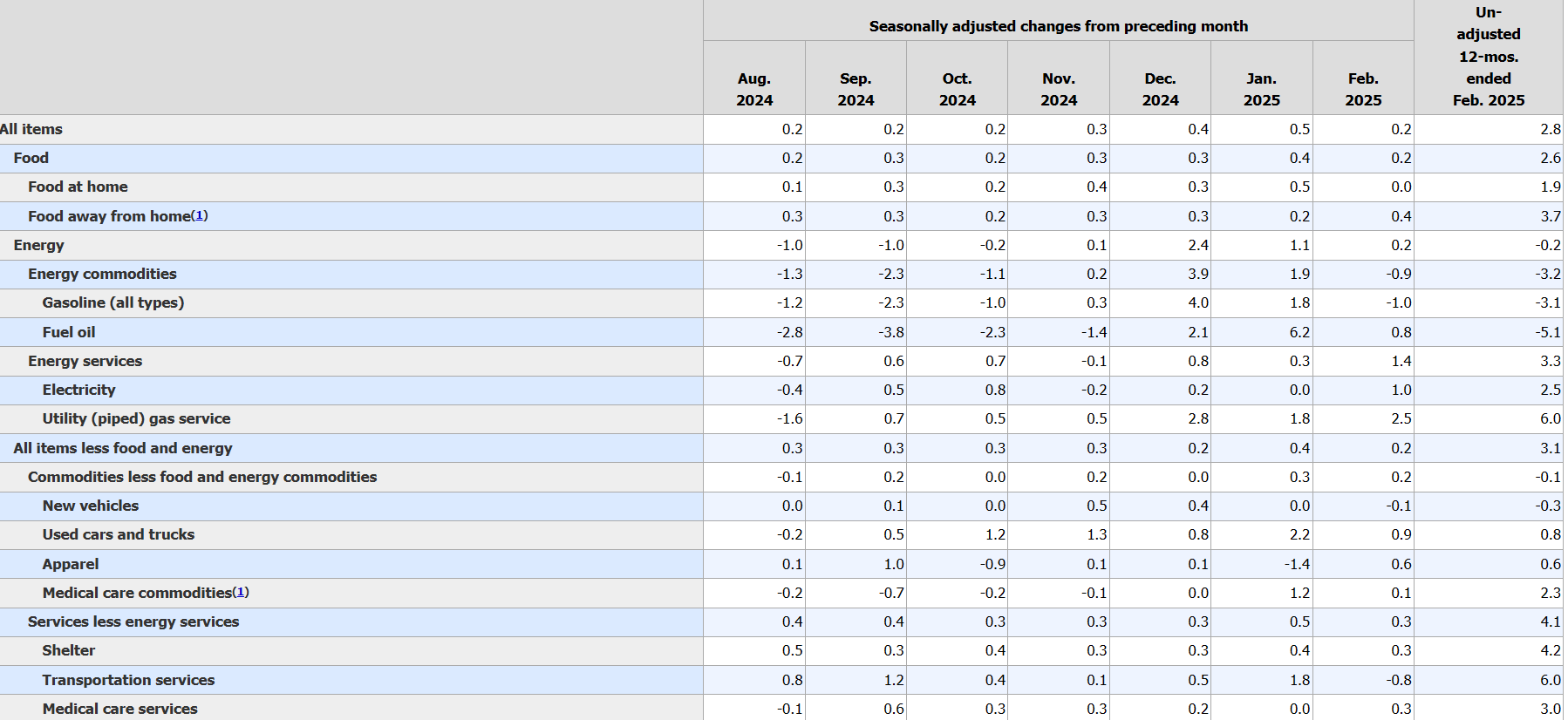

1. CPI INFLATION

- The Consumer Price Index (CPI) rose 0.2% in February and 2.8% year-over-year, cooling more than expected and potentially providing some relief to markets and policymakers on guard about price pressures.

- Core-CPI, which removes the more volatile food and energy components, mirrored the headline 0.2% month-over-month figure but arrived slightly higher on an annual basis at 3.1%. Nonetheless, Core CPI also fell short of Wall Street’s consensus forecast, with economists expecting a 0.3% month-over-month increase in both the headline and core numbers.

- Shelter costs notably decelerated from January (+0.35 month-over-month) but remain responsible for roughly half the monthly increase in headline CPI. Further, since shelter makes up about one-third of the CPI weight, it managed to push core inflation above the headline metric this month even as food and energy prices were on the rise.

- Food and energy prices each rose by 0.2% in February, with eggs soaring another 10.4% in the month—taking its 12-month increase to a massive 58.8%. Beef prices also rose 2.4%

- This month’s CPI release comes amid a flurry of economic policy moves by the White House that could have both short- and long-term implications on growth and inflation. Both stock market futures and treasury yields rose following the Wednesday CPI release.

2. BUSINESS OPTIMISM DECLINES

- Business optimism took a significant dive in February, according to the National Federation of Independent Businesses (NFIB). The Business Optimism Index fell 2.1 points from January, which puts it at its lowest level since October, just prior to the 2024 presidential election.

- Also notable, a supplemental indicator of the index that measures uncertainty has surged to its second-highest level on record, beaten only by the initial uncertainty surrounding COVID-19.

- Expectations for the next six months declined, as did the share of business owners who believe now is a good time to expand their business. Labor quality and inflation continue to be the main concerns of business owners.

3. TARIFFS, UNCERTAINTY, AND REAL ESTATE

- The US Logistics Managers’ Index (LMI) came in at 58.4 in November, a slight downtick from October’s level but marking the 12th consecutive month of growth for the logistics industry. Logistics activity is a leading indicator of Industrial Real Estate demand.

- Inventory levels were down, in line with seasonal patterns, which saw warehouse utilization fall and capacity rise. The drop off in inventory also caused transportation capacity to expand and prices to fall.

- According to the reporting, inventory costs and warehousing prices saw the fastest growth, reflecting higher costs as more inventory is now held closer to consumers.

4. MARCH JOBS REPORT

- According to the Bureau of Labor Statistics, the US economy added 151k jobs in February, a rebound from a downwardly revised 125k additions in January but short of the 170k job additions that were expected.

- Job growth in health care, finance, as well as transportation and warehousing led job growth for the month, while federal government and retail trade drops saw some of the most notable declines.

- Average hourly earnings rose 0.3% month-over-month and rose annually by 4%.

- Treasury yields fell slightly, and fed futures forecasts consolidated around a projection of two rate cuts in 2025. However, with a flurry of economics-related developments arriving in the days since, the jobs data had little lasting impact on markets.

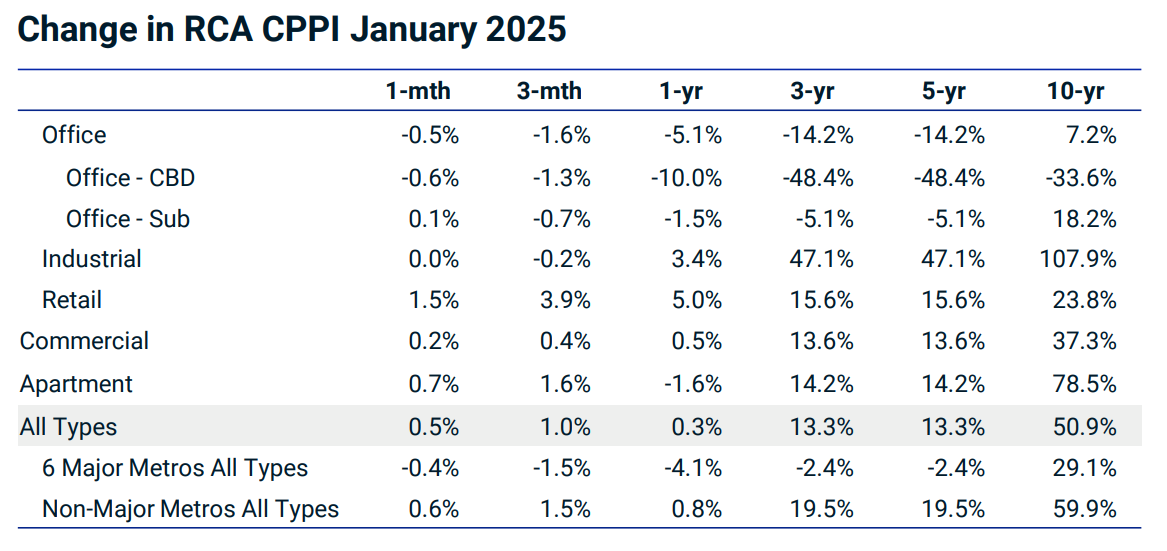

5. COMMERCIAL PROPERTY PRICES

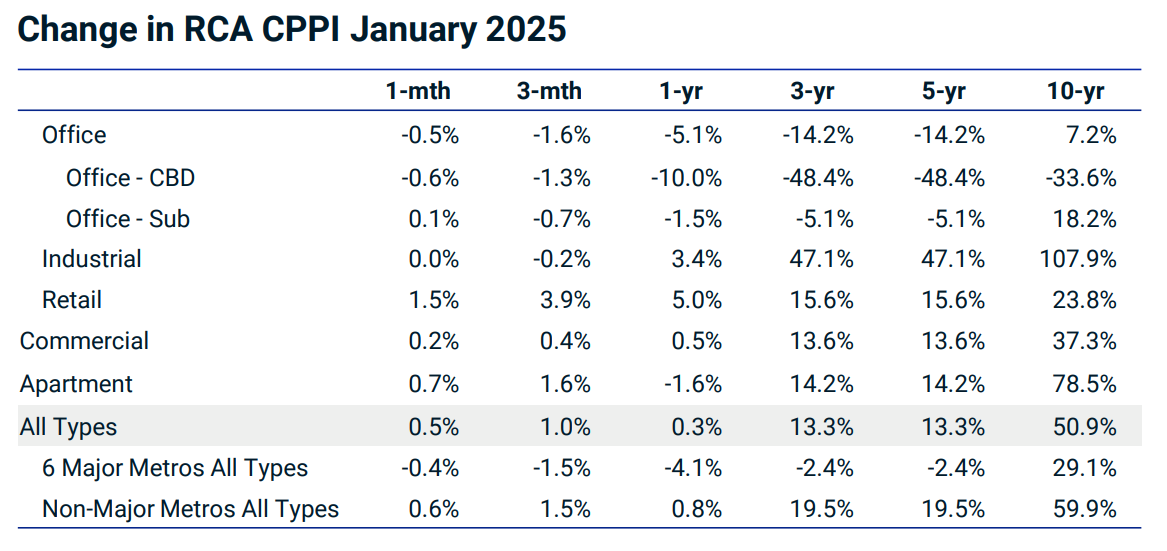

- Commercial real estate prices edged into year-over-year growth in January and posted their third consecutive monthly increase, according to the latest Commercial Property Price Index (CPPI) data from MSCI-RCA.

- Overall, commercial prices are up 0.5% from December and 0.3% over the past twelve months. Moreover, monthly price growth is accelerating, implying a faster annualized growth pace if the trend continues.

- The Retail sector led all property types in price momentum during both January and over the past year, rising 1.5% and 3.8%, respectively.

- Prices in the Industrial sector were unchanged on a monthly basis but Industrial joined Retail as the only property type to experience an annual increase in prices through January, climbing 3.4%.

- Apartment prices in the CPPI rose 0.7% in January, and though still negative year over year, the sector is gradually beginning to show positive momentum since prices hit a floor in August 2024.

- CBD office properties fell 0.6% from December despite signs during the fourth quarter that price declines were slowing. Suburban office prices are up 0.1% month over month and down 1.5% year over year.

6. FALLING CRE DISTRESS

- According to reporting from CRED iQ, distress for both conduit and single-borrower large loan deal types dropped for the first time in five months during February.

- This comes after MSCI reported in its January US distress tracker, which combines delinquencies and special servicing rates, that levels had reached their highest in a decade.

- Distress levels dropped 70 basis points in January to 10.8%, breaking a streak of four consecutive highs.

- Office distress continues to climb, however, reaching 19.3%.

- Looking at the components of the distress metric, delinquencies, as measured by CRED iQ, fell from 8.9% to 8.0% in February. The special servicing rate dropped 20 basis points to 10.1%. For context, one year ago, the delinquency and special servicing rates were 5.4% and 7.0%, respectively.

- Among property types, self-storage saw the largest downward move, but this was caused by a $2 billion portfolio reaching maturity, drastically skewing results.

- Elsewhere, Industrial distress fell 110 basis points to a CRE-low 0.5%. Hotel distress fell 20 basis points to 10.2%, with Retail dropping by the same amount but hovering a bit higher at 10.7%. Multifamily distress rose 10 basis points to 13.0%.

7. LOGISTICS ACTIVITY

- Logistics activity rose for a second consecutive month in February and, like in January, charted its strongest growth since June 2022, according to the Logistics Mangers’ Index (LMI)

- A notable uptick in inventory levels drove logistics activity growth, with both upstream and downstream firms expanding. LMI researchers note that expanding inventories across the supply chain is similar to a dynamic observed last year, but overall, expansion levels are elevated.

- According to the report, February’s inventory increases were at least partially driven by shifting trade dynamics. As a result, inventory and warehousing prices rose at their fastest pace in several years.

- Further, transportation capacity started to loosen during the latter half of the month, suggesting that much of the trade-related inventory buildup occurred at the start of the month before becoming more static as uncertainty rose among firms and consumers.

8. CONSTRUCTION PLANNING ACTIVITY FLATTENS

- According to the Dodge Construction Network’s momentum index (DMI), construction activity grew 0.7% in February while planning activity moderated.

- Commercial planning rose 3.3% during the month, while institutional planning fell 4.6%, leading to a mostly flat period for overall activity.

- Data center activity is propping up growth in the overall DMI, which, according to the researchers, would have contracted by 2% in February if data center growth had been removed.

- Increased uncertainty around material prices and fiscal policies is believed to be weighing on planning decisions, but for now, existing plans are moving forward.

- On the commercial side, data center, traditional office building, and retail planning led gains, while weaker education planning placed downward pressure on industrial planning actvitiy.

- The DMI remains up 27% compared to one year ago, but this has been driven by the commercial segment, where activity is up 43% year-over-year, while the institutional segment is up by a tepid 2% over the same period.

9. HOUSEHOLD UTILITY COSTS

- According to a recent analysis by Chandan Economics, the average US renter household pays $220 per month in utilities, and the costs vary widely by property type.

- On an absolute basis, tenants living in single-family rentals (SFR) pay considerably more in average utilities—about $327 per month, 56% higher than the next closest property type.

- These higher costs are typical for homes with larger square footage, explaining the consistently higher totals for SFR, but utility costs remain higher for SFR even on a relative basis.

- Utilities account for 18.3% of gross SFR housing costs, but this figure falls to 14.8% for 2-4 family rentals, 10.5% for small multifamily units, and 7.9% for large multifamily units.

- Because larger property types have more unit density, average utility costs fall in absolute and relative terms due to synergies gained from shared walls and centralized energy systems, which allow for more energy efficiency.

- While technological advances have helped level the playing field across residential property types, density remains a powerful driver of efficiency and cost savings.

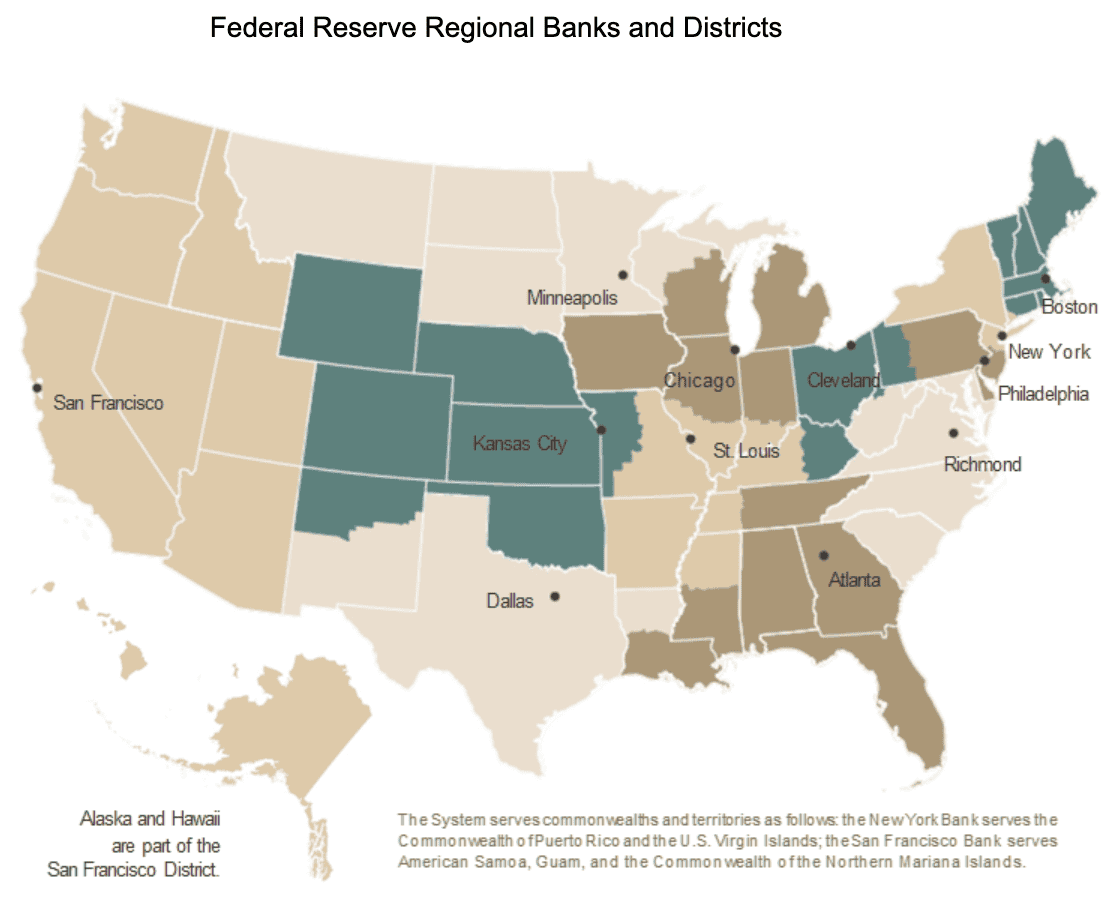

10. GEOGRAPHIC DIFFERENCES IN CREDIT ACCESS

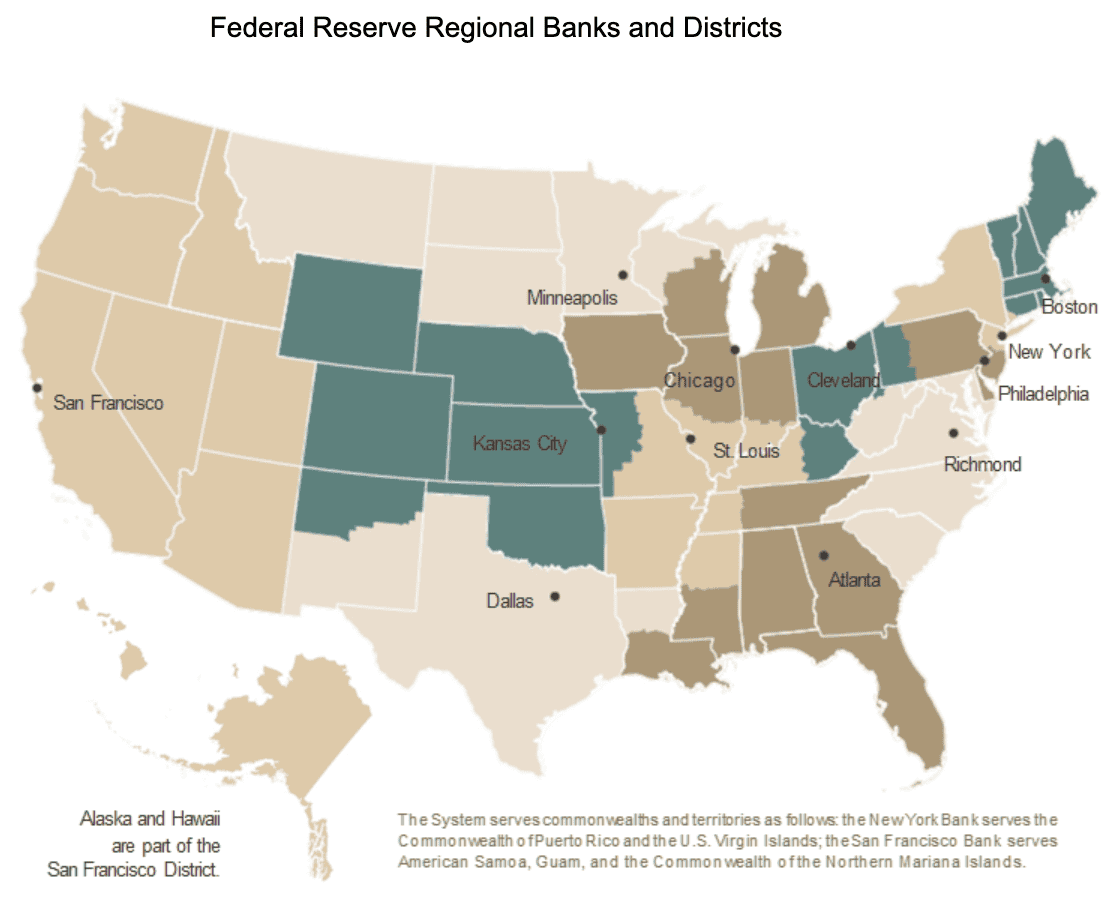

- A recent study by the New York Federal Reserve finds that residents in urban areas, specifically West Coast metros, have better access to credit on average than residents of other regions of the country.

- The study reports that between 2018 and 2023, rural areas had consistently worse credit health than urban areas. Further, 85% of the top 25 cities for credit access were on the West Coast or in the region near Minneapolis.

- Outside of these regions, credit security was highest in and around Chicago, Indianapolis, Washington D.C., and Raleigh.

- Cities with the least credit access were more geographically distributed, but many were around former industrial towns, such as Detroit and Syracuse, or college towns, including Gainesville (FL), Tuscaloosa (AL), and College Station (TX). In the latter cases, a larger share of the population is made up of students who are less likely to have a credit history, explaining some of the pattern.

SUMMARY OF SOURCES

1. CPI INFLATION

- Consumer prices rose 0.5% from December and 3.0% year-over-year, according to the latest data from the Bureau of Labor Statistics.

- The typically more volatile food and energy prices were key contributors to the increase, but core prices, which remove the items, were also up 0.4% on the month and 3.3% over the past year.

- Food price increases mostly reflected an uptick in grocery prices, which rose 0.5% in January, primarily driven by a nationwide egg shortage following an outbreak of avian flu. Egg prices are up 15.2% over the past four weeks.

- Gasoline prices also climbed, up 1.8% in January, but are down 0.2% from one year ago. Fuel oil rose 6.2% month-over-month.

- The shelter index continues to add upward pressure to CPI, accounting for roughly 30% of the monthly increase in the headline index. The shelter price increase in January is accelerated relative to its November and December levels.

2. CONSUMER SENTIMENT

- Consumer sentiment declined for a second consecutive month and dropped to a seven-month low, according to preliminary data from the University of Michigan. The index is down by 4.8% from January and 11.8% year-over-year.

- Sentiment fell across all key cohorts measured, including among consumers of different age groups and wealth levels and voters of both parties.

- The index also deteriorated among all of its sub-components but was led by falling sentiment surrounding buying conditions for durable goods. This was partly due to a perception that it may be too late to avoid the negative impacts of tariff policy.

- Expectations around personal finances also fell, while consumers increasingly worry that higher inflation could return within the next year, though alternate measures of inflation expectations dispute the latter.

3. INFLATION EXPECTATIONS

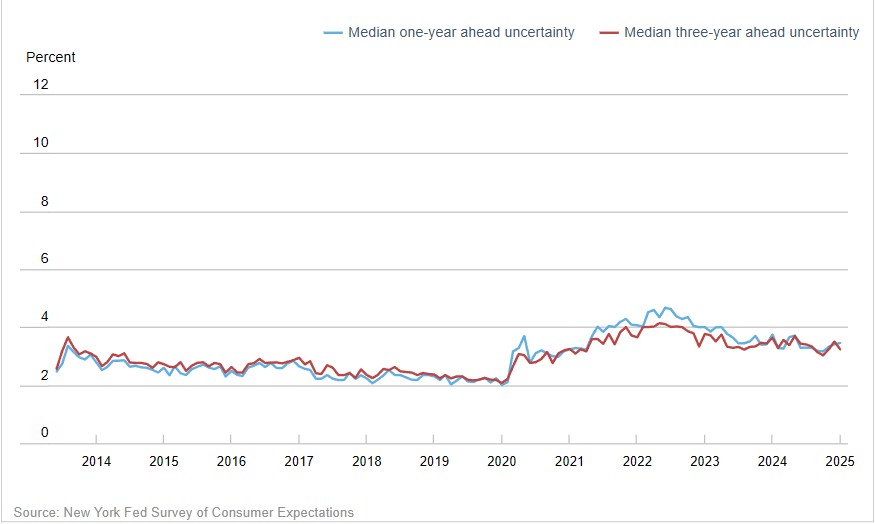

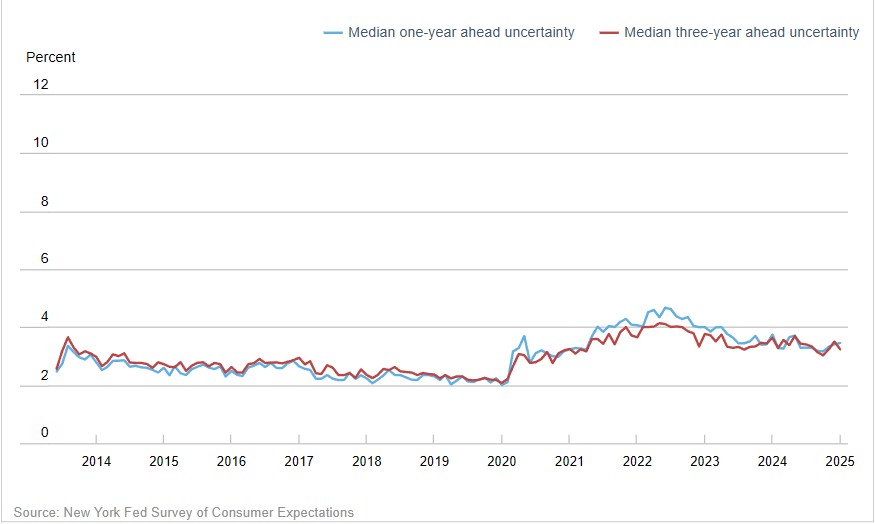

- According to the New York Federal Reserve’s Survey of Consumer Expectations, consumer inflation expectations appear stable, conflicting with signals from the University of Michigan’s assessment over a similar period.

- Both the one- and three-year-ahead expectation indices remained unchanged at 3.0% year-over-year. Households also expect to spend less relative to their sentiment one month ago, amounting to an expectation of 4.4% spending growth over the next year— the lowest reading since January 2021.

- The NY Fed index historically tracks better with inflation metrics compared to the University of Michigan measure. While the NY Fed index currently shows that inflation expectations are stable, its index of inflation uncertainty remains significantly elevated relative to pre-pandemic levels.

4. INTEREST RATE FORECASTS

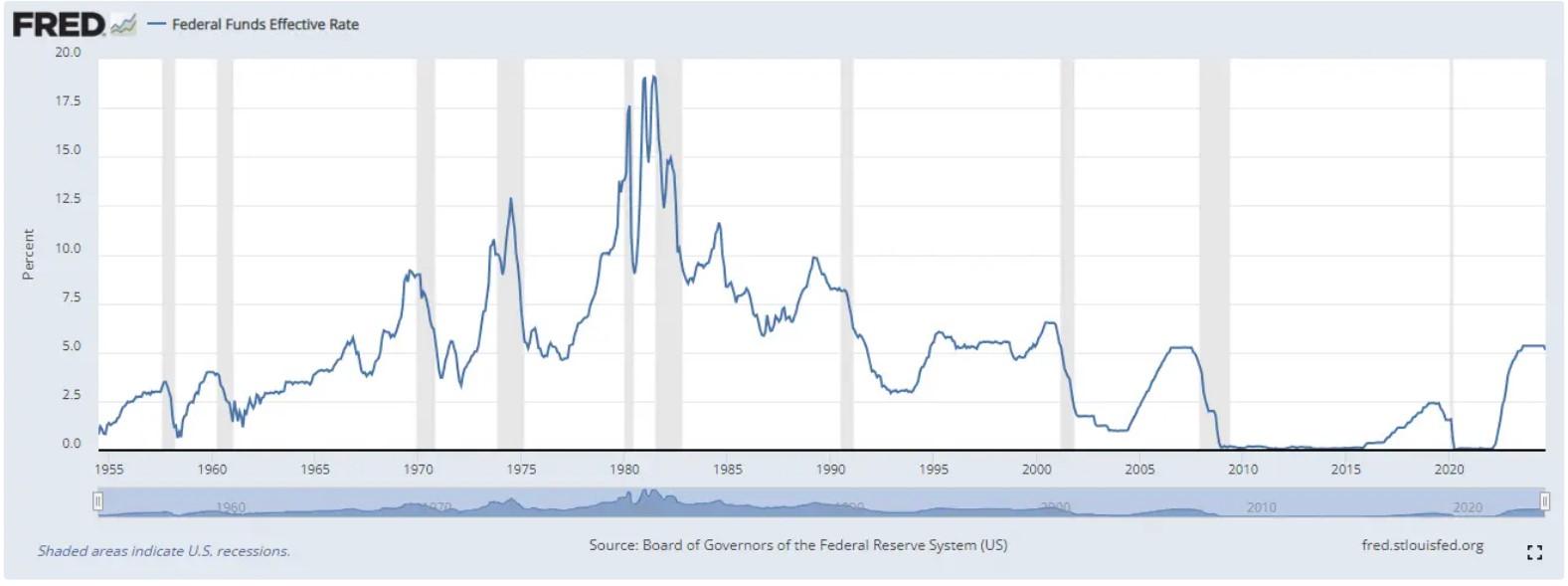

- Forecasts for the median year-end federal funds rate shifted significantly in the past week as consumer prices accelerated more quickly than expected in January, causing markets to adopt a more hawkish outlook for rates.

- By the end of the trading day on February 12th, the same day that the January CPI data was released, futures markets placed a majority 40.1% probability on just one rate cut by the end of the year. Just one week ago, markets placed a majority 32.4% probability of two rate cuts.

- While January’s inflation report follows several months of encouraging data, the acceleration will certainly test an FOMC already keeping its eyes peeled for a dislocation of forward-looking inflation expectations.

- Assuming the Fed’s preferred gauge, the PCE price index, mirrors the rise in core consumer prices; it will at least keep policymakers on hold through their next rate decision.

- Inflation expectations appear stable now, but January’s price acceleration risks filtering into those expectations.

5. POWELL TESTIFIES TO CONGRESS

- On February 12th, Fed Chair Jerome Powell testified in front of the new Congress for the first time, offering clues to the central banker’s outlook on the US economy and policy expectations.

- Powell reiterated the consensus FOMC view that the economy remains on a firm footing, supported by a less restrictive policy stance that he expects will hold for some time.

- Echoing comments made during his post-meeting press conference in January, Powell said that the combined potential for changes to trade, immigration, fiscal, and regulatory policies make it nearly impossible for the central bank to make clear policy judgments at this time.

- In the Fed’s upcoming framework review researchers will examine pandemic-era rate strategies where policymakers contended with trying to accommodate the economy while rates remained at historically low levels.

- Officials took a flexible approach to inflation targeting during the 2020 rebound, with some viewing that a brief period of above-target inflation could offset the long-term effects of historically low inflation during the last decade. Following a sustained period of above-average inflation, the approach was challenged, but Powell signals it’s a key part of a once-every-five-year review.

6. OFFICE VACANCY FORECASTS

- According to recent reporting from Hines, a leading global property manager, researchers expect the Office sector to continue to see rising vacancies through at least 2028 in most scenarios, though second-tier assets will continue to experience increased absorption over the next year.

- Illustrating the sector’s progress in finding its bottom, Hines points out that its own tenants returned an average of about 10% of leased space following lease expirations during 2024 compared to roughly 33% returned 12-18 months prior.

- Looking more medium-term, Hines forecasts that in a medium-case scenario where office usage gets halfway back to its pre-pandemic trend, vacancy rates will fall by about 1000 basis points by 2028. The national vacancy rate stands at 19.8% year-over-year.

7. LOGISTICS ACTIVITY

- In January, US logistics activity, a key indicator of Industrial Real Estate demand, rose at its fastest pace since June 2022, according to the Logistics Managers’ Index report.

- Reflecting activity seen toward the end of 2024, January’s increase comes amid a spike in imports driven by North American firms ramping up purchases ahead of anticipated tariffs. It also reflects further expansion in the US economy, with consumer spending helping propel fourth-quarter growth.

- The sub-index measuring inventory levels surged during the month, driven by increases at downstream firms, which was the opposite of activity in December that found upstream firms with inventory upticks.

- The shift led to cost increases for downstream firms, including inventory, warehousing, and transportation prices, collectively rising to their highest levels since April 2022.

- Capacity expansion slowed, signaling that strong consumer demand is providing a floor to inventory levels and that price pressures aren’t simply a reflection of supply chain considerations.

8. JANUARY JOBS REPORT

- According to the Bureau of Labor Statistics (BLS), US employers added 143,000 jobs in January while the unemployment rate ticked down to 4.0%.

- The report fell short of expectations, with the market consensus coming into the release projecting an increase of 175,000 payrolls. Nonetheless, the BLS upwardly revised the job additions from November and December by a total of 100,000 payrolls.

- Real wages continued to climb, with the average hourly wage up 0.5% during the month and 4.1% year-over-year.

- Healthcare and related jobs saw employment increases during the month, adding 44,000 payrolls. Retail trade employment was up 34,000, while social assistance and government jobs also rose.

- More cyclical sectors, such as construction and manufacturing, remain tepid. However, the Institute for Supply Management reported in its January Manufacturing PMI report that sector activity expanded for the first time in 26 months, potentially foreshadowing a rebound in manufacturing employment.

9. CONSTRUCTION SPENDING

- According to the latest data from the Census Bureau, US construction spending rose 0.5% month-over-month to a seasonally adjusted annual rate of $2,192 billion in December, surpassing the consensus estimate of 0.2%. Construction spending is up 4.3% year-over-year.

- Following an upwardly revised 0.2% monthly increase in November, this is now the third consecutive monthly increase in construction spending. Spending contracted twice in 2024, once in June and once in September.

- Private spending rose by 0.9% from November, led by the residential segment, which rose 1.5% mainly due to an increase in spending on single-family projects. The non-residential segment increased by just 0.1%.

- Public spending declined by 0.5%, driven by decreases in both residential and non-residential spending, which both contracted by 0.5%.

10. THE DIGITAL RETAIL TRANSFORMATION

- A recent look at the Retail landscape by Deloitte describes the industry as shifting from macro focuses to micro focuses in recent years, which references retailers moving away from a supply-driven approach that matches goods to the masses to a more data-driven approach that is personalized to the individual consumer.

- This Retail transition has come with high costs, and some of those headwinds are expected to continue in 2025. Meanwhile, retailers employing increased automation are experiencing a boost above the stagnant growth that the industry has experienced on average in recent years. Those offering gen AI tools during the Black Friday weekend noted a 15% conversion rate compared to those that didn’t.

- Increased digital efficiency will be critical to industry growth in 2025. According to the firm’s research, 7-in-10 retail executives expect to have AI capabilities in place within the next year.

SUMMARY OF SOURCES

1. END-OF-YEAR LOGISTICS ACTIVITY

- The Logistics Managers’ Index (LMI) fell to 57.3 in December, its lowest level in four months.

- According to the LMI report, a seasonal slowdown in inventory levels mostly drove the monthly decline. Still, underlying trends show that upstream firms, such as manufacturers and wholesalers, experienced an import-driven uptick in inventory levels, while downstream retailers saw inventory fall.

- The import spike is partly due to North American manufacturers ramping up buying activity before potential tariffs. According to GEP & S&P market data cited in the report, purchases by these firms hit their highest level in December of more than a year.

- Activity from Chinese firms supports this further, with the country’s customs authority reporting a 15.6% year-over-year increase in exports to the United States through December.

- Falling overall inventory also led to slowing growth in warehouse capacity compared to the previous month.

- Meanwhile, transportation prices accelerated by their fastest pace since April 2022 due to strong consumer demand and higher transportation needs as the holiday shopping season ramped up.

2. OUTDOOR SHOPPING VACANCIES HIT TWO-DECADE LOW

- Recent reporting by the Financial Times, utilizing data from Co-Star, details how vacancies at open-air shopping centers have recently fallen to historic lows, contradicting long-held concerns about the Retail real estate sector becoming saturated and sluggish.

- According to the data cited, just 6.2% of open-air shopping centers are available for rent, the lowest level since vacancy tracking began in 2006.

- Booming occupancy in outdoor retail spaces contrasts with trends in indoor mall space, which have seen vacancies rise in recent years as a rise in e-commerce dampens foot traffic at malls.

- It appears that falling mall activity does not imply similar shifts in consumer activity in outdoor spaces. According to Visa’s tracking of the holiday shopping season, despite the pandemic-era shift in online purchasing during the holidays, physical stores still accounted for 77% of all sales in 2024.

- Several retailers, particularly discount stores, are planning expansions in 2025. New demand generated from these plans will continue to place downward pressure on vacancies and upward pressure on pricing in tight markets.

3. TREPP YEAR-END ANALYSIS

- According to Trepp’s 2024 year-end commercial real estate report, market liquidity appears to have reached its inflection point last year. While risks remain, lenders continue to gradually pour back into capital markets.

- The report notes that the private-label CMBS loan market jumped nearly 165% to $103.6 billion in 2024, roughly three times the increase from 2023 and the third largest annual increase in issuance on record, behind just 2010 and 2011.

- Refinancing accounted for much of the activity. Property sales remained relatively slumped while maturing deals require new financing. $96.83 billion of them will mature by the end of 2026.

4. TOP INBOUND MIGRATION STATES IN 2024

- According to rental van tracking by U-Haul, the Carolinas, and Arizona, among other key standouts, saw increases in their inbound migration rates in 2024.

- Texas and Florida, which have attracted large inflows of new residents from out-of-state since 2020, were knocked from the top but remain high on the list. The top 5 include South Carolina, Texas, North Carolina, Florida, and Tennessee.

- Rounding out U-Haul’s top ten rankings are Arizona, Washington, Indiana, Utah, and Idaho.

- Dallas topped all other metro areas for incoming Uhauls in 2024. Zooming in on the Carolinas, Charlotte carried much of the weight, experiencing the second-largest increase of incoming movers compared to any other US metro in 2024.

- Rounding out the top 5 metros for incoming movers were Phoenix, Lakeland (FL), and Austin.

5. CPI INFLATION

- Consumer prices rose 0.4% month-over-month in December and 2.9% over the past 12 months, according to the latest release by the Bureau of Labor Statistics.

- Both headline and core CPI prices experienced month-over-month disinflation in December, each falling 10 basis points from November.

- Core-CPI grew 0.2% during the month, down from 0.3% in November, the first month-over-month disinflation in core prices since July. Core-CPI is up 3.2% year-over-year.

- Wednesday’s CPI report is the final key inflation indicator released before the FOMC’s January policy meeting. Meetings from their December meeting showed that officials discussed the above-expectations inflation pressures of recent months but continue to expect price pressures to trend downward overall.

- Stock futures surged in response to the release, which followed producer price data that also arrived under expectations. Treasury yields tumbled as bond markets recalibrate rate cuts and inflation expectations.

6. FOMC MEETING MINUTES

- The latest FOMC meeting minutes show that participants discussed the slowing pace of disinflation in 2024 and higher-than-expected readings to close the year. Nonetheless, the majority underscored the across-the-board progress in price pressures and an expectation that inflation will continue to move towards the committee’s two-percent target.

- Some officials highlight that apart from housing, prices in core goods and market-based core services categories are now increasing at similar rates to those seen during previous periods of price stability.

- However, some observe recent positive sentiment in financial markets and economic momentum as potential risks to re-anchored price stability.

- Participants described the uncertainty around the scope and timing of changes to trade and immigration policies as elevated but are accounting for its effect to varying degrees, suggesting that as moves by the incoming Trump administration become clearer, FOMC projections will increasingly reflect their potential longer-term impact.

7. Q1 2025 ECONOMIC OUTLOOK

- A recent outlook produced by Capital Economics foresees relatively healthy global GDP growth during 2025, a lesser tariff effect than prevailing consensus, and geopolitical contours that’s effects are more likely to be stretched over years rather than abruptly in 2025.

- The outlook expects soft landings to continue to be a central theme in 2025, with the world’s major economies, including the United States, seeing slowing GDP growth, but private balance sheets projected to remain strong.

- The outlook forecasts a pick-up in growth in China during the first half of 2025 as fiscal and monetary support from the central government takes hold. Euro-zone GDP is expected to expand slowly in 2025 as inflation slows, opening room for further rate cuts.

- Demand is not expected to provoke new inflation pressures in 2025, but if labor markets remain tighter than previously projected, wage pressures could remain.

- President-elect Donald Trump’s proposed tariff and immigration policies are expected to temporarily boost US inflation and limit the Fed’s ability to cut interest rates, but recent reports that the incoming administration may gradually roll out tariffs could push some of its potential price impacts beyond 2025.

8. DECEMBER JOBS REPORT

- According to the Bureau of Labor Statistics, the US economy added 256k jobs in December, beyond consensus expectations and the largest monthly job gain since March 2024.

- The overall unemployment rate edged down to 4.1% from 4.2%, while wage growth charted at 3.9%, roughly in line with its readings over the past three months.

- Supplemental unemployment measures also improved. The U-6 measure, which includes discouraged or underemployed workers and those who are unemployed, fell 0.2 points to 7.5%.

- Markets declined in response to the report as investors reassess the interest rate outlook, with futures markets now pricing in fewer rate cuts for 2025 than before the employment report’s release.

9. US ECONOMIC OPTIMISM

- US economic optimism declined in January following a large post-election bump, according to the RealClearMarkets/TIPP Economic Optimism Index.

- The index, which measures Americans’ six-month outlook on the economy, opinions of their personal financial outlook, and confidence in federal economic policies, rose from a contractionary 46.9 in October to 53.2 in November. This was followed by a reading of 54 in December, but the reading has since fallen to a more modest 51.9 in January.

- A reading above 50 indicates that, on balance, Americans remain optimistic in their outlook. The reduction may represent the fading effect of post-election optimism typically found around key issues for voters but may also show how concerns around tariffs and trade policies are beginning to feed into sentiment data.

10. SPECIAL SERVICING HITS FOUR-YEAR HIGH

- According to Trepp, the CMBS special servicing rate rose near 10% for the first time since November 2024, pushed higher in December by sizable increases in accommodations for loans in the mixed-use and multifamily sectors.

- Roughly $2.9 in loans entered special servicing in December. Loans of mixed-use properties saw the most significant monthly increase, climbing 182 basis points to 11.72%. It’s the first time the sector had more than 11% of its loans in special servicing since 2013.

- Multifamily also saw a large monthly increase, rising 136 basis points to 8.72%. Office increased 15 basis points to 14.73% and could breach the 15% mark within a few months, a level the sector hasn’t seen since the year 2000.

- Industrial experienced an uncharacteristically large bump in special servicing by 18 basis points to 0.56%, but the overall rate remains extremely low.

- The Retail special servicing rate fell 12 basis points to 11.67%, while the rate for lodging rose 14 basis points to 8.29%.

SUMMARY OF SOURCES

1. BLACK FRIDAY ACTIVITY

- According to data from Mastercard’s SpendingPulse indicator, US Black Friday sales (excluding automotive sales) were up 3.4% this year compared to 2023.

- Online retail sales rose 14.6%, while brick-and-mortar stores rose by a more modest 0.7% year-over-year.

- Jewelry, electronics, and apparel remained atop the list of goods most sold throughout the black-weekend discount window.

- Diving deeper, SpendingPulse points out notable themes throughout the black-week period. Apparel stores saw an uptick in in-store activity this year, which could be in part due to a warmer fall that delayed many seasonal purchases, while online sales maintained their post-pandemic strength. Meanwhile, footwear sales were stronger compared to 2023.

2. HOLIDAY SPENDING PROJECTED TO BOOST CRE

- According to recent reporting by Globe Street, several industry analysts expect this year’s holiday spending to grow, potentially boosting the retail, industrial, self-storage, and multifamily real estate sectors. Still, looking ahead, questions over consumer confidence remain a concern.

- The reporting notes that consumer savings are up 20% in real terms compared to 2019, while forecasts from the National Retail Federation ICSC expect retail sales growth to finish 2024 at roughly 2.5% to 3.5%% above last year’s level.

- Meanwhile, this year’s uptick in Black Friday sales and resurging logistics activity represent bullish signals for retail and interrelated sectors.

- Nonetheless, while consumer sentiment, as measured by the University of Michigan, has recovered from the lows experienced two years ago, it remains below pre-pandemic levels, which could limit the ceilings of related CRE sectors until the clouds of uncertainty clear.

3. LOGISTICS MANAGERS INDEX

- The US Logistics Managers’ Index (LMI) came in at 58.4 in November, a slight downtick from October’s level but marking the 12th consecutive month of growth for the logistics industry. Logistics activity is a leading indicator of Industrial Real Estate demand.

- Inventory levels were down, in line with seasonal patterns, which saw warehouse utilization fall and capacity rise. The drop off in inventory also caused transportation capacity to expand and prices to fall.

- According to the reporting, inventory costs and warehousing prices saw the fastest growth, reflecting higher costs as more inventory is now held closer to consumers.

4. THANKSGIVING INFLATION

- According to Chandan Economics ‘ annual Thanksgiving Inflation reporting, some of the major staples of the Thanksgiving feast saw their prices decline compared to last year. Nonetheless, cumulative post-pandemic price increases mean the feast has inflated more than just our waistlines in recent years.

- Turkey prices were down 3.9% year-over-year heading into the Thanksgiving holiday, while ham prices were down by an average of 2.0%. Potatoes fell by 1.5%. Meanwhile, eggs, a key input for baked desserts during Thanksgiving, saw a significant price increase, up by an average of 30.4%.

- Since 2020, the prices of Thanksgiving staples have cumulatively skyrocketed. Eggs are up 61.9% over the past four years, while flour and prepared flour mixed are up 35.6%. This is followed by bakery products (+27.0%), sauces and gravies (+25.4%), and turkey (+22.5%).

5. BEIGE BOOK

- According to Federal Reserve’s latest Beige Book summary, economic activity rose across most districts during the six weeks ending on November 22nd.

- National growth in economic activity was relatively small over the past six weeks, but expectations for growth rose across most regions and sectors as businesses expressed optimism that demand would rise in the coming months.

- Commercial real estate lending fell, but respondents to the beige book reported that financing remained generally available. Capital spending and materials purchases were flat or down in most districts.

- Demand for mortgages was low, but more recent indicators tells a more mixed picture, with mortgage applications increasing in recent weeks.

- Consumer spending was stable while many consumer-oriented businesses reported higher price and quality sensitivity from consumers.

- Electricity generation demand continues to grow at a robust rate as rapid expansions in data centers increase consumption.

6. JOB OPENINGS & LABOR TURNOVER

- According to the latest JOLTS report from the Bureau of Labor Statistics (BLS), the number of job openings in the United States changed little month-over-month through October, registering at 7.7 million on the last business day of the month.

- The hires rate ticked down in October while the quits rate rose slightly. Total hires were 5.3 million during the month, while quits ticked up to 3.3 million. Nonetheless, hires remained higher than quits across all sectors of the economy.

- Layoffs fell 169,000, the most in any month since April 2023. In aggregate, despite a slowdown in hiring, historically low layoffs are keeping the labor market anchored, stabilizing wages, and driving consumer spending.

7. FOMC MEETING MINUTES

- According to the minutes of the FOMC’s November policy meeting, officials expressed confidence about the path of easing inflation and the prospect for more rate cuts — but with a steady labor market, they expect cuts to come gradually.

- The minutes state that “if the data came in about as expected,” which to officials is an indication of inflation moving toward 2% with the economy remaining near maximum employment, then “it would likely be appropriate to move gradually to a more neutral stance of policy over time.”

- As of the end of the trading day on December 3rd, futures markets are pricing in a 74% probability of a 25-basis point cut at the Fed’s next meeting later this month.

8. CBD OFFICE VACANCIES

- According to recent data by Moody’s, the national office vacancy rate declined slightly in Q3 2024, sliding ten basis points to 20.0%. While the decline was modest, it’s a positive development for the sector as it works through systemic distress.

- Moody’s forecasts that the path ahead for office vacancies is nonlinear, and they expect vacancies to peak in late 2025 or early 2026.

- Entering 2025, capital markets are signaling that we’re nearing a bottom, but in addition to the evolving financing environment, other uncertainties such as inflation, geopolitics, and US federal policy will continue to produce downstream effects on the office market.

9. MORTGAGE APPLICATIONS

- Mortgage applications have now climbed for four consecutive weeks following a month and a half of declines, according to latest data from the Mortgage Bankers Association of America.

- During the week ending November 29th, US mortgage applications rose by 2.8% compared to the previous week and by 6.3% during the week before. The growth has been the result of resurging purchase activity in recent weeks.

- Meanwhile, refinancing activity fell for the second consecutive week and has declined in nine of the past ten weeks.

- The average rate for 30-year fixed-rate mortgages fell to 6.69% from 6.86%.

10. HOUSING AFFORDABILITY UPDATE

- According to Moody’s Q3 2024 Housing Affordability Update, US median household incomes rose by an average of 3.6% over the year, which has eased the average rent-to-income (RTI) ratio for renters over the same period, which has declined to 26.7%.

- Migration-related population growth in the South and Sun Belt region has drastically changed income demographics and impacted local housing affordability. States with higher population churn reflect a stronger appeal to new residents and are where affordability challenges have emerged the most.

- Student housing is also experiencing steep cost increases. Nationally, rent growth in the student segment has outpaced multifamily rent growth over the past two years. Moreover, several universities are experiencing higher rents for campus housing relative to the local multifamily market, reflecting demand pressures specific to this segment.

SUMMARY OF SOURCES

SHAREABLE FLIPBOOK DOWNLOADABLE PDF

1. SEPTEMBER JOBS REPORT

- The Bureau of Labor Statistics (BLS) reported that the US added 254k jobs in September, drastically defying expectations following a summer of worsening labor market conditions.

- The consensus forecast from economists heading into the data release was that the economy would add just 142,500 payrolls in September following massive downward revisions of previous months’ jobs data and anecdotal signs of labor market deterioration.

- Contrarily, the pace of job growth skyrocketed in September to its highest monthly level since March, while the July and August jobs reports were revised upward.

- The unemployment rate was little changed at 4.1%, while employment continued to rise in food and drinking places, the health care sector, government, social assistance, and construction.

- Wage growth rose by an impressive 0.4% month-over-month and 4.0% year-over-year.

2. FOMC MEETING MINUTES

- Key points from the minutes of the FOMC’s September meeting reveal where and how consensus was formed as the committee decided to move forward with a 50-basis point (bp) interest rate cut in September.

- According to the minutes, a “substantial majority” of voting members backed a 50 bp cut rather than a 25 bp cut as the committee pivoted to looser monetary policy. Further, there was a broader consensus that such a decision would not lock officials into future rate-cut decisions.

- As the minutes reveal, officials coalesced around a 50 bp cut as many believed it would align with the recent loosening of labor market conditions and signal a re-anchoring to the Fed’s commitment to both sides of the dual mandate.

- It was also crucial to some officials to move in a way that, on the one hand, signaled to markets their attention to labor market loosening but did not indicate that the central bank was anticipating a more negative economic outlook.

3. “SOFT LANDING” IMPACT ON CRE

- Results from Altus Group’s Q3 US CRE Industry Conditions and Sentiment Survey (ICSS) show overall greater optimism surrounding commercial real estate compared to last quarter, including a higher share of respondents indicating an intent to deploy capital in the short term.

- Survey respondents remain evenly split on the likelihood of a recession within the next six months, while most respondents will focus on managing their existing portfolio over the next six months rather than seek expansion opportunities.

- Still, 31% of participants said their primary focus for the next six months will be deploying capital—a significant jump from 20% in the Q2 survey.

- While it’s too soon to conclude that the Fed has executed a “soft landing” for the US economy following its two-plus year battle against inflation, the labor market has remained remarkably resilient as prices have gradually decelerated, boosting optimism in the economy’s short-term health.

- Further, most ICSS respondents expect that if a recession arises, it will be “shallow and short-lived.”

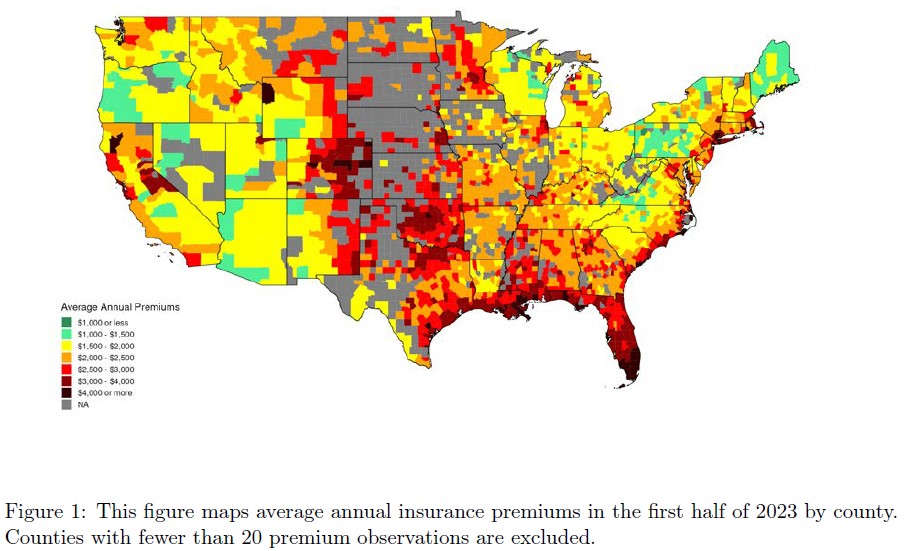

4. DISASTER RISK AND RISING HOME INSURANCE PREMIUMS

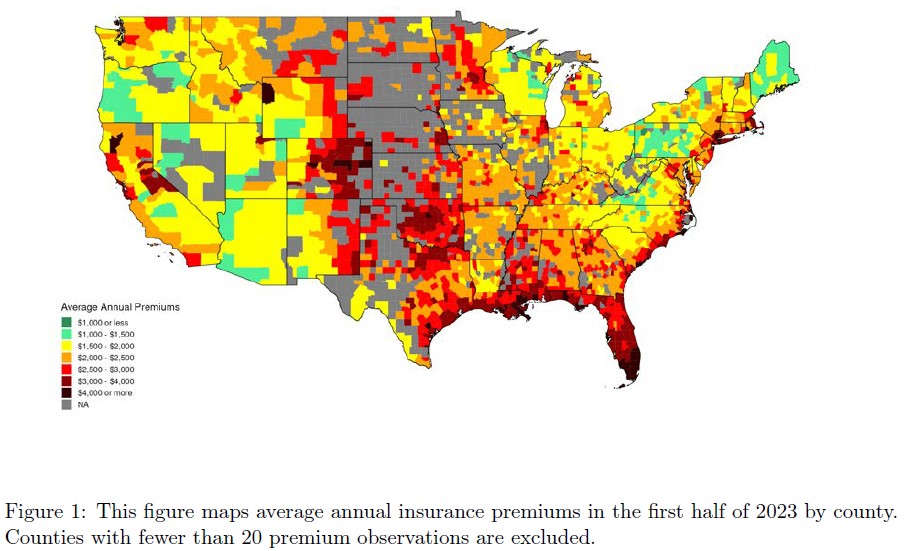

- A recent working paper by the National Bureau of Economic Research shows that average property insurance premiums have climbed more than 30% since 2020 with large location-based variation.

- Intuitively, premiums have risen fastest for homeowners in areas with a higher risk of natural disasters such as hurricanes or wildfires. Still, the relationship between disaster risk and premiums has grown stronger over time as the rate of natural disasters rises and long-term trends become less predictable.

- Analyzing data on escrow payments, the researchers built a dataset of roughly 47 million observations of insurance costs in the US between 2014 and 2023. The analysis found that between 2020 and 2023, average home insurance costs rose by an inflation-adjusted 13%.

- Moreover, increases in the ZIP codes with the highest disaster risks were significantly larger, with neither change in home values nor changes in state-specific regulations accounting for such variation.

- Digging further, the researchers find that the rise in risk premiums between 2018 and 2023 coincides with a doubling of US property and casualty reinsurance costs. They point to several reasons for this “reinsurance shock,” including an uptick in migration of the US population towards increasingly risky areas, rising interest rates, and an overall reassessment of climate risks by re-insurers.

5. CPI INFLATION

- According to the Bureau of Labor Statistics, the Consumer Price Index rose by 2.4% year-over-year in September, exceeding expectations but registering a two and a half year low.

- The headline CPI metric rose 0.2% from August, with the shelter index – a key contributor to overall price pressures, rising by the same amount. food prices rose 0.4% month-over-month in September, which, combined with the shelter metric, accounted roughly 75% of the increase in overall inflation.

- Core-CPI, which excludes volatile food and energy prices, rose 3.3% annually and 0.3% month-over-month in September, also slightly above the consensus forecast. The elevated core-inflation numbers over headline inflation is largely contributed to a fall in energy prices, which fell by 1.9% month-over-month in September following a 0.8% decline in August.

6. HAS OFFICE HIT ITS BOTTOM?

- The Q2 2024 results of MSCI RCA’s Commercial Property Price Index showed that US Office market prices had declined by 12.5% year-over-year through the quarter. While distress in the sector remains palpable, price declines have decelerated from late 2023 levels.

- In late 2023 and early 2024, many developers opted to extend maturing loans rather than sell at major losses, hoping to hold onto their assets until prices recovered.

- However, a recent Reuters article found that some market analysts are seeing signs of a pickup in sales of stressed office properties as expectations of financial condition loosening take shape.

- An August report by Moody’s also showed an uptick in office prices sold at a discount during Q2—seven sold at a discount of $100 million or more compared to just one sold with such a discount in Q1. Only two such sales took place during the whole of 2023.

- While $100 million discounts may sound daunting, the uptick in Office transactions suggests that activity in the sector is thawing. Even as prices are unlikely to climb anytime soon, the pace of price declines appears to be turning a corner.

7. CONSTRUCTION SPENDING

- US construction fell in August by a monthly rate of 0.1%, following a revised 0.5% decline in July, according to the latest data from the US Census Bureau.

- August was the third consecutive monthly decline in construction spending, with private spending down 0.2%, driven by a 0.3% decline in the residential segment.

- Within residential, single-family projects saw the most significant slowdown in August, with construction activity in the space falling by 1.5% month-over-month.

- Activity in the non-residential segment also slowed in August, shrinking by 0.1%. Declines in the non-residential segment were primarily driven by declines in educational (-1.1%) and healthcare (-0.8%) related construction.

- Contrary to the trend, public spending rose by 0.3% in August, driven by a 1.6% increase in public residential construction and a 0.3% rise in non-residential construction.

8. GEOPOLITICAL RISKS

- Blackrock’s recent quarterly Geopolitical Risk Dashboard indicates that geopolitical risks remain structurally elevated, driven by deeper fragmentation between global economic blocks, a less predictable world order and accelerating changes in globalization norms.

- The dashboard highlights risk of a Middle East Regional War as key emerging risk as the conflict between Israel, Iran, and its proxies in the middle east heat up with tensions forecasted to remain high well into next year.

- US-China strategic competition remains a high-level risk according to Blackrock. The report notes that as the US gears up for the 2024 election and China looks to stimulate stagnant domestic markets, both countries have favored stability, but intense competition continues in the background, particularly in the South China Sea. Global technology decoupling also shows little sign of slowing down.

- Russia-NATO conflict risk also remains high in the eyes of the analysts. Ukraine’s recent advance into Russian territory and Russia’s military ramp up in response to it has lowered the likelihood of a ceasefire or diplomatic solution to the conflict in the short term.

- A cascading of global risks could have serious implications on the global economy, which could arise from several channels such as energy markets, supply chains, migration patterns, and market confidence.

9. LOGISTICS MANAGERS’ INDEX

- The Logistics Manager’s Index experienced its highest monthly uptick in two years during September, signaling that demand in the logistics sector is picking up.

- The index has climbed for ten consecutive months through September — though it appears to have ramped up in anticipation and response to the September interest rate cut and the consumer activity that looser financial conditions could induce.

- Inventory levels increased during September, primarily due to restocking activity by downstream retailers. Growth in inventory levels also caused inventory costs to rise during the month.

- Transportation capacity declined in September, hitting 50 for the second time this year. An Index level of 50 indicates that transportation capacity is neutral, neither expanding nor contracting.

- Warehousing capacity slowed, while transportation utilization and prices expanded at slower rates than the previous month.

- Meanwhile, warehousing utilization and prices are expanding more quickly than in August.

10. JOB OPENINGS AND LABOR TURNOVER

- According to the BLS, job openings rose to 8.04 million in August, rising 329k from an upwardly revised 7.71 million in July and exceeding the consensus expectation of 7.66 million.

- Signals from the US labor market appear to be taking a U-turn following a summer of deterioration. The rebound in job openings in August and upward revisions in July coincides with an unexpectedly strong jobs report in September and upward revisions in payroll numbers from July and August.

- The largest increases in job openings were in construction (+138k) and state and local government, excluding education (+78k).

- Both the number of hires and total separations were little changed at 5.3 million and 5.0 million, respectively. Within separations, quits declined to 3.08 million, its lowest since August 2020.

SUMMARY OF SOURCES

1. CPI INFLATION

- According to the US Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) increased 0.2% month-over-month (MoM) in August, repeating July’s pace and in line with the consensus forecasts that led up to the data release.

- The annual CPI measure fell for the fifth consecutive month to 2.5%, its lowest since February 2021.

- Over the past 12 months, energy prices have been the main force driving down the headline inflation rate, which is down by 4% year-over-year (YoY). Transportation prices have also kept the inflation rate elevated, up 7.9% annually, yet they have decelerated from the previous month.

- Core-CPI inflation, which excludes the more volatile food and energy components from the index, rose by 0.3% MoM in August, marginally above July’s 0.2% pace.

- Monthly, core inflation was higher than expected, boosted by an acceleration in shelter and airfare price increases. Annually, core price inflation matched its three-year low of 3.2% reached in July.

- Shelter remains the critical component of CPI, which is still elevated on an annual basis and continues to accelerate — up 5.2% YoY and up ten basis points from July. Airfare price acceleration can be attributed to more robust travel demand during the summer, which should ease in the coming months.

- While the PCE price index is the Federal Reserve’s preferred measure of inflation for influencing monetary policy decisions, August’s CPI report is more evidence that inflation is trending downward and likely cements the outlook for a September rate cut.

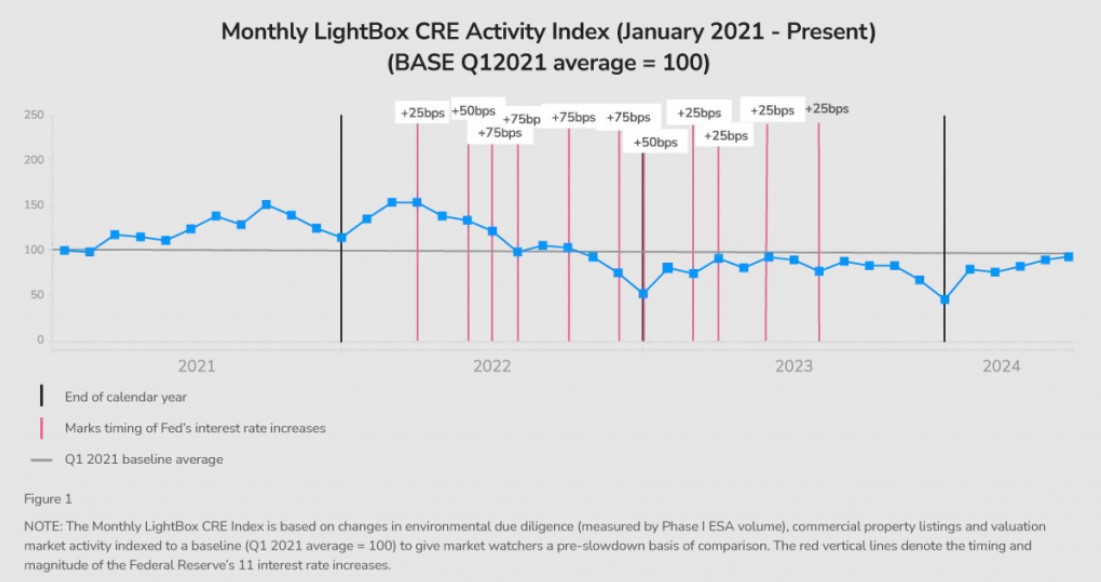

2. CRE POISED FOR CUTS

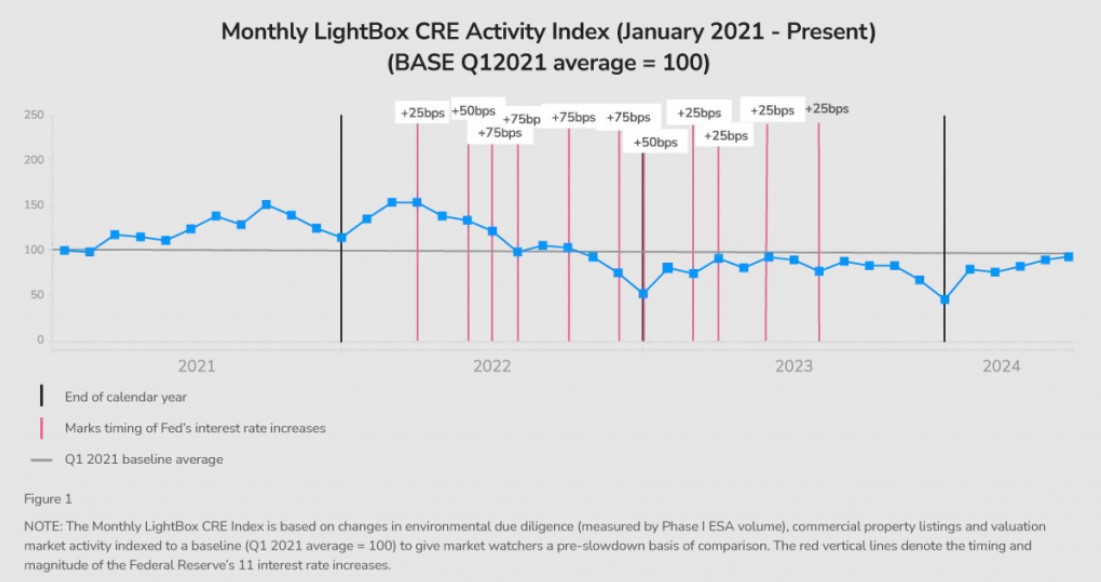

- According to Lightbox’s monthly CRE Activity Index, CRE transaction activity has inched up every month since March, and the sector appears poised for a strong Q4, with the market anticipating one or more rate cuts by the end of 2024.

- The index softened slightly in August, interrupting a five-month trend of modest increases. However, the analysts of the report did not consider the downtick a concern, with the August level still nine points above its level one year ago.

- The year-over-year climb in activity reflects a CRE transaction landscape that is gradually thawing from a pricing standoff between buyers and sellers. As rate cuts filter into commercial mortgage borrowing rates, investors are likely to deploy more capital if current patterns hold, causing transaction activity to rise.

- Still, investors will need to keep watch of a softening labor market and its potential implications on consumer spending and demand. It remains to be seen whether the Fed is ahead of or behind the curve on a rate pivot and can stave off an economic recession.

3. MULTIFAMILY AWAITS IMPACT OF SEPTEMBER RATE CUT

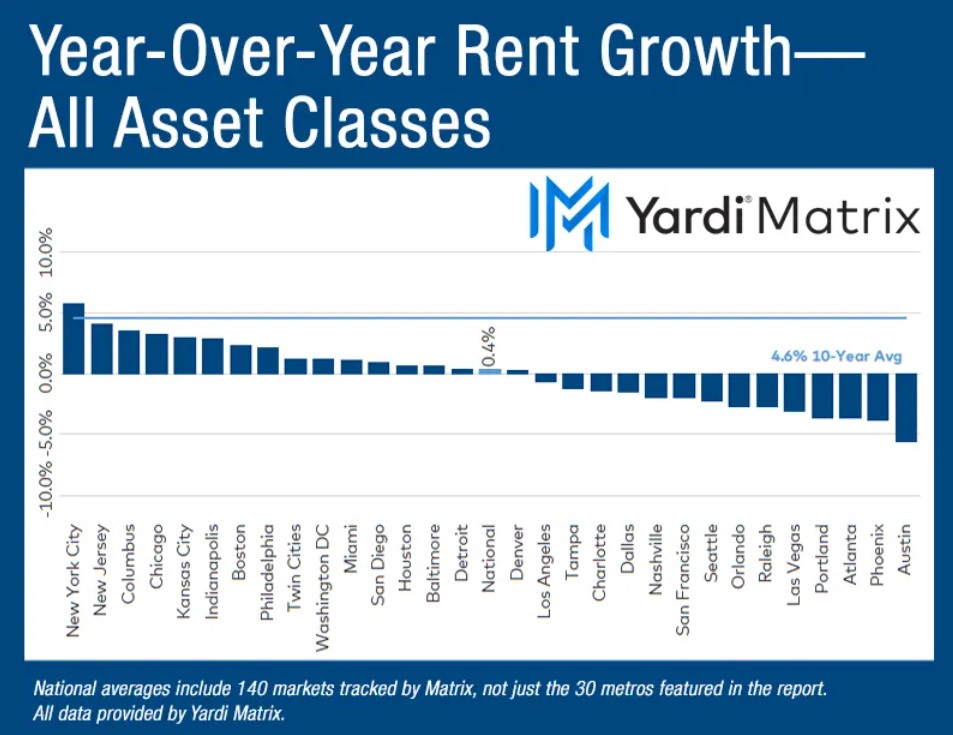

- Multifamily rent growth was flat in August as shifting seasonality trends ended a six-month streak of growth, according to the latest Multifamily National Report by Yardi Matrix.

- According to the report, the apartment sector is in a holding pattern as the market awaits an imminent September rate cut. Following the Fed’s anticipated move, a thawing of transaction and refinancing activity is expected to follow. An interest rate cut is also likely to reduce the pressure on underwater properties.

- Still, as rates are poised to come down, the economy is showing signs of cooling, with slowing job growth and weaker wage growth compared to recent years. As the Multifamily market feels rate relief, a slowing labor market may place a drag on consumer and apartment demand.

4. ELECTION VOLATILITY

- According to a recent analysis by Chandan Economics, market volatility typically spikes in the months leading up to a US presidential election, usually beginning to shift around July.

- On average, during calendar years when there is a presidential contest, volatility, as measured by the CBOE Global Market’s Volatility Index (VIX), has tended to decline over the first seven months of the year before shifting higher during the final three months of the campaign.

- In September and October of election years, the VIX has had an average value of 19.2 compared to an average of 18.2 during July.

- The volatility experienced in stock markets over the past several weeks may, in part, reflect the typical election impact on markets and a market tendency that is in part independent of recent economic developments.

5. AUGUST JOBS REPORT

- According to the BLS, the US economy added 142,000 jobs in August, above July’s downwardly revised increase of 89,000 but indicative of additional labor market cooling, with another downward revision in August likely.

- The unemployment rate fell slightly to 4.2% last month, which put an end to a months-long increase in the unemployment rate that began in March.

- Education, healthcare, leisure & hospitality, and government positions accounted for 117,000 of the 142,000 jobs added in August. However, new healthcare and government jobs have slowed notably. Professional & business services and information-related jobs remain subdued.

- The number of people employed part time for economic reasons was little changed at 4.8 million, but the measure is still up from 4.2 million one year ago.

- Average hourly earnings increased by 14 cents, or 0.4%, in August and are up 3.8% over the past year. Annual wage growth has gradually slowed from a post-2020 peak of 5.9% in March of 2022.

6. BEIGE BOOK

- According to the Federal Reserve’s latest beige book of economic activity, nine (9) of the 12 Federal Reserve districts reported slow or declining activity, up from five (5) in the previous period.

- Employment levels were steady across most districts, but there were notable reports of firms lowering overall employment through reducing hours, attrition, or only filing necessary positions.

- Consumer spending fell after remaining steady throughout the previous period. Meanwhile, manufacturing activity declined in most districts.

- On average, most districts reported mixed residential construction and softer home sales, while commercial construction and real estate activity were mixed.

7. RETAIL DURING THE POST-PANDEMIC PERIOD

- As detailed in a recent analysis by Brookings on commercial real estate trends during the post-pandemic period, Retail was the most stable sector throughout the pandemic, balancing steady value growth with stable occupancy levels.

- Despite a sharp rise in sector distress during the early days of the pandemic lockdown, retail demand has grown from its pre-pandemic levels, and rental properties have generated competitive returns.

- Nationally, the Retail vacancy rate is at a five-year low and is the only product type for which aggregate vacancy has declined since 2019.

- Still, these vacancy rates vary locally, and the variation often reflects increasing vacancies in downtown areas and retail inequality in minority-majority neighborhoods.

8. TRANSIT-ORIENTED DEVELOPMENT STUDY

- A recent GlobeSt look into a study conducted by the University of North Texas Economic Research Group describes the impact of transit-oriented development on local economic activity in Dallas.

- The study examined the impact of real estate developments near Dallas Area Rapid Transit (DART) light rail stations and found an increase in direction spending and job creation in those areas.

- Focusing on 21 real estate developments built near DART stations between 2019 and 2021, the study found that collectively, the projects generated $980 million in direct spending and 10,747 jobs.

- The projects encompassed a mix of commercial, residential, and public developments. They generated $144.7 million in federal tax revenue and another $49.6 in state and local tax receipts, according to the results of the analysis.

9. LOGISTICS MANAGERS INDEX

- The US Logistics Managers Index ticked down slightly in August compared to July, but the report continued to point to a moderate pace of growth in the logistics sector.

- Most notably, there was an increase in inventories as firms gear up for the holidays and Q4 spending season. August ended three consecutive months of contractions in inventory levels. The report also suggests that firms may be anticipating a return to the traditional patterns of seasonality not experienced since before the pandemic.

- The effect of increased warehousing capacity and transportation capacity partly softened the rise in inventories.

- According to the analysis, this is consistent with reports that firms are keeping most of their inventory near points of entry, waiting for them to move to retailers. Transportation prices eased compared to the previous month, while warehousing prices were up.

10. NFIB SMALL BUSINESS OPTIMISM INDEX

- According to the National Association of Independent Business, small business optimism in the US declined in August to its lowest level in three months.

- Inflation remains at the top of owners’ minds, and sales expectations have fallen significantly. Overall, rising uncertainty continues dominating movements in the index, with the outlook on future business conditions gradually worsening.

- 24% of small business owners cited inflation as their number one concern, while the net percent of owners expecting higher sales volumes fell to a net -18%. Meanwhile, 20% plan to raise compensation in the next three months, an uptick from the latest report.

SUMMARY OF SOURCES