1. FED INTEREST RATE DECISION

- The Federal Reserve’s FOMC held rates unchanged at 4.25%-4.50% during its May policy meeting, aligning with market expectations leading up to the decision.

- While markets and experts largely expected the FOMC to keep rates steady in May, some expressed concern about leading anecdotal data, such as the Beige book, recently pointing to deteriorating conditions in the labor market, arguing that there could be room for a pre-emptive rate cut.

- However, despite Fed Chair Jerome Powell referencing the “great deal of uncertainty” around tariffs during his post-meeting press conference, he said that policymakers need not “be in a hurry to adjust its monetary policy” and that to wait-and-see remains “the appropriate thing to do.”

- Notably, within a few days of the May FOMC meeting, the Trump administration announced a 90-day pause on its ‘reciprocal tariffs’ against China. As a result, the CME fed futures markets are, on average, forecasting delayed and fewer rate cuts in 2025 relative to before the announcement of a tariff pause.

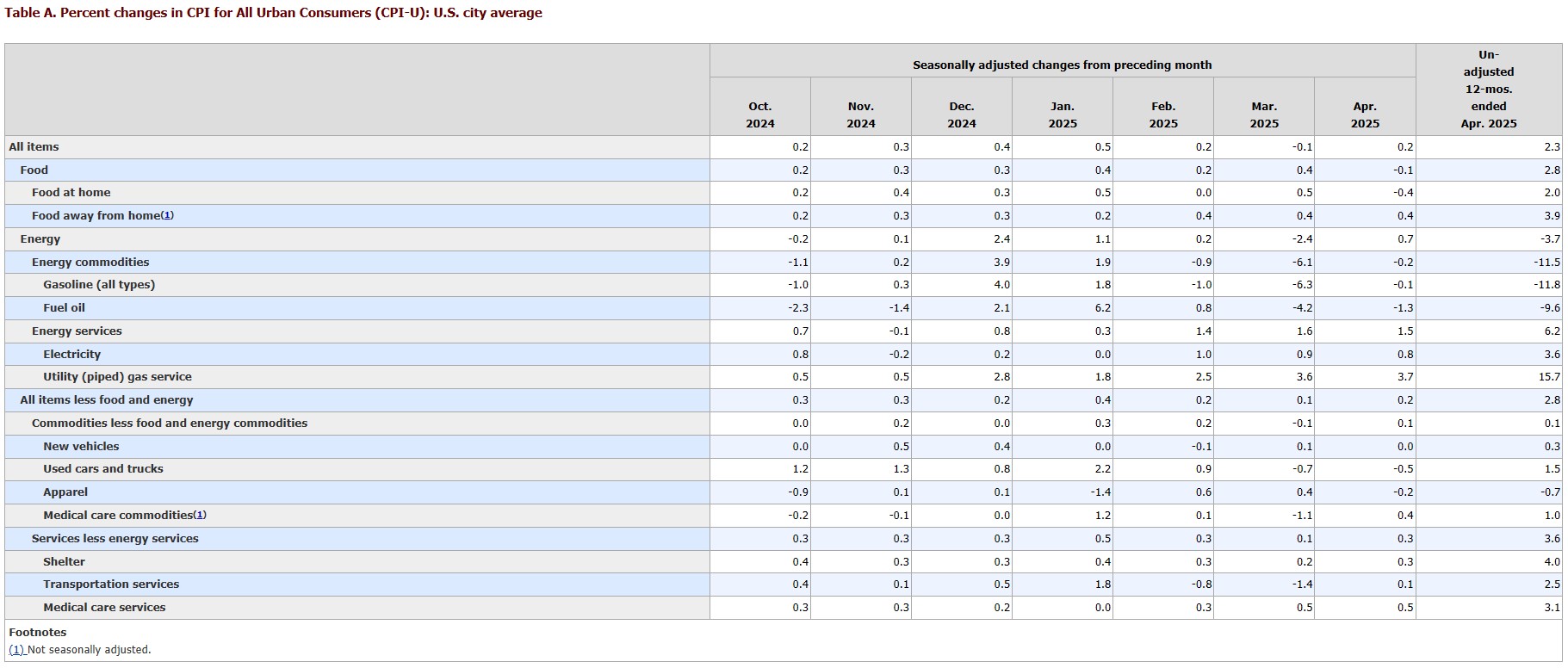

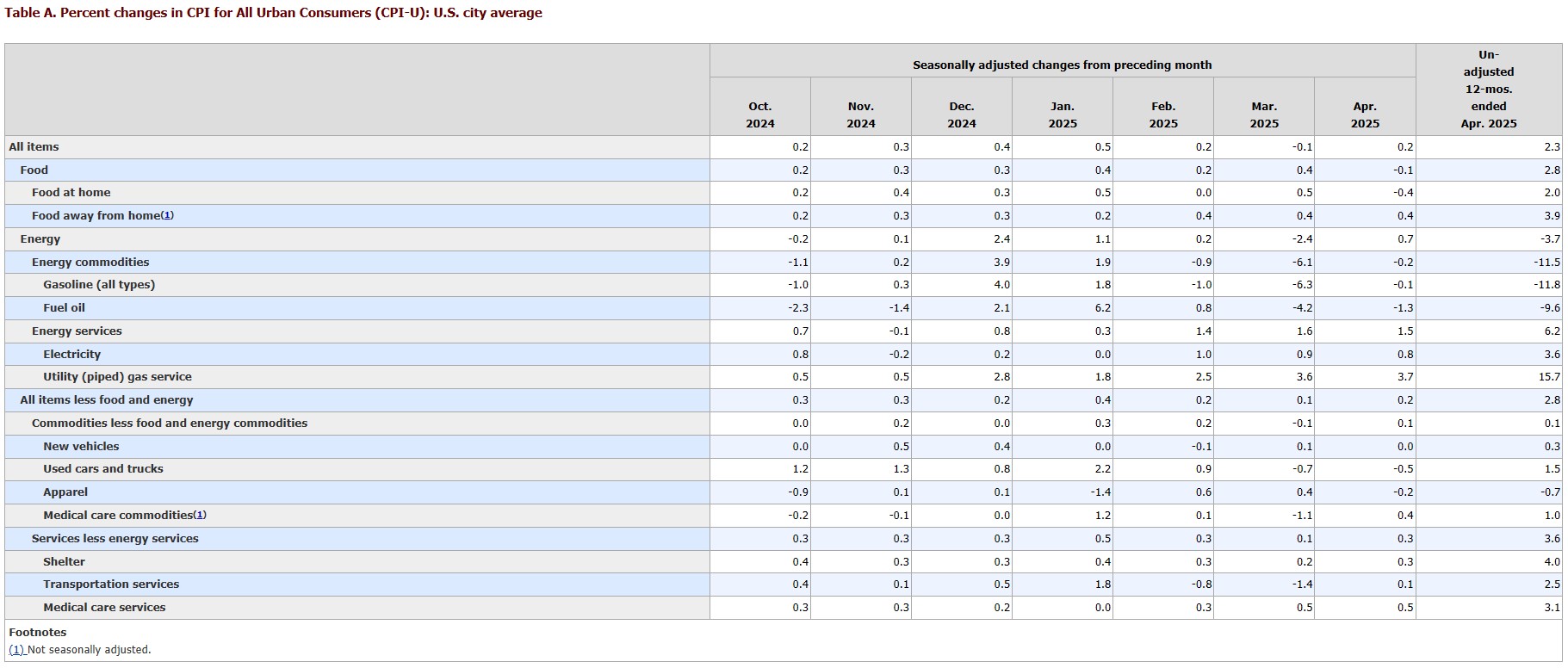

2. CPI INFLATION

- CPI inflation eased on an annual basis to 2.3% in April, its lowest annual reading since February 2021. Prices climbed 0.2% on the month.

- Core CPI prices increased 0.2% month-over-month and 2.8% year-over-year.

- While monthly readings edged higher compared to March, they largely fell short of market expectations and were seen as a positive sign in the face of fear of potential tariff-induced inflation.

- Shelter costs rose 0.3% during the month, accounting for more than half of the monthly gain in headline CPI.

- Energy prices rose by 0.7% month-over-month, driven by a rise in natural gas and electricity costs, while gasoline prices declined. Meanwhile, food prices fell by 0.1% in March.

3. SMALL BUSINESS OPTIMISM

- Small business optimism declined in April, according to seasonally adjusted data from the National Federation for Independent Businesses (NFIB).

- Optimism remained below its historical average for a second consecutive month as fewer owners expect to increase business investments in the near term.

- The net share of small business owners who expect better business conditions fell six points to a net 15% in April, its lowest share since October 2024.

- 34% of business owners expressed doubt in their ability to fill existing job openings, down percentage points from March. Interestingly, job openings are at their lowest level since January 2021.

- A net -4% of owners plan inventory investment in the coming months, down three points from March and its lowest reading since June of last year.

- 18% of owners are planning capital outlays in the next six months, down three points from March and its lowest since the depth of the COVID-19 pandemic in 2020.

- The most recent survey, conducted in April, does not capture the effect of the Administration’s announcement of a pause in its China tariff policy, which could meaningfully boost sentiment in the coming weeks.

4. CONSUMER CONFIDENCE

- According to data from the Conference Board, consumer confidence fell by 7.9 points in April to an index level of 86.0, its fifth consecutive monthly decline.

- Both consumers’ assessment of current business conditions and their short-term outlook for conditions shifted toward the downside, with the expectations index reaching a 13-year low.

- Forward-looking expectations deteriorated across the board, including expectations regarding future business conditions, employment prospects, and future income.

- Further, the share of consumers who expect fewer jobs in the next six months sits at 32.1%, roughly as high as in the middle of the Great Recession.

- The fall in consumer confidence was also broad demographically, falling amongst all age and most income groups and shared across all political affiliations.

- The decline was sharpest among consumers 35-55 years old and those making more than $125,00 per year.

5. CONSTRUCTION SPENDING

- US construction spending shrank by a seasonally adjusted 0.5% month-over-month in March, according to the latest available data from the US Census Bureau.

- High mortgage rates and tariffs on imports contributed to both a supply and demand-driven increase in construction costs, constraining homebuilding activity during the month.

- Private sector spending fell 0.6% in March, driven by pull-backs in both non-residential investment (-0.8%) and residential investment (-0.4%).

- Public sector spending fell 0.2%, primarily due to a fall in non-residential investment and reduced spending on power, commercial, and amusement and recreation construction. Office and transportation construction experienced some of March’s most significant spending increases.

- Annually, US construction spending is up 2.8% through March.

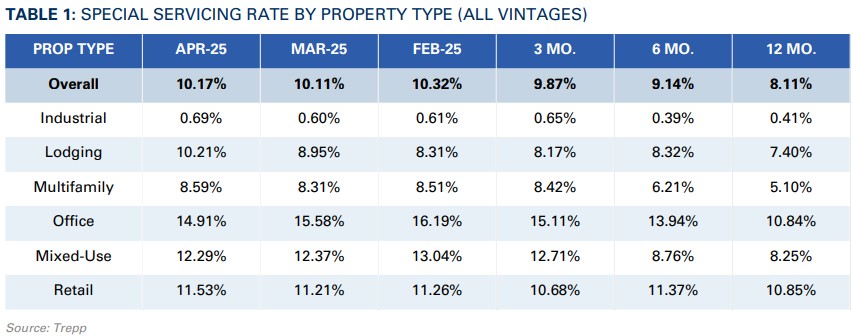

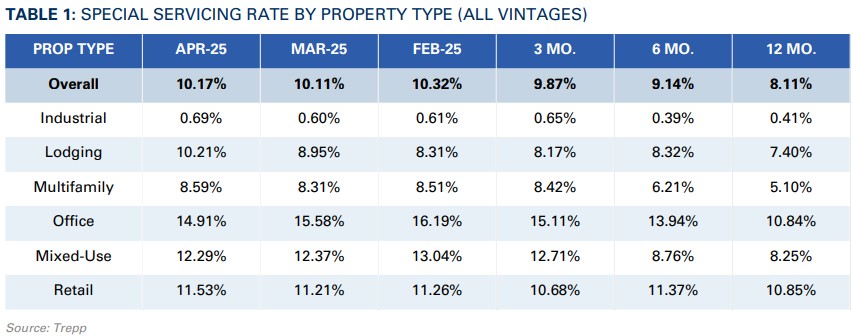

6. SPECIAL SERVICING RISES IN APRIL

- According to Trepp, the special servicing rate for CMBS loans rose six basis points (bps) to 10.17% in April.

- While April’s increase was relatively modest, the industry-wide special servicing rate sits well above the 8.11% charted one year ago and the 5.62% registered in April 2023.

- There were significant variations in sector-level performance during the month. Lodging continued to chart the most significant increase, climbing 126 bps to 10.21% in April and following a 64 basis point jump in March.

- Multifamily and Retail also saw special servicing rates climb during the month, rising roughly 30 basis points each. Industrial rose just nine bps.

- Office saw some relief as its rate dropped by 68 basis points, a repeat of March, to 14.91%.

7. LOGISTICS MANAGERS’ INDEX

- Logistics activity rose in April following a slowdown in March, according to the latest reading of the Logistics Managers’ Index.

- Logistics activity was elevated to start the year as North American firms attempted to front-run a potential trade war before snapping back in March. April’s rebound reflects a growth level more consistent with logistics sector performance before the 2024 Presidential Election.

- Inventory levels rose but at a much slower pace compared to activity experienced during the first quarter, reflecting a more normal seasonal inventory buildup.

- Despite lower inventory growth, warehousing prices and inventory costs climbed faster than the previous month, suggesting that much of the first-quarter inventory buildup remains sitting in storage facilities.

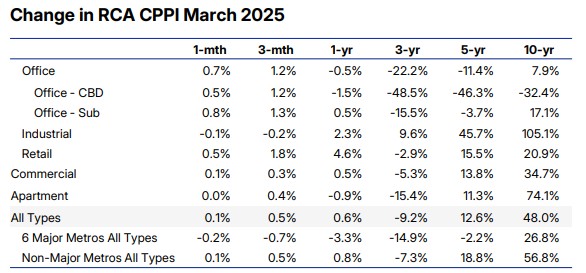

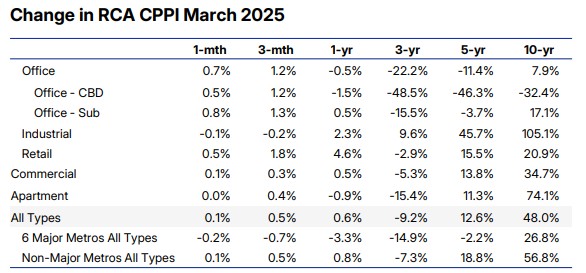

8. COMMERCIAL PROPERTY PRICES

- Commercial property prices rose 0.6% year-over-year in March as commercial real estate gradually edges into a faster pace of annualized growth. Further, a quarter-over-quarter gain of 0.5% during Q1 puts the pace of annualized growth at 1.8%.

- According to the monthly update by MSCI-Real Capital Analytics, CRE prices have not yet responded to the spike in uncertainty that has accompanied recent trade negotiations and policy rollouts.

- Rather, CRE still exhibits the uneven price performance across sectors that has persistent since 2022.

- Retail led all sectors during Q1, rising 1.8% from Q4 2025 and 4.6% year-over-year.

- Industrial, which has typically seen the strongest price growth of any sector during the post-pandemic period, followed Retail with a 2.3% year-over-year increase during Q1 but declined 0.2% from Q4.

- Apartment prices declined 0.9% year-over-year during Q1 but climbed 0.4% quarter-over-quarter, its second consecutive quarter of growth, suggesting that price stagnation is gradually thawing in the sector.

- CBD office prices were down just 1.5% year-over-year in Q1, a significant turnaround from the more than 30% recorded one year ago. Suburban office prices rose 0.5% year-over-year during Q1.

9. GDP

- Real US GDP contracted at an annualized rate of 0.3% during the first quarter of 2025, based on the advance estimate from the US Bureau of Economic Analysis.

- The first-quarter decline was primarily due to a sharp increase in imports, which is a negative factor in the GDP calculation. GDP’s other components—consumer spending, investment, and exports—each also increased, partly offsetting the downside effect of imports.

- Beneath the surface, the US economy still exhibits strong fundamentals. The rise in imports during the first quarter was significantly driven by US firms and consumers, who front-loaded their purchases of goods in anticipation of the Trump Administration’s tariffs.

- It reflects robust consumer spending despite softening consumer sentiment. Nonetheless, the first-quarter numbers indicate that consumers and producers significantly adjusted their activities in anticipation of heightened trade tensions.

10. APRIL JOBS REPORT

- The US Economy added 177k payrolls in April, above consensus estimates of 130k, according to the Bureau of Labor Statistics (BLS). The unemployment rate was unchanged at 4.2%.

- It was a strong showing for firms despite being a month headlined by heightened economic uncertainty and volatility. April’s job growth slightly edged out the average monthly increase of 152k over the previous 12 months.

- Payrolls grew the most in the healthcare sector (+51k), transportation and warehousing (+29k), and financial activities (+14k). The increase in transportation and warehousing employment comes after little change in March and arrives after an uptick in logistics activity, including imports and inventories, to start the year. Federal government employment continued to decline (-9k).

SUMMARY OF SOURCES

1. EMERGING TRENDS IN REAL ESTATE

- Investors and developers should expect an upturn in fate for the commercial real estate industry as post-pandemic disruptions abate and positive cyclical forces reemerge, according to ULI-PwC’s Emerging Trends in Real Estate (ETRE) report for 2025.

- The likelihood that the US economy has moved beyond peak inflation and peak interest rates arises as the most important cyclical factor in the report. Falling rates are reducing construction costs and boosting construction activity. Nonetheless, falling rates are also indicative of a slowing economy, encouraging some dealmakers to wait things out.

- The share of survey respondents who expect their firm’s profit to be “good” or “excellent” is more than 20 percent higher than last year. However, many investors expect the neutral rate of interest to be higher than before the Fed’s tightening cycle and don’t foresee a return to pre-pandemic growth levels.

- ETRE 2025 also discusses the emergence of specific supply dynamics that will differentiate the upcoming cycle from previous ones. For example, a modernized stock of office buildings intensifies the struggle of aging buildings in today’s distressed environment, with older, less amenitized buildings struggling to compete.

- From the view of the report, CRE’s “new normal” has arrived, with the effects of remote work and online shopping essentially baked into developer outlooks. Meanwhile, responses suggest growing worry that tenant demand may struggle to keep up with the construction boom seen across many sectors.

2. ELECTION IMPLICATIONS ON CRE

- Donald Trump won the 2024 Presidential Election, which, alongside a Republican victory in the Senate and a House that is still up for grabs, suggests that the commercial real estate industry will pivot towards a more favorable regulatory environment yet with greater supply chain uncertainty.

- The GOP White House and Senate win drastically reduces the likelihood of new taxes on capital and will renew pressure towards reducing regulatory barriers to supply, which could even see bi-partisan success in a split-government scenario where Democrats win the House.

- Global trade uncertainties, including the incoming administration’s planned use of tariffs, complicate the outlook for input costs. Construction costs may climb if significant tariffs are applied to input materials imported from foreign economies and an escalating trade war ensues, while a major deportation effort would likely drive-up labor costs.

- Several state and local ballot measures surrounding residential rent control were also held on election day. California rejected Proposition 33, which would have removed state prohibitions on rent control by municipal governments. Elsewhere, Hoboken, NJ, voted to retain rent control rules, shooting down a measure that would have allowed for a market reset of rents upon turnover.

3. Q3 GDP

- Real GDP rose by a 2.8% annualized rate in the third quarter, according to the Bureau of Economic Analysis (BEA), slowing from the second quarter rate of 3.0%.

- Increases in consumer spending, exports, and federal government spending contributed to the increases, while an uptick in imports, a subtraction from the GDP calculation, slightly moderated its growth.

- Consumer spending increases in goods were dominated by prescription drugs, other non-durables, and motor vehicles and parts. Health care and food services/accommodations were the main contributors to services.

- The deceleration in real GDP relative to the second quarter primarily reflected a decline in private inventory and residential fixed investment. Meanwhile, an acceleration in exports, led by capital goods, and government spending, led by defense, partly offset declines in investment.

4. ISM SERVICES

- According to the Institute of Supply Management, US services activity rose by its highest amount in over two years in October, reaching an index level of 56 — not seen since August 2022.

- The strength in the US service sector was primarily driven by an employment rebound and slower supplier delivery performance, which is a downward force on the index as it accelerates.

- Price pressures in the services sector also eased slightly, while business activity/production, new orders, and inventories each experienced shallow increases. Meanwhile, the index tracking order backlogs shrank.

- According to the committee analyzing the report, political uncertainty was more prevalent in this month’s report than in the previous month. Meanwhile, labor disputes and hurricane impacts were frequently mentioned in survey responses, indicating their effect on economic activity during October.

5. COMMERCIAL PROPERTY PRICES

- According to the latest MSCI RCA Commercial Property Price Index, real estate prices fell monthly in September for the third consecutive month. The National All Property Index fell 0.3% from August and 1.9% year-over-year.

- Industrial was the only property type with an annual gain, climbing 6.7% year-over-year, roughly in line with the sector’s growth in the past three months. Industrial prices are up 0.4% from August.

- Apartment prices are down 6.3% year-over-year, the largest drop by any property type outside of the widely distressed office sector. Nonetheless, Apartment price declines have moderated over the past year. For context, in September 2023, apartment prices were falling 13.4% year-over-year.

- Office sector prices are down 8.0% year-over-year, with assets in commercial business districts continuing to experience the largest declines, down 22.4% in the past 12 months. Comparatively, suburban office assets are down just 3.3% year-over-year.

- Retail property prices fell 1.5% from one year ago, which follows a similar trend of declines seen in the sector since the spring. The sector has recovered from the high single-digit declines registered about a year ago. The retail index fell just 0.1% month-over-month from August.

6. OFFICE DEMAND

- According to VTS’ Office Demand Index (VODI), nationwide office demand has climbed by 11.8% in the past year, and analysts expect this growth momentum to continue.

- All major local markets tracked by the VODI have increased relative to one year ago except for Washington, DC, which analysts believe reflects a frozen transaction landscape brought on by the uncertainty of the 2024 election.

- New office demand is highest in Los Angeles and New York, though much of this gain has taken place over the past two years while the two metros have seen demand recede slightly in recent months.

- The report also notes that work-from-home rates in recent months have been the lowest since the start of the pandemic, a trend that appears to be industry-agnostic. Today, less than one-third of work days are spent at home, and this downward trend contributes to a more bullish outlook for the office compared to one year ago.

7. LOGISTICS MANAGERS INDEX

- The Logistics Manager’s Index rose to 58.9 in October, its highest level since September 2024, a tick above the 58.6 registered in September. US logistics growth has been consistently solid over the past six months

- Faster increases were seen for warehouse utilization, transportation utilization, and transportation prices, the latter of which experienced its most rapid growth rate since May of 2022.

- Transportation capacity rebounded from a neutral reading of 50 in September. Meanwhile, inventory levels continue to expand but at a slower rate compared to other logistics components, as did inventory costs and warehousing capacity.

8. EXTEND AND PRETEND

- A recent analysis by the Federal Reserve of New York suggests that during the post-pandemic period, some banks “extended and pretended” their distressed CRE mortgages, a practice of extending the maturing loans to avoid writing off their capital, leading to credit misallocation.

- Using loan-level supervisory data on maturity extensions, the analysis found that “extend-and-pretend” crowds out new originations and led to a 4.8-5.3% drop in CRE mortgage origination since Q1 2023.

- As a result, the number of CRE mortgages maturing in the near term has climbed, standing at 27% of total bank capital as of Q4 2024.

- While extensions led to fewer defaults, banks took these actions due to weak underlying capitalization, which resulted in a strong positive relationship between maturity extensions for distressed mortgages and bank undercapitalization.

9. OCTOBER JOBS REPORT

- The US economy added just 12,000 payrolls in October as extreme weather events and a significant labor strike sharply eroded job growth.

- According to the Bureau of Labor Statistics, a major strike at Boeing likely subtracted 44,000 jobs in the manufacturing sector, while two severe hurricanes virtually halted hiring activity in affected regions.

- The unemployment rate was virtually unchanged at 4.1%, while a broader measure that includes discouraged workers and those working part-time for economic reasons was similarly unchanged, holding at 7.7%.

- Average hourly earnings rose 0.4% in October at 4% over the past year.

- Overall, markets had a muted reaction to the numbers. October’s job activity further cements expectations that the Federal Reserve will move forward with another interest rate cut at its November meeting.

10. HIGHER INFLATION FOR LOW-INCOME HOUSEHOLDS

- Construction spending rose to a seasonally adjusted annualized rate of $2.14 billion in September, 0.1% above August’s pace. The annualized rate of construction in September 2024 was 4.6% above the September 2023 estimate. Meanwhile, during the first nine months of the year, construction spending outpaced the same period in 2023 by 7.3%.

- The pace of private construction spending was roughly unchanged from the previous month, as a decline in nonresidential construction activity mostly offset an increase in residential construction spending.

- The annual rate of public construction spending rose 0.5% above its August pace. The annual pace of Educational construction rose 0.3% above its revised August estimate, while highway construction rose 0.5% above its revised August estimate.

SUMMARY OF SOURCES

And that’s without taking into account the impact of rising Treasury yields.

Everyone in the industry is aware of how difficult the CRE refi market is at this point. However, the connection between high interest rates and many lenders, particularly banks, tightening their requirements and even withdrawing from the markets is still unclear.

To better understand at least one mechanism in place based on the Secured Overnight Financing Rate (SOFR), CRED iQ conducted some data analysis. This is “a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities,” according to the Federal Reserve Bank of New York, rather than looking at a rate range the Federal Reserve sets for the federal funds rate. Instead of self-reported data that banks could manipulate for profit like the old LIBOR measure did, the data is based on transaction costs that have actually been gathered.

It makes sense that the firm highlighted that adjustable rate CRE loans provide a hurdle when interest rates are rising. The increasing rate tidal indicates that there is a significant likelihood that whatever floating rate a plan has foreseen won’t be enough unless an investor, developer, owner, or operator has prepared ahead.

According to CRED iQ’s research on floating loans, 44% of loans with near-term expirations will have rate cap agreements that expire before the loans mature. According to the Federal Reserve Bank of New York’s SOFR data, it is obvious that the increase in SOFR is having a significant impact on upcoming floating rate loan maturities.

a warning that correlations don’t always imply causality. Even though two sets of data are trending in the same direction, they may not fully or even mostly be responsible for one another’s moves. Many apparent correlations between lending and SOFR were discovered by CRED iQ. When researching Fannie Mae floating rate issuance, they discovered “effects of the rising interest rate environment, including the aggregate Average Original Note Rate, Average Loan Scheduled Interest Due, and how these metrics vary by Seller.”

According to CRED iQ, “it is clear from the analysis of the trailing twelve-month (TTM) data that the average interest due on Fannie Mae loans has increased by over 280%.” If rates rise on a floating rate loan, then more money flows into rent-taking with less available to enhance DSCR and lower property values increasing LTV. “This surge is exerting substantial pressure on Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) ratios for these properties.”

Remember that there are other factors as well, such as rising Treasury yields. They act as markers for secure returns that can be used to calculate risk-adjusted management. Over 5.5% yields are on the short end of the Treasury curve. On Monday, September 25, a 1-year is 5.46%, and a 10-year is 4.44. To exit a safe investment, investors require a large return. The biggest asset management, BlackRock, believes that rates will remain high and may even continue to rise from their 16-year highs.

The SVN Vanguard team can help with your Commercial Real Estate needs. We can help you find the ideal commercial property for sale or lease. Interested in discussing a sale-leaseback? Contact us.